GBP/JPY Daily Outlook

Daily Pivots: (S1) 147.27; (P) 147.69; (R1) 148.26;

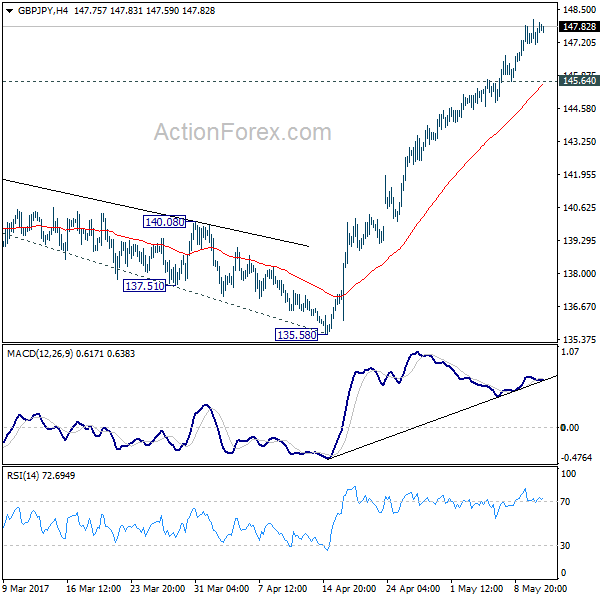

Intraday bias in GBP/JPY stays on the upside at this point. Whole rise from 122.36 is resuming and break of 140.20 resistance will target 150.42 long term fibonacci level first. Break there will pave the way to 100% projection of 122.36 to 148.42 from 135.58 at 161.64. On the downside, below 145.64 minor support will turn bias neutral and bring consolidation before staging another rise.

In the bigger picture, based on current momentum, rise from 122.36 bottom should be developing into a medium term move. Break of 38.2% retracement of 195.86 to 122.36 at 150.42 should pave the way to 61.8% retracement at 167.78. This will now be the favored case as long as 135.58 support holds.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 123.68; (P) 124.00; (R1) 124.51;

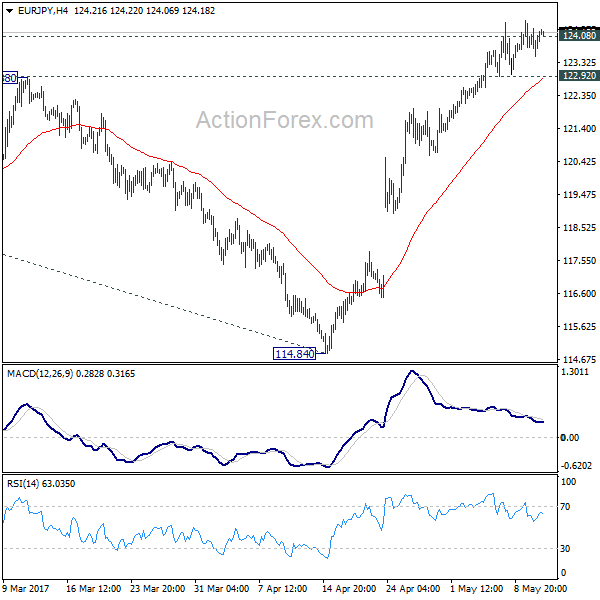

No change in EUR/JPY's outlook despite diminishing upside moment as seen in 4 hour MACD. Further rally is expected with 122.92 minor support intact. Firm break of 124.08 resistance will confirm resumption of whole rise from 109.20. In that case, EUR/JPY would target 126.09 resistance first. Break there will pave the way to 100% projection of 109.03 to 124.08 from 114.84 at 129.89. On the downside, below 122.92 minor support will turn bias to the downside and bring pull back.

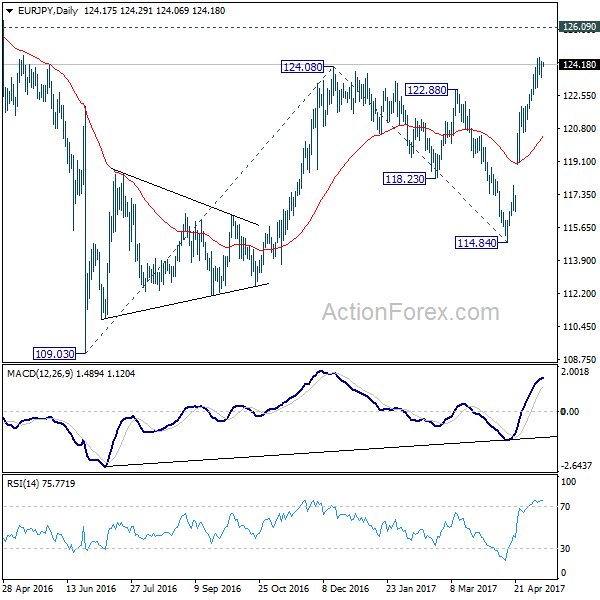

In the bigger picture, focus is back on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.