GBP/JPY Daily Outlook

Daily Pivots: (S1) 160.69; (P) 161.45; (R1) 162.55;

The corrective pattern from 154.70 is still in progress and further rise could still be seen to 61.8% retracement of 175.01 to 154.70 at 167.25. Meanwhile, below 158.54 minor support will turn bias back to the downside for 154.70 low. After all, break of 154.70 is needed to confirm fall resumption. Otherwise, more corrective trading would be seen in near term.

In the bigger picture, a medium term top was formed at 195.86 on bearish divergence condition in weekly MACD. Fall from 195.86 is currently viewed as a correction and would likely extend to 61.8% retracement of 116.83 to 195.86 at 147.01 before completion. On the upside, break of 175.01 resistance is needed to indicate completion of fall from 195.86. Otherwise, outlook will remain bearish in case of rebound.

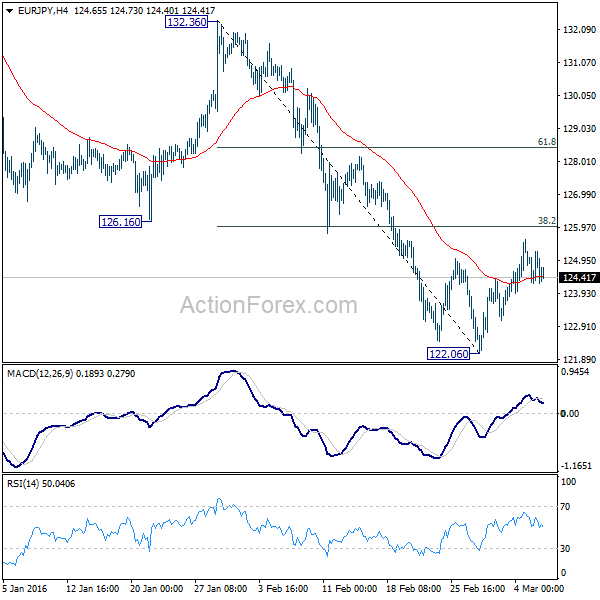

EUR/JPY Daily Outlook

Daily Pivots: (S1) 124.38; (P) 124.80; (R1) 125.37;

The corrective pattern from 122.06 short term bottom is still in progress. Another rise could be seen and sustained break of 38.2% retracement of 132.36 to 122.06 at 125.99 will target 61.8% retracement at 128.42. In any case, break of 122.06 is needed to confirm fall resumption. Otherwise, we'd expect more corrective trading in near term.

In the bigger picture, medium term correction from 149.76 is still in progress and would extend to 100% projection of 149.76 to 126.09 from 141.04 at 117.37. We'll look for bottoming signal around 61.8% retracement of 94.11 to 149.76 at 115.36. Break of 132.36 resistance is needed to be the first sign of medium term reversal. Otherwise, outlook will stay bearish in case of rebound.