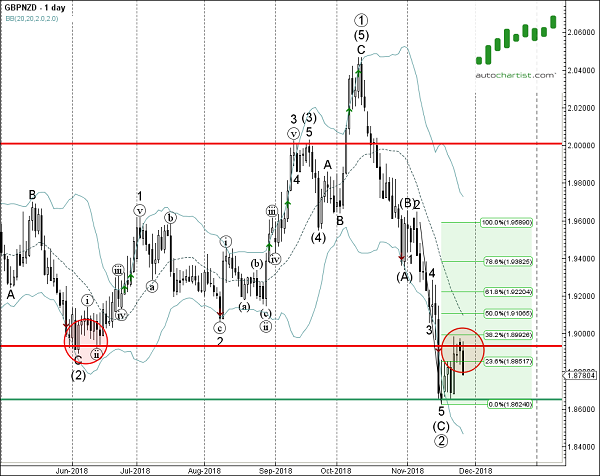

GBP/NZD continues to fall after the recent breakout of the hourly Triangle chart pattern which was recently identified by Autochartist. Autochartist rates the quality of this Triangle at the 7-bar level – which is the result of the below-average Initial Trend (4 bars), significant Uniformity (7 bars) and above-average Clarity (6 bars). GBP/NZD is expected to fall toward the forecast price 1.8736 – in line with the earlier downward reversal from the key resistance area shown below.

As can be seen from the daily GBP/NZD chart below, the price earlier reversed down from the combined resistance area lying between the key resistance level 1.8930 (former powerful support from June) and the 38.2% Fibonacci correction of the previous downward impulse from the start of November. The proximity of this resistance area increases the probability GBP/NZD will continue to fall toward the forecast price 1.8736.