EUR/USD

EUR/USD" title="EUR/USD" width="600" height="600">

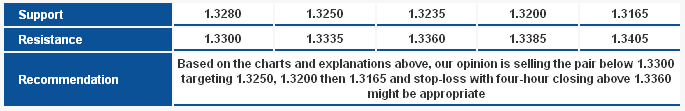

EUR/USD" title="EUR/USD" width="600" height="600">The pair is still trading negatively and stability below Linear Regression Indicator 34 keeps the possibility of a new downside move today. Stochastic offers negativity and accordingly we prefer the bearish correctional move unless levels 1.3360 were breached.

The trading range for today is among the key support at 1.3165 and key resistance at 1.3405.

The general trend over short term basis is negative targeting 1.1865 as far as areas of 1.3550 remains intact.  EUR/USD: Support And Resistance" title="EUR/USD_S&R" width="685" height="111">

EUR/USD: Support And Resistance" title="EUR/USD_S&R" width="685" height="111">

GBP/USD GBP/USD" title="GBP/USD" width="600" height="600">

GBP/USD" title="GBP/USD" width="600" height="600">

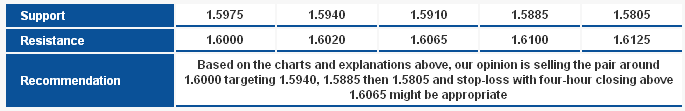

The pair broke the key ascending support level as shown on the graph, and accordingly we expect the downside move might extend. Linear Regression Indicators are negative supporting our expectations. Stability above 1.6065 levels again threatens to fail our bearish expectations.

The trading range for today is among key support at 1.5790 and key resistance at 1.6125.

The general trend over short term basis is to the downside targeting 1.6875 as far as areas of 1.4225 remains intact.  GBP/USD: Support And Resistance" title="GBP/USD_S&R" width="685" height="111">

GBP/USD: Support And Resistance" title="GBP/USD_S&R" width="685" height="111">

USD/JPY USD/JPY" title="USD/JPY" width="600" height="600">

USD/JPY" title="USD/JPY" width="600" height="600">

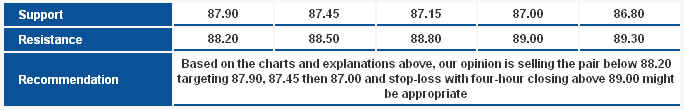

The pair’s attempt to the upside yesterday remained limited below Linear Regression Indicators as shown on the graph. The pair is still trading outside the ascending channel breaking its key support level. Therefore, we expect a new bearish attempt today, and stability below 88.20 levels will support this outlook and Stochastic is showing negative signals supporting our expectations.

The trading range for today is among key support at 86.80 and key resistance at 90.10.

The general trend over short term basis is to the upside targeting 91.70 as far as areas of 83.40 remain intact.  USD/JPY: Support And Resistance" title="USD/JPY_S&R" width="684" height="110">

USD/JPY: Support And Resistance" title="USD/JPY_S&R" width="684" height="110">

USD/CHF USD/CHF" title="USD/CHF" width="600" height="600">

USD/CHF" title="USD/CHF" width="600" height="600">

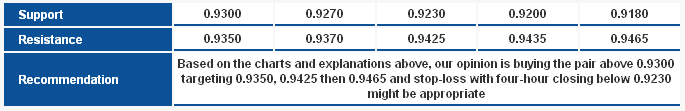

The pair’s trading is weak and still above the second target of the bullish harmonic AB=CD Pattern represented in 61.8% correction at 0.9270 levels, this provides possibility to extend the upside move to complete a new harmonic formation at 0.9465 levels. Trading above 0.9230 make us hold onto our bullish expectations for today.

The trading range for today is among key support at 0.9200 and key resistance at 0.9465.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.  USD/CHF: Support And Resistance" title="USD/CHF_S&R" width="685" height="111">

USD/CHF: Support And Resistance" title="USD/CHF_S&R" width="685" height="111">

USD/CAD USD/CAD" title="USD/CAD" width="600" height="600">

USD/CAD" title="USD/CAD" width="600" height="600">

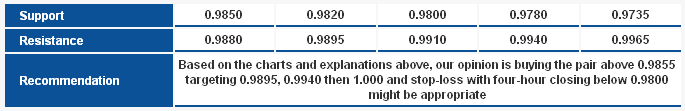

The pair is stable above 78.6% correction at 0.9850 levels and showed its first attempt to breach 61.8% correction at 0.9875–80 levels. Linear Regression Indicators are positive and Relative Strength Index has stabilized above 50, therefore we are in front a possible bullish move today, and breaching 0.9880 further supports the upside move.

The trading range for today is between the key support at 0.9735 and the key resistance at 1.000.

The general trend over short term basis is to the downside below levels 1.0125 targeting 0.9400.  USD/CAD: Support And Resistance" title="USD/CAD_S&R" width="685" height="111">

USD/CAD: Support And Resistance" title="USD/CAD_S&R" width="685" height="111">

AUD/USD AUD/USD" title="AUD/USD" width="600" height="600">

AUD/USD" title="AUD/USD" width="600" height="600">

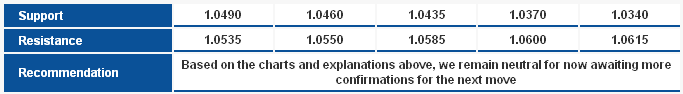

The downside move couldn`t break 1.0490 levels but it still threatens the bullish possibility. This upside bias didn’t completely fail whereas the pair is still stable above levels that enable the completion of the harmonic formation shown on the graph. Nevertheless, to support this outlook, the pair must hold above 1.0535 levels once again so we prefer to remain neutral today.

The trading range for today is among key support at 1.0435 and key resistance at 1.0650.

The general trend over short term basis is to the downside below levels 1.0710 targeting 0.9400.  AUD/USD: Support And Resistance" title="AUD/USD_S&R" width="683" height="94">

AUD/USD: Support And Resistance" title="AUD/USD_S&R" width="683" height="94">

NZD/USD NZD/USD" title="NZD/USD" width="600" height="600">

NZD/USD" title="NZD/USD" width="600" height="600">

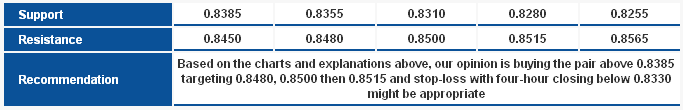

Closing remains stable above Linear Regression Indicator 34 despite yesterday’s attempts to the downside, and that forces us to hold on to our positive expectations. Trading above 0.8355 levels make us hold on to our expectations and our risk limit will be a break of 0.8330 with intraday stability below it.

The trading range for today might be among key support at 0.8280 and key resistance at 0.8565.

The general trend over short term basis is to the upside with steady daily closing above 0.8130 targeting 0.8845.  NZD/USD: Support And Resistance" title="NZD/USD_S&R" width="683" height="110">

NZD/USD: Support And Resistance" title="NZD/USD_S&R" width="683" height="110">

Technical Crosses

GBP/JPY GBP/JPY" title="GBP/JPY" width="600" height="600">

GBP/JPY" title="GBP/JPY" width="600" height="600">

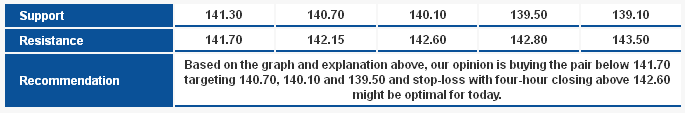

The pair trades in a sideways bias yet in areas below Linear Regression Indicators, and Stochastic is near overbought areas.Therefore, we believe trading below 142.60 is sufficient to maintaining potential downtrend .

The trading range expected for today is between the key support at 139.50 and the key resistance at 144.15.

The short-term trend is to the downside targeting 112.00 as far as 150.00 remains intact.  GBP/JPY: Support And Resistance" title="GBP/JPY_S&R" width="685" height="113">

GBP/JPY: Support And Resistance" title="GBP/JPY_S&R" width="685" height="113">

EUR/JPY EUR/JPY" title="EUR/JPY" width="600" height="600">

EUR/JPY" title="EUR/JPY" width="600" height="600">

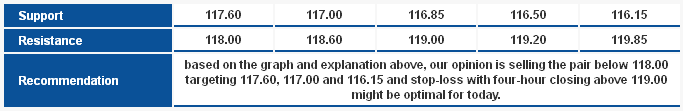

The pair attempts to rise today, yet remains limited in areas below Linear Regression Indicators and below 118.60; trading below this level maintains possibility of a downtrend comeback. The first target of this trend is testing 116.15 which represents the uptrend`s main support and 127.2% Fibonacci. Stochastic is in overbought areas supporting our expectations.

The trading range for today is between the key support at 115.00 and the key resistance at 119.00.

The short-term trend is to the upside targeting 109.15 as far as 98.75 remains intact at week`s closing.  EUR/JPY: Support And Resistance" title="EUR/JPY_S&R" width="683" height="111">

EUR/JPY: Support And Resistance" title="EUR/JPY_S&R" width="683" height="111">

EUR/GBP EUR/GBP" title="EUR/GBP" width="600" height="600">

EUR/GBP" title="EUR/GBP" width="600" height="600">

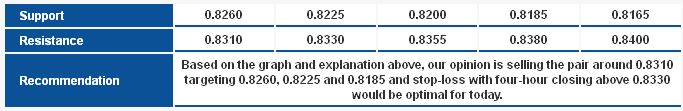

The pair is confined in levels above 0.8260 support however below the downtrend`s main resistance. Stochastic projects continued negativity, which encourages us to suggest a downside movement unless 0.8330 is broken . Breaking through 0.8260 could extend the downside correction.

The trading range expected for today is between the key support at 0.8200 and the key resistance 0.8420.

The short-term trend is to the upside targeting 1.0370 as far as 0.7785 remains intact.  EUR/GBP: Support And Resistance" title="EUR/GBP_S&R" width="683" height="111">

EUR/GBP: Support And Resistance" title="EUR/GBP_S&R" width="683" height="111">