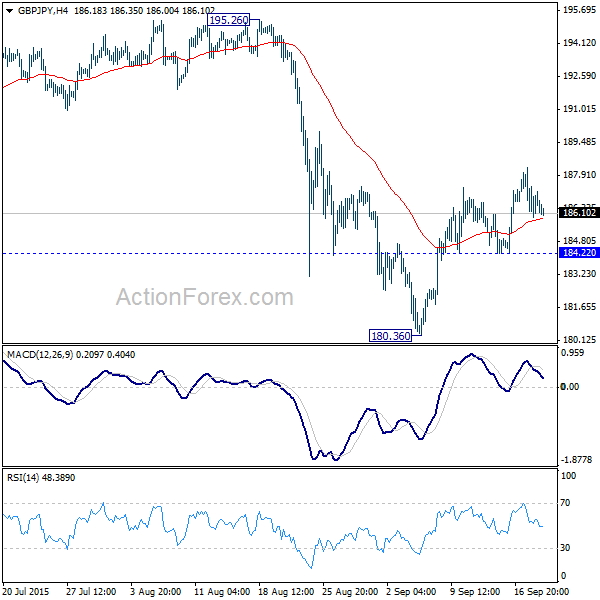

GBP/JPY Daily Outlook

Daily Pivots: (S1) 185.63; (P) 186.50; (R1) 187.06;

With 184.22 minor support intact, further rise is still in favor in GBP/JPY. The corrective pattern from 195.86 might have completed at 180.367 already. Further rise could be seen back to retest this high. However, below 184.22 minor support will turn focus back to 180.36 low instead.

In the bigger picture, the break of the medium term trend line support is taken as a sign of trend reversal. This is supported by bearish divergence condition in weekly MACD. Also, GBP/JPY was close to key cluster resistance of 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level. Break of 174.86 will confirm trend reversal and bring deeper fall to 38.2% retracement of 116.83 to 195.86 at 165.67. In case of another rise, we'll be cautious on strong resistance from 199.80/200.00 to bring reversal finally.

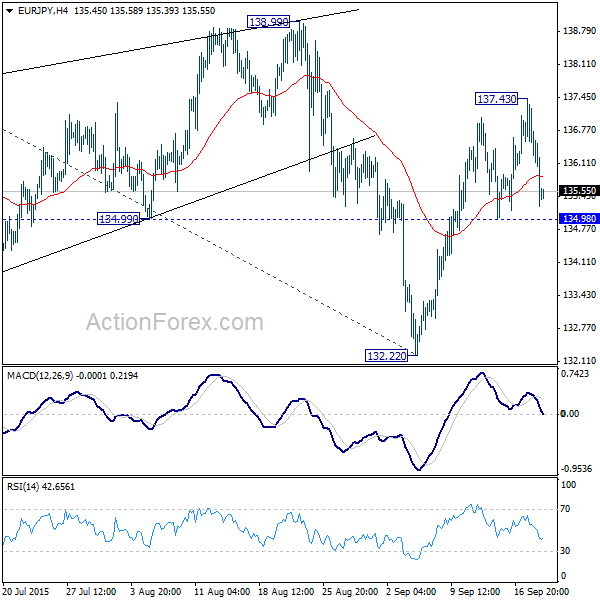

EUR/JPY Daily Outlook

Daily Pivots: (S1) 134.74; (P) 136.02; (R1) 136.80;

Intraday bias in EUR/JPY remains neutral for the moment. As long as 134.98 minor support holds, we're favoring another rise in the cross. Above 137.43 will target 138.99/141.04 resistance zone. Break will resume whole rebound from 126.09 and target 100% projection of 126.09 to 141.04 from 132.33 at 147.17. However, break of 134.98 will turn focus back to 132.22 support instead.

In the bigger picture, price actions from 149.76 medium term top is viewed as corrective in nature. Strong rebound after failing to sustain below 38.2% retracement of 94.11 to 149.76 at 128.50 argues that it's developing into a sideway pattern. We'd expect more range trading between 126.09 and 149.76 in medium term. And that should then be followed by an upside breakout at a later stage. Nonetheless, decisive break of 126.09 would extend the correction towards 61.8% retracement at 115.36.