GBP/JPY Daily Outlook

Daily Pivots: (S1) 138.33; (P) 138.82; (R1) 139.36;

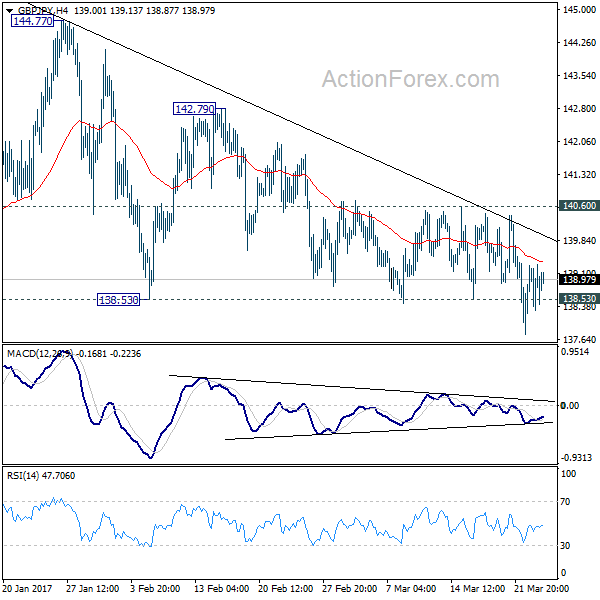

At this point, deeper decline is expected in GBP/JPY with 140.60 minor resistance intact, for 136.44 support and possibly below. Overall, price actions from 148.42 are viewed as a consolidation pattern. We'd expect 50% retracement of 122.36 to 148.42 at 135.39 to contain downside and bring rebound. On the upside, break of 140.60 resistance will turn bias to the upside and send GBP/JPY through 144.77 resistance.

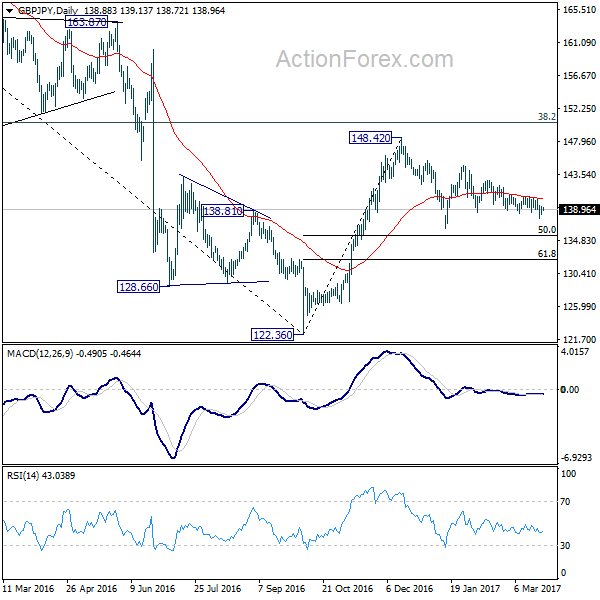

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Or, sustained break of 50% retracement of 122.36 to 148.42 at 135.39 will turn outlook bearish for a test on 122.36 low. Though, sustained break of 150.42 will extend the rebound towards 61.8% retracement of 195.86 to 122.36 at 167.78.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 119.19; (P) 119.74; (R1) 120.17;

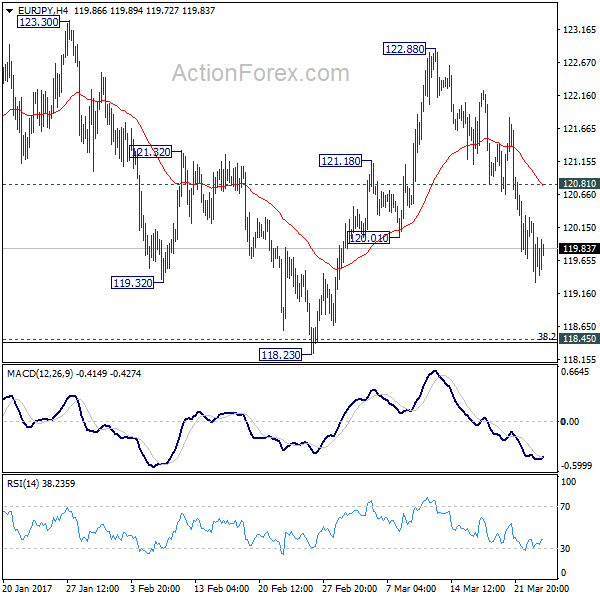

EUR/JPY drops to as low as 119.32 so far and intraday bias stays on the downside for 118.39/45 key cluster level (38.2% retracement of 109.20 to 124.08 at 118.39). Current fall is seen as part of the consolidation pattern from 124.08. We'd expect strong support from 118.39/45 to contain downside and bring rebound. On the upside, above 120.81 minor resistance will turn bias back to the upside for 122.88 and then 124.08.

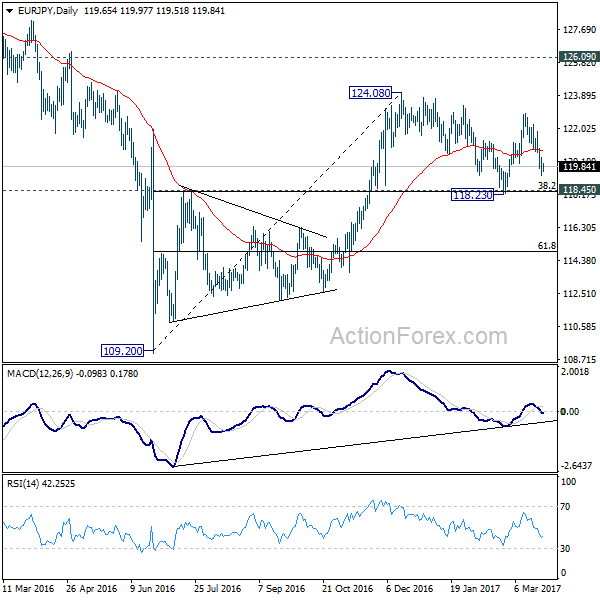

In the bigger picture, we're holding on to the view that medium term rise from 109.20 is still in progress. Focus is on 126.09 key resistance level. Sustained break will confirm completion of the whole decline from 149.76. And rise from 109.20 is of the same degree as the fall from 149.76. In such case, further rally would be seen to 104.04 resistance and possibly above before topping. Meanwhile, rejection from 126.09, or firm break of 118.45 cluster support, will likely extend the fall from 149.76 through 109.20 low.