The US Dollar rallied against most of its Forex counterparts as demand for the currency remained high subsequent to the publication of economic reports which pointed to a surge in Durable Goods Orders and Consumer Confidence. The greenback came close to trading at the highest rate in eight weeks versus the euro as comments pointing to a possible implementation of stimulus by the European Central Bank pushed the euro to the downside. Gold prices fell 2 percent on Tuesday following the announcement of U.S. economic metrics which confirmed an unexpected hike in orders of Durable Goods. The positive numbers fueled speculation that the U.S. economy is progressing. Futures for August delivery traded at $1,265.60 a troy ounce on the New York Mercantile Exchange. The last time the precious metal dipped to a low of $1,261.10 was when Russia annexed the Crimean region.

The euro depreciated for a second consecutive day versus the Japanese yen, and slumped further against the greenback following news indicating that German Unemployment climbed this month, while E.U. bank loans fell. The reports raised speculation that the European Central Bank will have no choice but to implement some type of measure to make certain the economy does not cool off. In Sintra, Portugal, Mr. Mario Draghi, the ECB President concluded his talks by stating that the Monetary Authorities will find the way to tackle the low percentages of inflation reported recently. Furthermore, the eurozone announced a drop in the Money Supply, thereby supporting the need for action. The British Pound remained under pressure after domestic releases revealed a dip in Mortgage Approvals. Bank of England Governor Mark Carney unveiled a series of steps geared towards fixing the financial system. He suggested that governments ought to implement new bonus rules so that performance failures are not rewarded.

The yen rose against the U.S Dollar but its upward trend is predicted to reverse, as many trading analysts believe the monetary unit remains overbought. Some Forex experts believe that the appreciation of the yen was not supported by domestic macroeconomic fundamentals, but mostly by risk aversion in the markets.

Lastly, in the South Pacific, the Australian Dollar weakened against its U.S. peer despite stellar reports denoting an increase in construction activities. New Zealand’s Dollar was impacted by less than positive figures on Business Confidence which signaled that entrepreneurs are worried about a number of issues including the slow-down of China’s economy and a dip in dairy product prices.

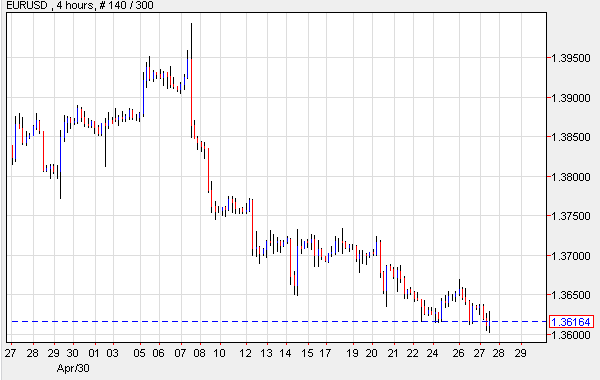

EUR/USD- ECB Must Prevent Deflation

The EUR/USD slumped to a three-month low on mounting speculation that the European Central Bank may not hold off from adding stimulus. On the data front, Germany reported that the number of individuals out of work climbed by the greatest amount in five years. The number of Unemployed individuals climbed by 23,937 to 2.91 million this month. Furthermore, the European Central Bank revealed that bank loans fell 1.8 percent in April as lending rose 0.2 percent in March. And lastly, the M3 or Money Supply for the Euro region contracted. According to analysts, the fact that anti-Euro Parties obtained a victory in the Parliamentary elections has not impacted the Euro.

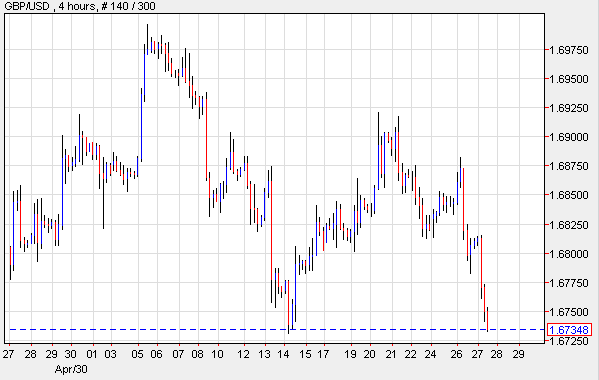

GBP/USD- Pound Weighed On By Mortgage Loans

The GBP/USD plummeted as the greenback continued to rally days after FOMC officials indicated that the central bank could boost the interest rate by 2015. In the U.K., economic reports revealed the greatest decline in Mortgage Approvals to since August of 2013, suggesting that the real estate market, especially in London, could be slowing down. The British Banker’s Association stated that only 42,173 loans were approved in April. Analysts anticipate that the Bank of England could be the first among the major central banks to raise the key cash rate, but this may not happen this year. The data issued on Mortgage Loans also signals that the BOE has tightened lending practices to prevent a bubble from occurring.

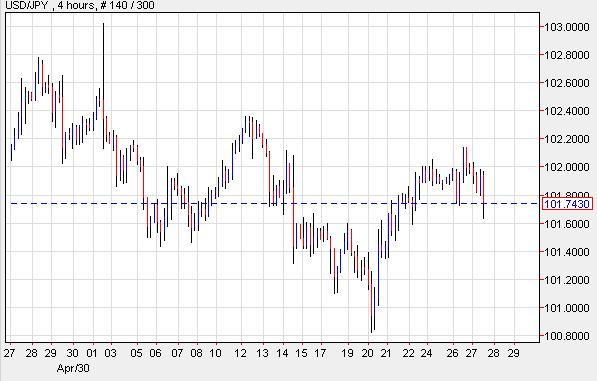

USD/JPY- Yen Rallies On Signs Of Economic Improvement

The USD/JPY remained high even as the yen rallied on comments suggesting that the Japanese economy is moving in the right direction. Bank of Japan officials stated that they do not plan to implement further stimulus and have instead shifted their attention towards supporting economic growth while contemplating ways to wind down stimulus. Haruhiko Kuroda, the bank’s governor, voiced the need for more government involvement in spurring economic growth, confirming that the central bank does not wish to take on the responsibility completely alone. However, some analysts are actually predicting that the USD/JPY could rise, as it is clear from technical analysis that the currency remains overbought.

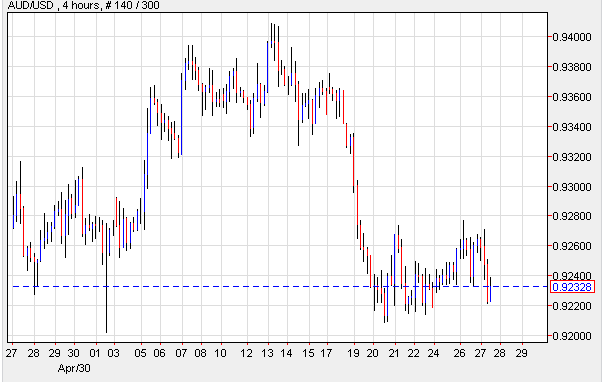

AUD/USD- Construction Drops

The AUD/USD fell even as activities in the Construction sector posted an increase. Official releases confirmed that Construction projects done in the first three months of 2014 climbed 0.3 percent, surpassing expectations for a 0.2 percent jump. The AUD/USD advanced further as demand for the greenback remained high following positive news showing that Consumer Confidence for the world’s biggest economy went up to 83 this month after posting at 81.7 in April.

Today’s Outlook

Today’s economic calendar shows that the U.S. will report on GDP, Initial and Continuing Jobless Claims, Real Consumer Spending, and Pending Home Sales. The U.K. will issue Gfk Consumer Confidence. Japan will announce Household Spending, National CPI, National Core CPI, Tokyo CPI, Industrial Production and the Unemployment Rate. Australia will provide data on Private Sector Credit. And New Zealand will publish ANZ Business Confidence.