NZD/CHF continues to fall inside the Clear Down Channel chart pattern, which was previously identified by Autochartist on the 30-minute charts. Autochartist rates the Quality of this Down Channel at the 5 bar level – which is the result of the slow Initial Trend (2 bars), above-average Uniformity (6 bars) and near-maximum Clarity (9 bars). NZD/CHF is expected to fall inside this Down Channel – continuing the earlier breakout of the support area highlighted below.

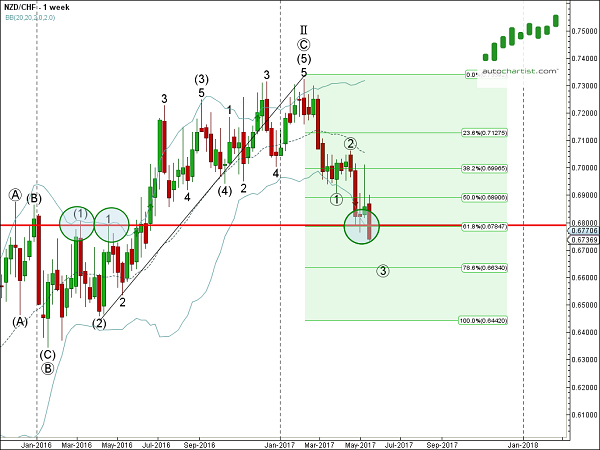

As can be seen from the weekly NZD/CHF chart below, this Down Channel continues the earlier breakout of the support zone lying between the strong support level 0.6800 (former major resistance level from the start of 2016) and 61.8% Fibonacci correction of the weekly upward impulse from April of 2016. This price area is acting as resistance zone after it was broken. The proximity of this resistance area adds to the probability NZD/CHF will continue to fall inside this Down Channel.