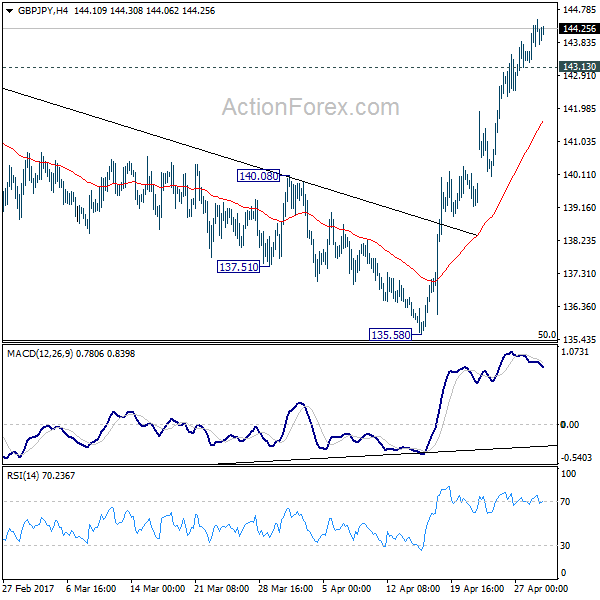

GBP/JPY Daily Outlook

Daily Pivots: (S1) 143.53; (P) 144.01; (R1) 144.74;

While GBP/JPY is losing upside momentum, there is no sign of topping yet. Intraday bias remains on the upside for 144.77 resistance. As noted before, consolidation pattern from 148.42 has completed at 135.58, ahead of 135.39 medium term fibonacci level. Break of 144.77 will resume the whole rebound from 122.36 through 148.42 resistance. On the downside, break of 143.13 minor support will turn bias neutral and bring consolidation before staging another rally.

In the bigger picture, based on current momentum, rise from 122.36 bottom should be developing into a medium term move. Break of 38.2% retracement of 195.86 to 122.36 at 150.42 should pave the way to 61.8% retracement at 167.78. This will now be the favored case as long as 135.58 support holds.

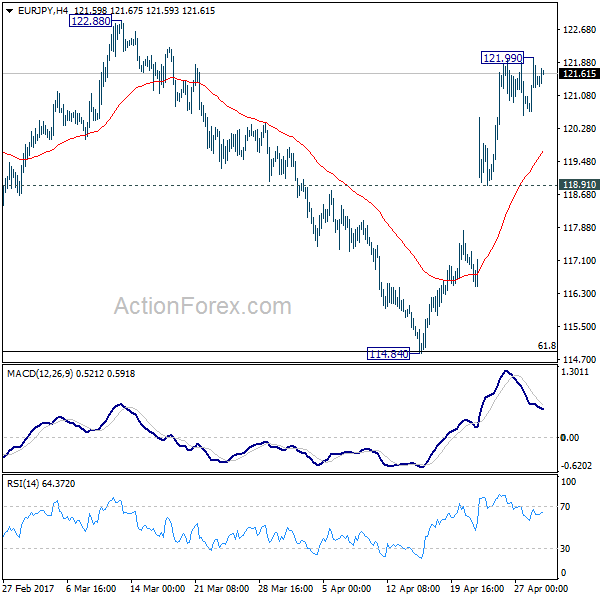

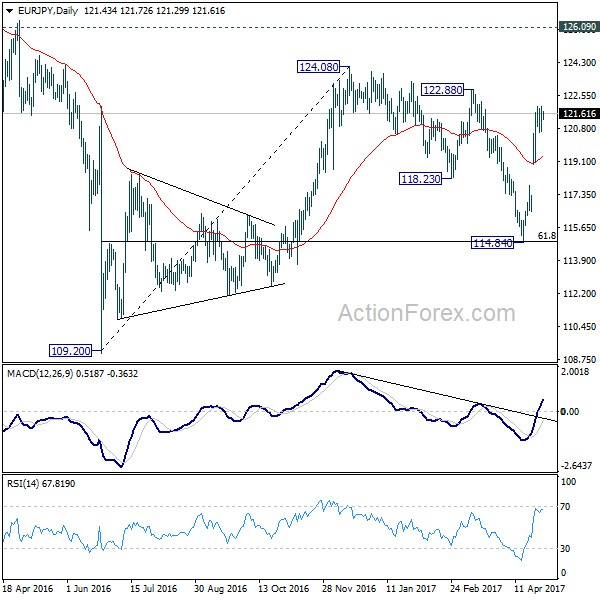

EUR/JPY Daily Outlook

Daily Pivots: (S1) 120.79; (P) 121.39; (R1) 122.09;

No change in EUR/JPY's outlook as further rise is expected as long as 118.91 support holds. As noted before, correction from 124.08 should have completed with three waves down to 114.84. Break of 122.88 resistance will extend larger rise from 109.20 through 124.08 high. On the downside, however, break of 118.91 will turn focus back to 114.84 instead.

In the bigger picture, focus is back on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.