was bolstered by optimism in the market, but dropped slightly despite better than anticipated Trade Deficit data which showed that the deficit has widened. According to official figures, the country’s Trade Deficit expanded 8.5 percent as it slipped to -$40.3 billion after posting at -$37.1 billion in April. Nonetheless, reports indicated that exports and imports advanced, suggesting the economy hasn’t slowed down. The Commerce Department stated that U.S. Imports climbed 2.4 percent to $227.7 billion and Exports rose 1.2 percent to $187.4 billion. Analysts indicated that higher demand for electronics produced overseas pointed to an increase in household and business consumption that may help the country weather the government’s spending cuts. A hike in auto exports also suggested that the biggest world economies are stabilizing.

Gold

Meanwhile, gold prices dipped after the greenback rebounded on talks Japan may implement new measures to bolster growth, a factor that caused the Yen’s depreciation. Gold remained under pressure after India, the world’s biggest consumer of the precious metal, indicated that it may restrict imports in an effort to shrink the current account deficit. Gold prices reached as high as $1,417 per troy ounce after a rally in oil prices, but the gain was short-lived and settled close to $1,410 a troy ounce on the Comex Division of the New York Mercantile Exchange.

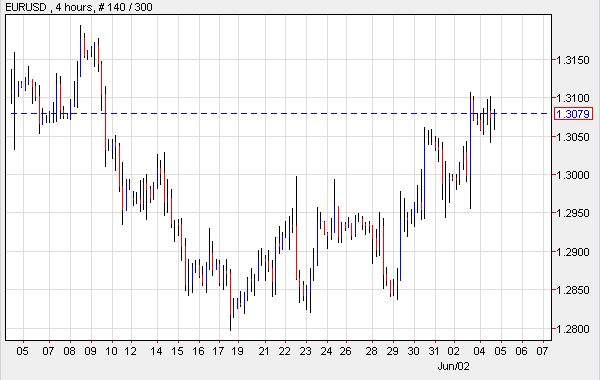

The Euro recovered after it declined against the U.S. Dollar when less-than stellar data out of the euro zone weighed on the shared currency. According to reports, Germany obtained France’s backing to delay issuing any rules relating to direct bank assistance by the region’s Firewall fund. Regional Finance Ministers hoped to reach a consensus this month on when and how they’ll activate the European Stability Mechanism so that a new program can be ready for 2014, which is when the Euro bloc wishes to commence “common supervision.” The British Pound weakened against the U.S. Dollar as market investors opted for the American currency as it rallied against the Yen. However, the Sterling’s losses were limited as the U.K. released better than forecast Construction metrics.

JPY

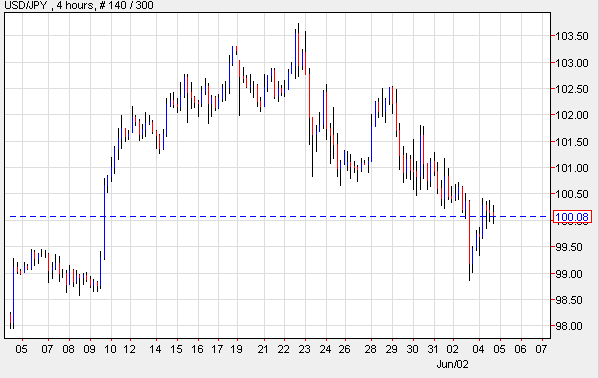

The Yen dipped to more than 100 per U.S. Dollar a day after it traded at the strongest price in three weeks; this happened as the Bank of Japan indicated it may implement further monetary easing to promote economic growth. The Yen remained under pressure as investors reacted to a release suggesting the bank may extend the low interest terms to other banks.

AUD

Lastly in the South Pacific, the Australian Dollar went down against all of its trading counterparts after the Reserve Bank stated that the current inflation outlook has left room for further easing. The bank also announced it will leave the benchmark interest rate at a record low.

EUR/USD: Euro Dips On Demand For Greenback

The Euro slipped versus the greenback as the American currency advanced and traded above the 100.0 level versus the Yen. The greenback’s rally was mostly due to the fact that the Bank of Japan announced it will offer longer-term funds. In addition, the European Central Bank indicated it won’t engage in a big plan “to revive lending” within the region. The 17-nation currency traded softer when the E.U.’s statistics office said that the Producer Price Index slipped 0.6 percent in April; this has been the biggest monthly drop in close to four years, and it spurred speculation that the European Central Bank may maintain the current loose policy. Today, Italy and Spain are scheduled to report on the activity level of several important economic sectors. EUR/USD" title="EUR/USD" width="600" height="380">

EUR/USD" title="EUR/USD" width="600" height="380">

GBP/USD: U.K. Data Lifts Sterling

The British Pound dropped against the U.S. Dollar, but it recouped some of its losses after official metrics indicated that Construction Output in the U.K. climbed to the highest since October of 2012. According to Markit, the Construction Purchasing Manager’s Index reached 50.8 in May after it posted at 49.4 the prior month. The figures were issued a day after the U.K. reported that its Manufacturing sector expanded at the quickest pace in over one year. The Sterling did not erase all of its losses as investors remained cautious in anticipation of today, when the Bank of England is expected to issue a decision on interest rates. GBP/USD" title="GBP/USD" width="600" height="378">

GBP/USD" title="GBP/USD" width="600" height="378">

USD/JPY: Greenback Recovers Against Yen

The greenback rebounded versus the Yen after it sustained serious declines in the previous trading session when the U.S. reported lackluster Manufacturing data. Japan’s monetary unit dipped to more than 100 per U.S. Dollar despite domestic metrics which revealed that wages rose by the most in one year in April, indicating that Shinzo Abe’s plan to reflate the nation’s economy after 15 years of declining prices is working. The Yen remained under pressure on comments by bank officials who indicated that the BOJ may lengthen the terms of the loans to the banks; and furthermore, the Japanese government stated that it may call on pensions to raise the targeted stock assets. USD/JPY" title="USD/JPY" width="599" height="378">

USD/JPY" title="USD/JPY" width="599" height="378">

AUD/USD: RBA Left Rates Unchanged

Australia’s Dollar traded lower against the greenback as the country’s central bank suggested there’s more room for additional monetary easing, given the inflation outlook. The Aussie remained low despite domestic reports which indicated that the country’s Current Account deficit contracted more than forecast in the first three months of 2013. The Deficit went from AUD14.8 billion to AUD8.5 billion. Meanwhile, the Reserve Bank indicated it will leave the key cash rate at a record 2.75 percent. AUD/USD" title="AUD/USD" width="600" height="378">

AUD/USD" title="AUD/USD" width="600" height="378">

Today’s Outlook

Today’s economic calendar shows that the Euro region will report on Services PMI, GDP and Retail Sales. The U.S. will issue the ADP Non-Farm Employment Change, Non-Farm Production, Unit Labor Costs, Factory Orders, ISM Non-Manufacturing Index and the Beige Book. Australia will release the Trade Balance. And Japan will announce Foreign Bonds Buying.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily FX Report

The U.S. Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.