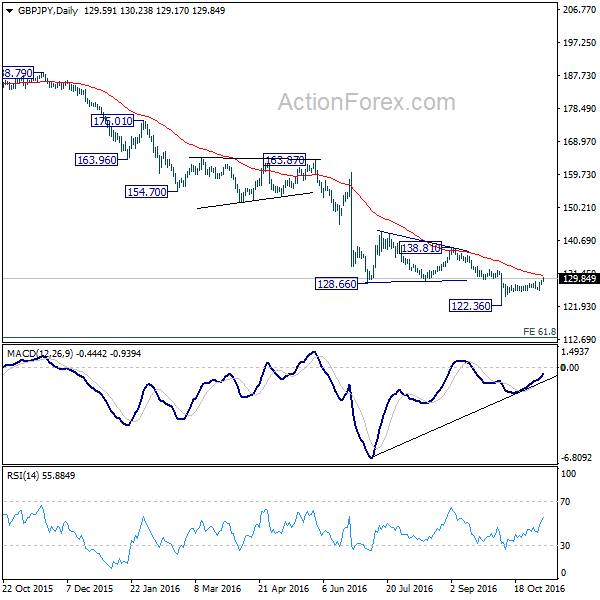

GBP/JPY Daily Outlook

Daily Pivots: (S1) 128.32; (P) 128.88; (R1) 129.54;

The break of 129.61 support turned resistance suggests that rebound from 122.36 is resuming. Intraday bias is turned to the upside for 132. 21 resistance first. Break will target 138.81 next. Bullish convergence condition in daily MACD raises the chance of trend reversal. And we'll pay attention to the reaction at 138.81. Meanwhile, break of 126.48 support is needed to indicate completion of the rebound. Otherwise, further rise will remain in favor.

In the bigger picture, fall from 195.86 medium term top is still in progress and met 100% projection of 195.86 to 154.70 from 163.87 at 122.71. There is prospect of retesting 116.83 (2011 low). On the upside, break of 138.81 resistance is needed to be the first sign medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 114.36; (P) 114.59; (R1) 115.06;

Break of 115.67 resistance suggests that rise from 112.60 is resuming. Intraday bias is back on the upside for 116.27 first. Break there should extend the rebound from 109.20. But in that case, strong resistance should be seen at longer fibonacci level at 121.36 to limit upside. Meanwhile, below 114.00 will turn bias back to the downside for 112.60 support. Overall, price actions from 109.20 are seen as a consolidation pattern.

In the bigger picture, current development argues that a medium term bottom is in place at 109.20 and rebound from there would extend. However, momentum isn't convincing enough for trend reversal yet. Hence, in case of stronger rise, we'd be expecting strong resistance from 38.2% retracement of 141.04 to 109.20 at 121.36 to limit upside, at least on first attempt. Meanwhile, break of 112.07 will extend the down trend from 149.76 to 76.4% retracement of 94.11 to 149.76 at 107.24.