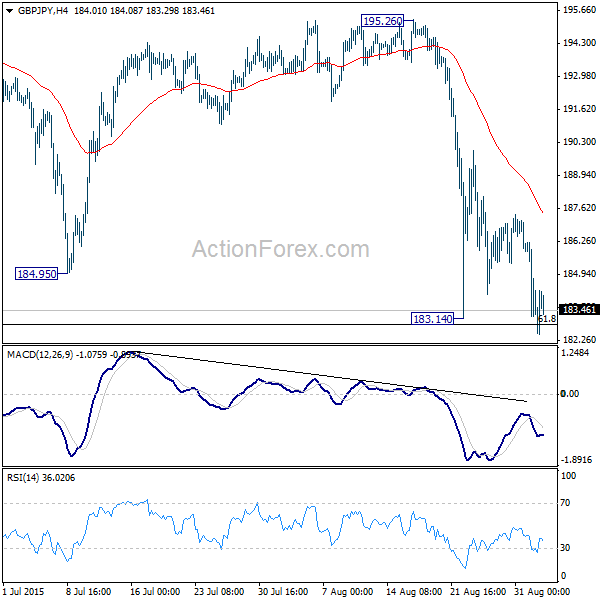

GBP/JPY Daily Outlook

Daily Pivots: (S1) 181.39; (P) 183.81; (R1) 185.08; More.....

Focus in GBP/JPY is back to 61.8% retracement of 174.86 to 195.86 at 182.88. Sustained trading there is an early sign of larger trend reversal and would bring deeper fall back to 174.86 key support level. Meanwhile strong rebound from current level would send GBP/JPY for a new high above 195.86 before topping.

In the bigger picture, the is not enough evidence for medium term reversal yet. The up trend from 116.83 could extend to 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level and top there. Meanwhile, considering bearish divergence condition in weekly MACD. Break of 174.86 support will suggest that the trend has reversed earlier than we expect.

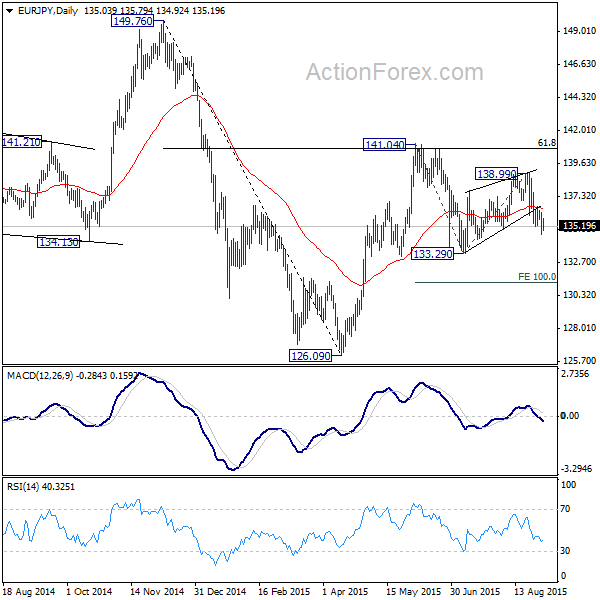

EUR/JPY Daily Outlook

Daily Pivots: (S1) 134.42; (P) 135.32; (R1) 135.98; More...

The break of 134.99 support suggests that fall from 138.99 is resuming. Intraday bias turned to the downside. As noted before, the rebound from 133.29 is likely a corrective move and could have finished at 138.99 already. EUR/JPY should target 133.29 and then 100% projection of 141.04 to 133.29 from 138.99 at 131.24. On the upside, above 136.61 minor resistance will dampen this bearish view and turn bias neutral first.

In the bigger picture, price actions from 149.76 medium term top is viewed as corrective in nature. Strong rebound after failing to sustain below 38.2% retracement of 94.11 to 149.76 at 128.50 argues that it's developing into a sideway pattern. We'd expect more range trading between 126.09 and 149.76 in medium term. And that should then be followed by an upside breakout at a later stage. Nonetheless, decisive break of 126.09 would extend the correction towards 61.8% retracement at 115.36.