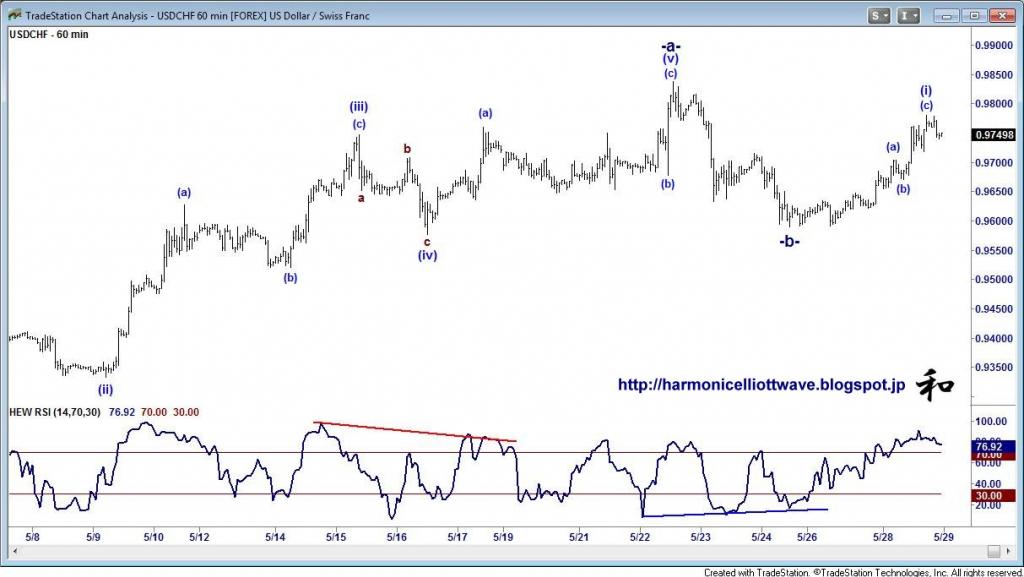

BIAS: I suspect a correction lower today

Resistance: 0.9780 0.9798 0.9817 0.9838

Support: 0.9734 0.9718 0.9697-02 0.9678 USD/CHF" title="USD/CHF" width="1560" height="799">MAIN ANALYSIS: Yesterday's rally was quite persistent and reached 0.9780 this morning. The common theme I am seeing suggests a pullback lower. Also, take note of the 0.9798 projection. Overall I see downward progress towards the 0.9718 corrective low - possibly the 0.9697-02 area. At these supports it wouldn't surprise me to see a mild correction higher. As long as this remains below 0.9780, we should then see losses below 0.9718 and 0.9690 to extend losses to 0.9645-55 at least. From this point on, start looking for bullish reversal signals. The problem with this correction is that it has no ideal depth. Note the 0.9630-40 area.

USD/CHF" title="USD/CHF" width="1560" height="799">MAIN ANALYSIS: Yesterday's rally was quite persistent and reached 0.9780 this morning. The common theme I am seeing suggests a pullback lower. Also, take note of the 0.9798 projection. Overall I see downward progress towards the 0.9718 corrective low - possibly the 0.9697-02 area. At these supports it wouldn't surprise me to see a mild correction higher. As long as this remains below 0.9780, we should then see losses below 0.9718 and 0.9690 to extend losses to 0.9645-55 at least. From this point on, start looking for bullish reversal signals. The problem with this correction is that it has no ideal depth. Note the 0.9630-40 area.

COUNTER ANALYSIS: Any earlier break above 0.9798 would extend gains to the 0.9838 high. Take care here, as this is another area that could trigger a correction lower. Above note 0.9859-76 and 0.9898.

MEDIUM TERM ANALYSIS:

29th May: I think it's safe to say the rally has resumed, but we've only seen its first leg. While 0.9631-60 supports (although even a 100% retracement would still be valid) we should see the uptrend resume. At this point I don't have the foundation waves to identify the next intermediate target, but overall I do feel this rally will retest the daily 0.9971 high.

Only back below 0.9590 would be a matter of some concern; if this comes with a break of the Dollar Index at 83.43, we'll have to review it as it will suggest further losses.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Forecast For USD/CHF: May 29, 2013

Published 05/29/2013, 03:41 AM

Updated 07/09/2023, 06:31 AM

Daily Forecast For USD/CHF: May 29, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.