GBP/JPY Daily Outlook

Daily Pivots: (S1) 149.20; (P) 150.61; (R1) 153.04;

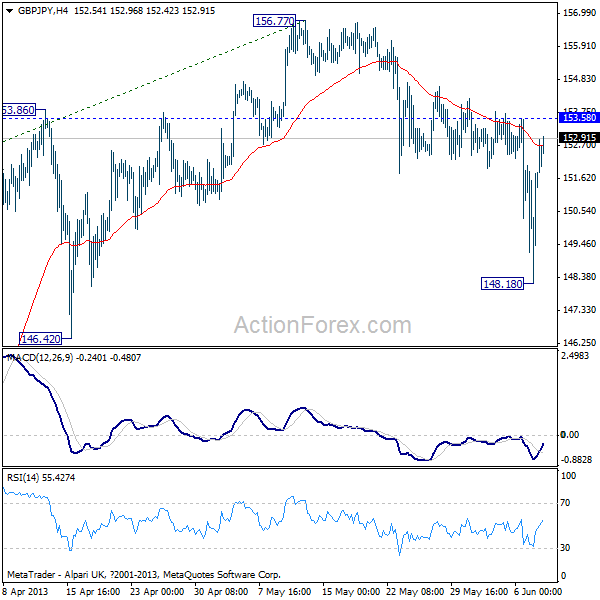

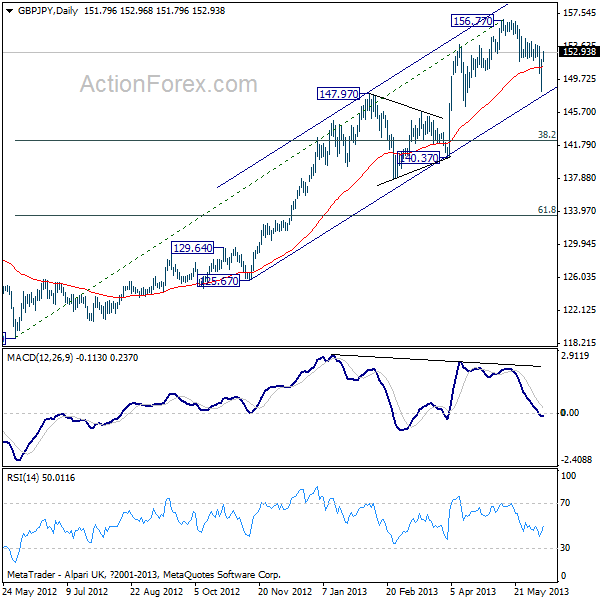

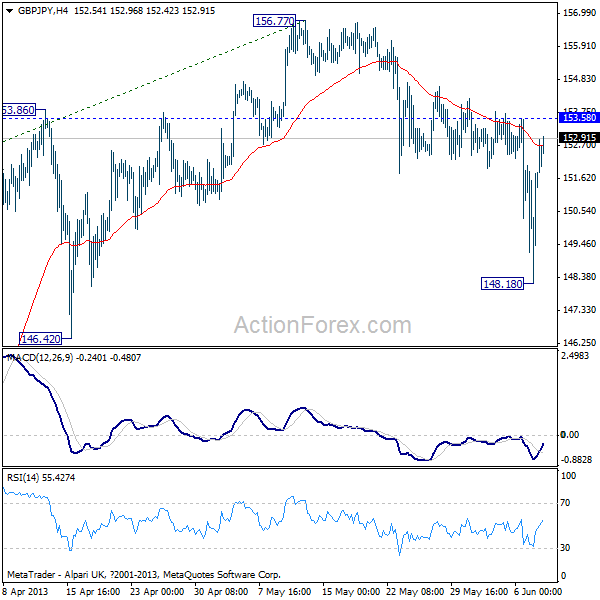

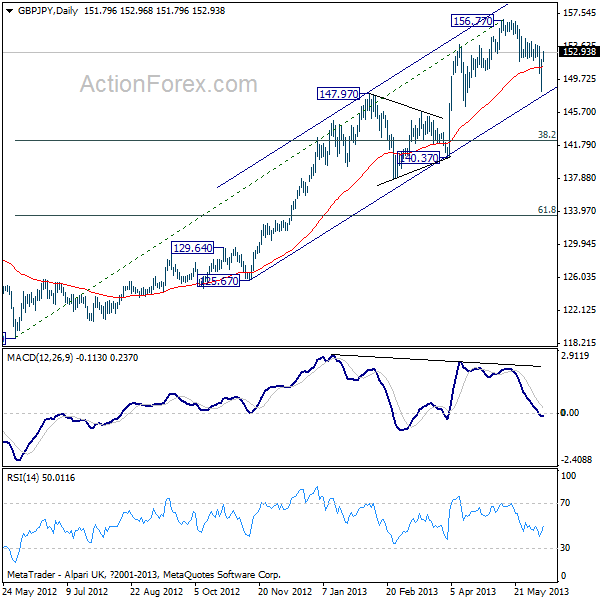

The GBP/JPY's recovery from 148.18 extends higher today. But with 153.58 minor resistance intact, risk remains on the downside. As noted before, the cross has possibly topped out earlier than expected at 156.77. Decline from there might now be correcting the whole rally from 118.82. Below 148.18 will target 146.20, and a break will confirm this bearish case. On the upside, above 153.55 will indicate that another high above 156.77 would be seen before the GBP/JPY reverses.

Current development argues that a medium term top is in place at 156.77, on bearish divergence condition in daily MACD. A deeper pull back could be seen to 38.2% retracement of 118.82 to 156.77 at 142.27. Overall, we'd still expect a whole rise from 116.83 medium term bottom to resume later to 163.05 resistance and above, after completing the correction.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

EUR/JPY Daily Outlook

Daily Pivots: (S1) 127.00; (P) 128.09; (R1) 130.01;

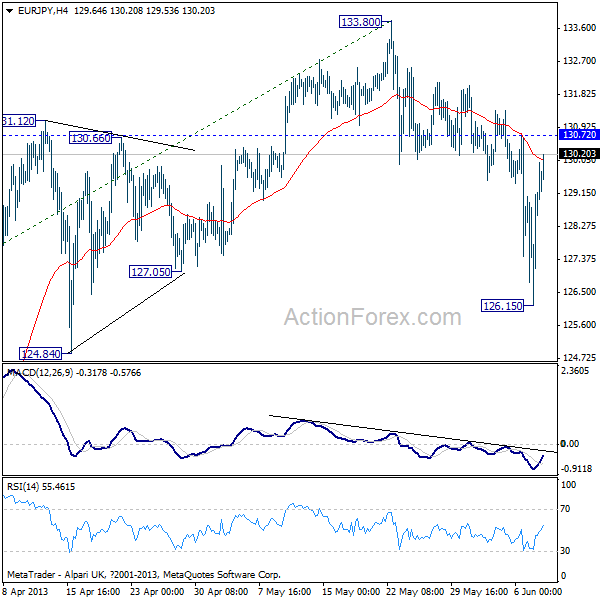

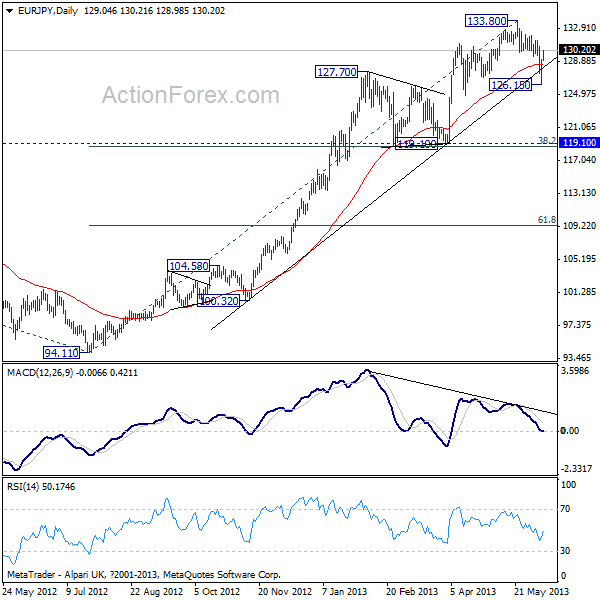

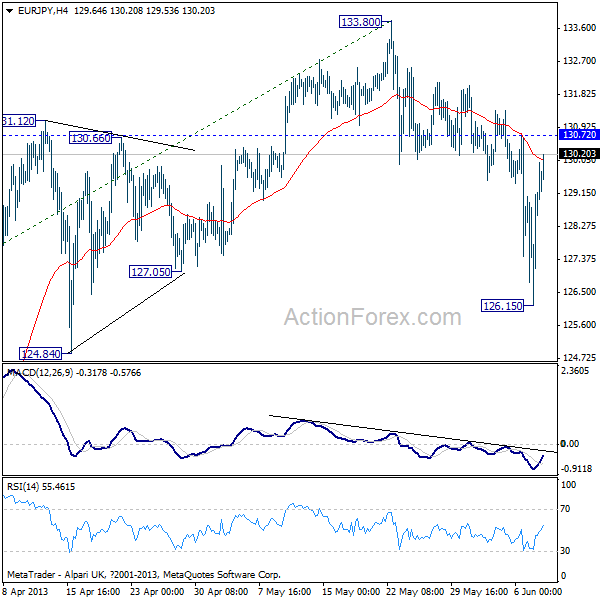

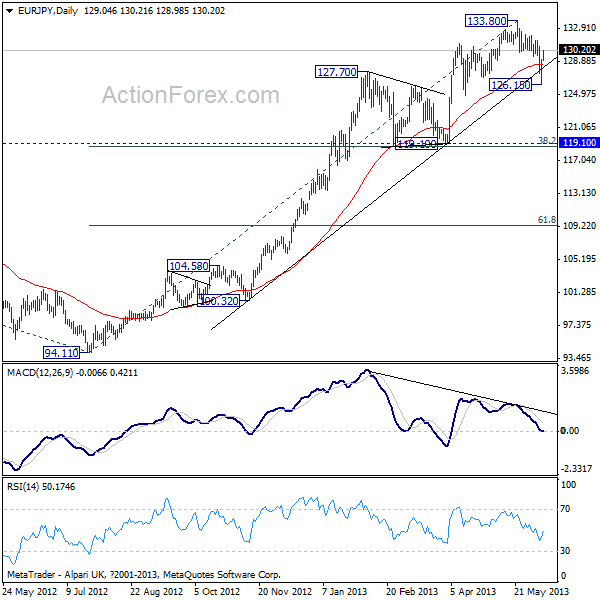

The EUR/JPY's recovery from 126.15 continues today, but with 130.72 minor resistance intact, risk remains on the downside. A deeper decline could still be seen. As noted previously, the EUR/JPY might have topped out earlier than expected at 133.80. A fall from there is correcting the whole rally from 94.11, and below 126.15 will target 124.84 first. A break will confirm this bearish case, and target 119.10 cluster support next. On the upside, above 130.72 will suggest that another high above 133.80 will be seen before the EUR/JPY reverses.

The current development argues that the medium term uptrend from 94.11 topped out at 133.80, on bearish divergence condition in daily MACD. Such a correction would target 119.10 cluster support (38.2% retracement of 94.11 to 133.80 at 118.63). A break will target 61.8% retracement at 109.27. Considering the five wave structure of the rise from 94.11, we expect another medium term rally after completing the anticipated correction.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 149.20; (P) 150.61; (R1) 153.04;

The GBP/JPY's recovery from 148.18 extends higher today. But with 153.58 minor resistance intact, risk remains on the downside. As noted before, the cross has possibly topped out earlier than expected at 156.77. Decline from there might now be correcting the whole rally from 118.82. Below 148.18 will target 146.20, and a break will confirm this bearish case. On the upside, above 153.55 will indicate that another high above 156.77 would be seen before the GBP/JPY reverses.

Current development argues that a medium term top is in place at 156.77, on bearish divergence condition in daily MACD. A deeper pull back could be seen to 38.2% retracement of 118.82 to 156.77 at 142.27. Overall, we'd still expect a whole rise from 116.83 medium term bottom to resume later to 163.05 resistance and above, after completing the correction.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 127.00; (P) 128.09; (R1) 130.01;

The EUR/JPY's recovery from 126.15 continues today, but with 130.72 minor resistance intact, risk remains on the downside. A deeper decline could still be seen. As noted previously, the EUR/JPY might have topped out earlier than expected at 133.80. A fall from there is correcting the whole rally from 94.11, and below 126.15 will target 124.84 first. A break will confirm this bearish case, and target 119.10 cluster support next. On the upside, above 130.72 will suggest that another high above 133.80 will be seen before the EUR/JPY reverses.

The current development argues that the medium term uptrend from 94.11 topped out at 133.80, on bearish divergence condition in daily MACD. Such a correction would target 119.10 cluster support (38.2% retracement of 94.11 to 133.80 at 118.63). A break will target 61.8% retracement at 109.27. Considering the five wave structure of the rise from 94.11, we expect another medium term rally after completing the anticipated correction.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />