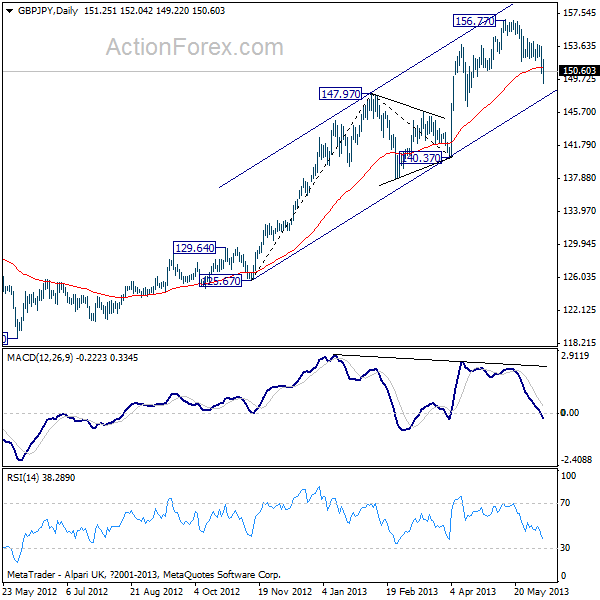

GBP/JPY Daily Outlook

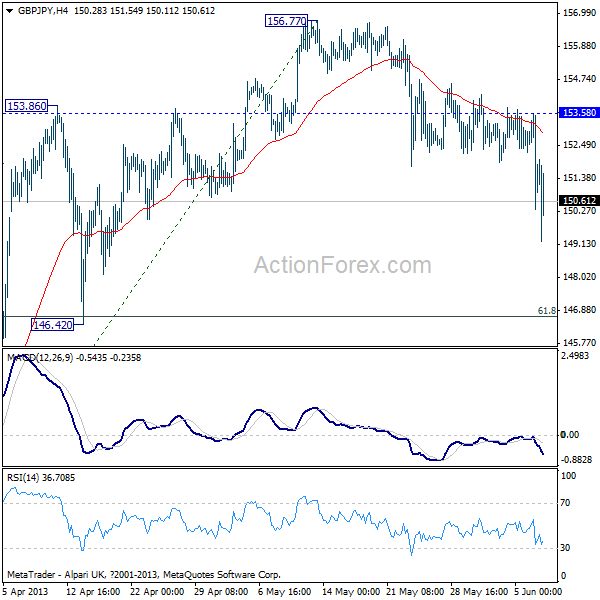

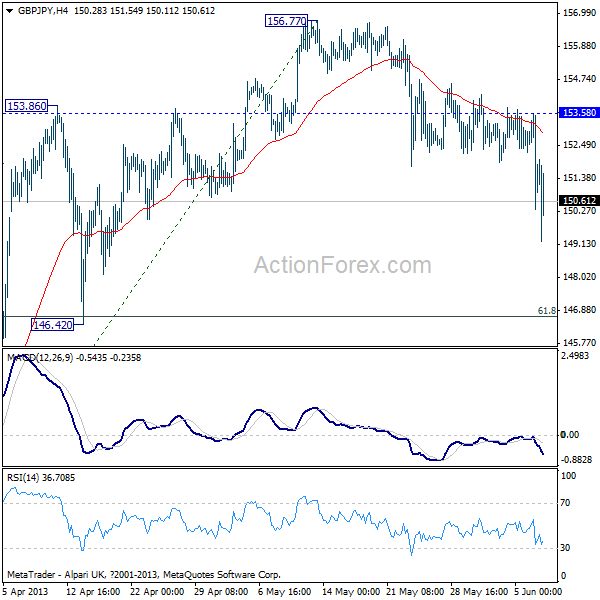

Daily Pivots: (S1) 149.87; (P) 151.72; (R1) 153.11;

The GBP/JPY dropped as low as 149.22 Thursday, and intraday bias remained on the downside. We recommend caution on rebound from 146.42 cluster support (61.8% retracement of 140.37 to 156.77 at 146.63). Above 153.58 indicates that the pull back is finished, and bias will turn back to the downside. A break of 146.42/63 will indicate larger trend reversal and bring deeper fall to 140.37 support and below.

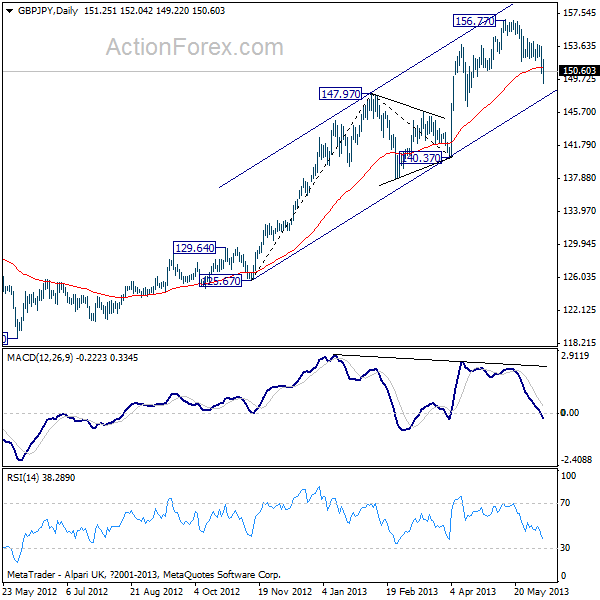

In the bigger picture, the medium term rise from 116.83 is still in progress. Whether such a rally is impulsive or corrective in nature, it's at least a move at the same degree as fall from 163.05. We expect the current rise to extend to 163.05 resistance and above. Considering the bearish divergence condition in the daily MACD, a break of 146.42 will indicate medium term topping and should bring deeper fall back to 140.37 and below.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

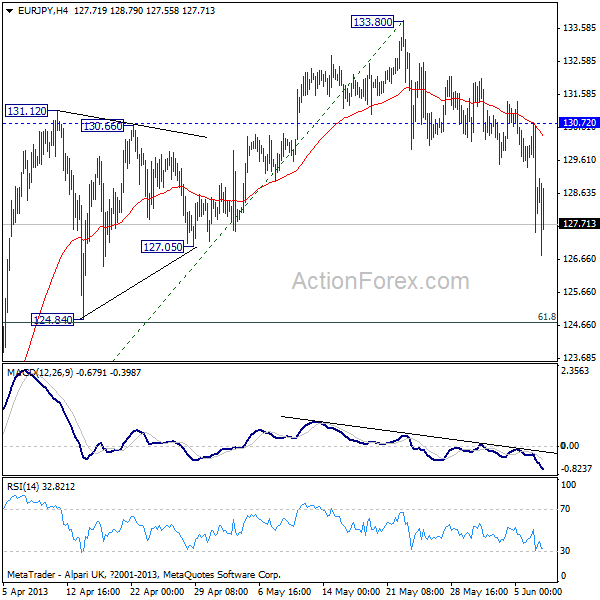

EUR/JPY Daily Outlook

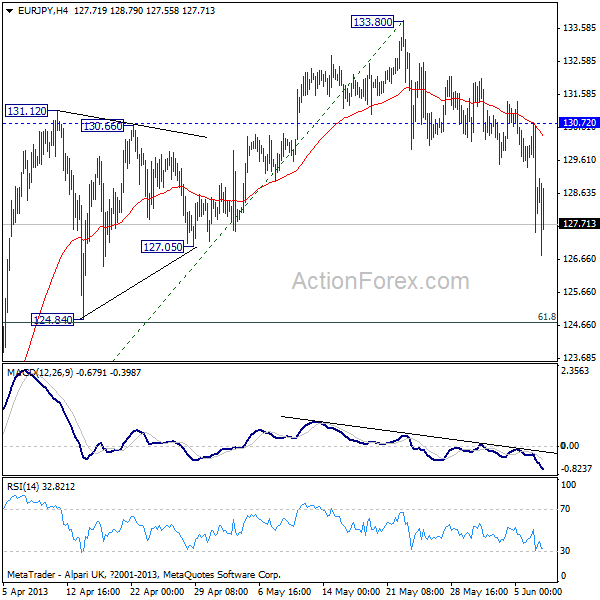

Daily Pivots: (S1) 127.06; (P) 128.88; (R1) 130.25;

The EUR/JPY dropped as low as 126.76 so far today and breached 127.05 support. Intraday bias remains on the downside and deeper decline would be seen. We recommend caution on rebound, contained by 124.84 cluster support (61.8% retracement of 119.10 to 133.80 at 124.75). A break of 130.72 resistance will indicate that pull back from 133.80 has completed, and turn bias back to the upside for 133.80 and above. Note that a sustained break of 124.75/84 should confirm near term trend reversal and target 119.10 key support level.

The up trend from 94.11 long term bottom is starting to lose momentum, with bearish divergence condition seen in the daily MACD. We'll probably see strong resistance between projection level at 136.02 and 61.8% retracement of 169.96 to 94.11 at 140.98 to limit upside, and bring a sizeable consolidation/correction. A break of 124.84 will confirm medium term topping and target 119.10 and below. Considering the five wave structure of the rise from 94.11, we expect another medium term rally after completing the anticipated correction.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 149.87; (P) 151.72; (R1) 153.11;

The GBP/JPY dropped as low as 149.22 Thursday, and intraday bias remained on the downside. We recommend caution on rebound from 146.42 cluster support (61.8% retracement of 140.37 to 156.77 at 146.63). Above 153.58 indicates that the pull back is finished, and bias will turn back to the downside. A break of 146.42/63 will indicate larger trend reversal and bring deeper fall to 140.37 support and below.

In the bigger picture, the medium term rise from 116.83 is still in progress. Whether such a rally is impulsive or corrective in nature, it's at least a move at the same degree as fall from 163.05. We expect the current rise to extend to 163.05 resistance and above. Considering the bearish divergence condition in the daily MACD, a break of 146.42 will indicate medium term topping and should bring deeper fall back to 140.37 and below.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 127.06; (P) 128.88; (R1) 130.25;

The EUR/JPY dropped as low as 126.76 so far today and breached 127.05 support. Intraday bias remains on the downside and deeper decline would be seen. We recommend caution on rebound, contained by 124.84 cluster support (61.8% retracement of 119.10 to 133.80 at 124.75). A break of 130.72 resistance will indicate that pull back from 133.80 has completed, and turn bias back to the upside for 133.80 and above. Note that a sustained break of 124.75/84 should confirm near term trend reversal and target 119.10 key support level.

The up trend from 94.11 long term bottom is starting to lose momentum, with bearish divergence condition seen in the daily MACD. We'll probably see strong resistance between projection level at 136.02 and 61.8% retracement of 169.96 to 94.11 at 140.98 to limit upside, and bring a sizeable consolidation/correction. A break of 124.84 will confirm medium term topping and target 119.10 and below. Considering the five wave structure of the rise from 94.11, we expect another medium term rally after completing the anticipated correction.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />