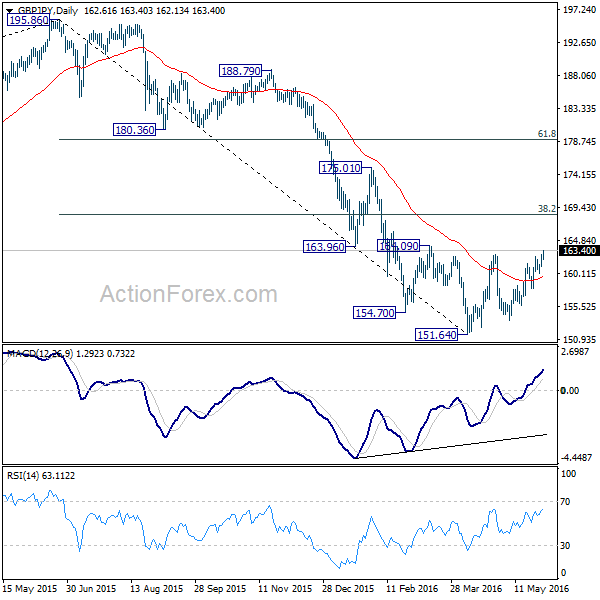

GBP/JPY Daily Outlook

Daily Pivots: (S1) 161.58; (P) 162.23; (R1) 163.28;

GBP/JPY's rise continues today and the break of 162.80 resistance now argues that a medium term bottom is formed at 151.64 on bullish convergence condition in daily MACD. Intraday bias is on the upside for 38.2% retracement of 195.86 to 151.64 at 168.53 next. On the downside, break of 160.14 support is needed to signal short term topping. Otherwise, outlook will stay cautiously bullish in case of retreat.

In the bigger picture, current development argues that corrective fall from 195.86 has completed at 151.64 on bullish convergence condition in daily MACD. Rebound from there is currently seen as the second leg of a medium term sideway pattern. Thus, further rise could be seen to 61.8% retracement of 195.86 to 151.64 at 178.96. But we'll be cautious on strong resistance above 178.96 to bring another falling leg of the consolidation pattern.

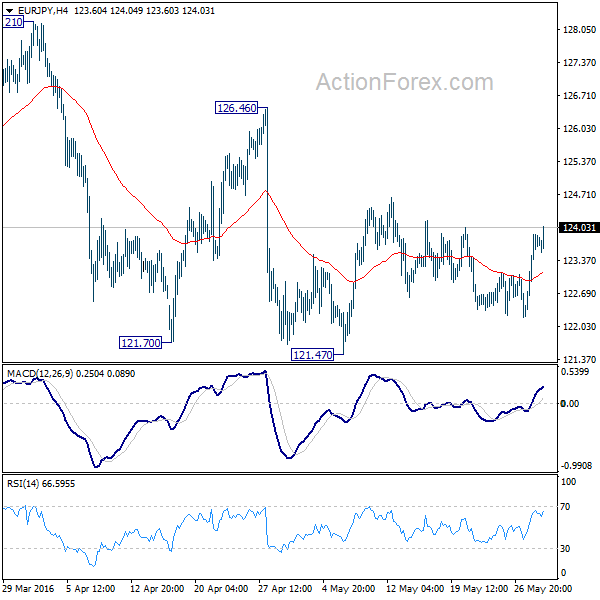

EUR/JPY Daily Outlook

Daily Pivots: (S1) 122.96; (P) 123.43; (R1) 124.20;

Intraday bias in EUR/JPY remains neutral as the corrective price action from 121.47 might continue. With 126.46 resistance intact, the larger down trend is still expected to extend lower. Break of 121.47 will target next projection level at 117.37. However, decisive break of 126.46 will carry larger bullish implication and target 128.21 resistance first.

In the bigger picture, medium term correction from 149.76 is still in progress and would extend to 100% projection of 149.76 to 126.09 from 141.04 at 117.37. We'll look for bottoming signal around 61.8% retracement of 94.11 to 149.76 at 115.36. Break of 126.46 resistance, however, will suggest that the correction has completed earlier than we thought and turn outlook bullish.