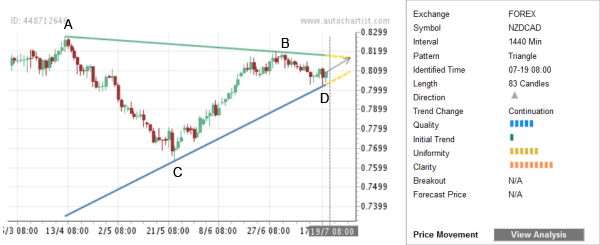

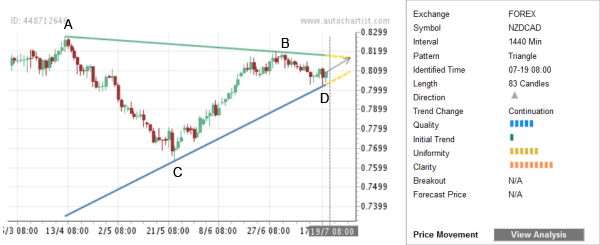

NZD/CAD continues to rise inside the Clear Triangle chart pattern identified by Autochartist on the daily charts. The overall Quality of this Triangle is rated at the 5 bar level as a result of the low Initial Trend (one bar), above-average Uniformity (6 bars) and near-maximum Clarity (9 bars). This chart pattern continues the prevailing uptrend that can be seen on the weekly NZD/CAD charts. The bottom of this Triangle (point C on the chart below) formed when the pair reversed up form the strong support area made out of the following support levels: 50% Fibonacci Retracement of the preceding sharp weekly upward price impulse from the March of 2011, the round price level 0.7700, and the weekly upward-sloping support trendline from the start of 2009 (as is shown on the second chart below). The pair is expected to rise further in the nearest time.

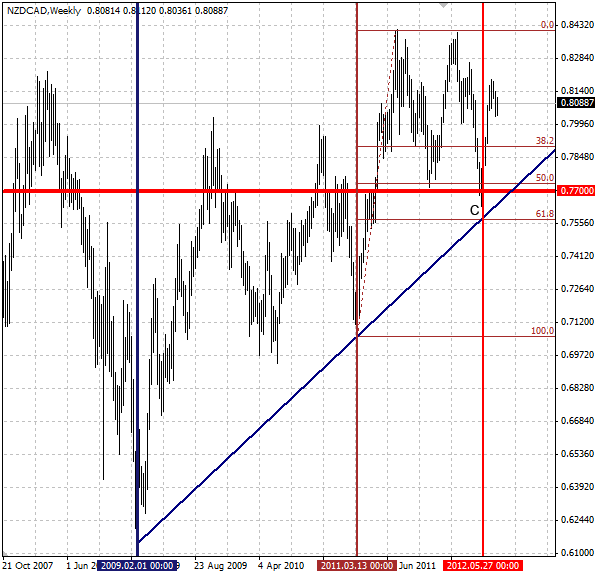

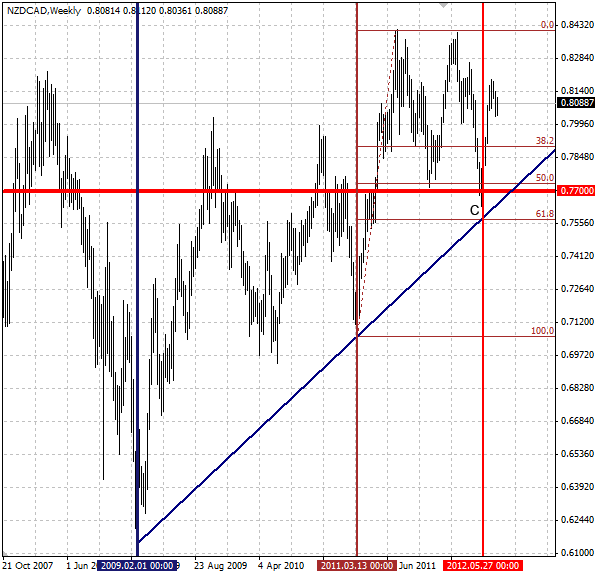

The following weekly NZD/CAD chart shows the technical price levels mentioned above:

NZD/CAD" title="NZD/CAD" width="595" height="574" />

NZD/CAD" title="NZD/CAD" width="595" height="574" />

The following weekly NZD/CAD chart shows the technical price levels mentioned above:

NZD/CAD" title="NZD/CAD" width="595" height="574" />

NZD/CAD" title="NZD/CAD" width="595" height="574" />