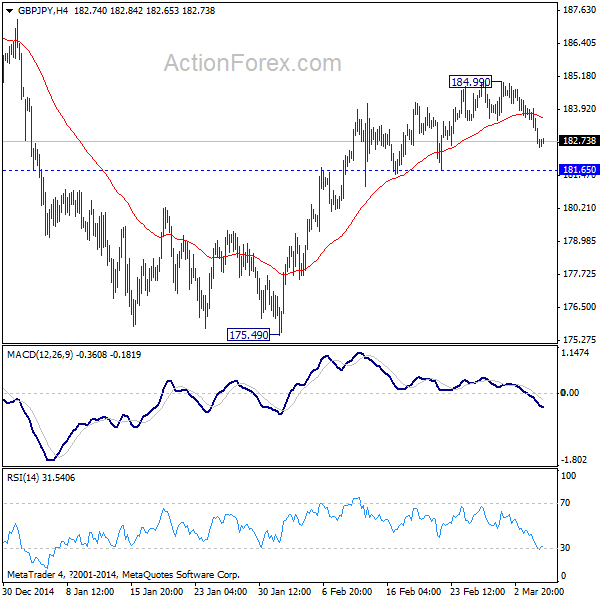

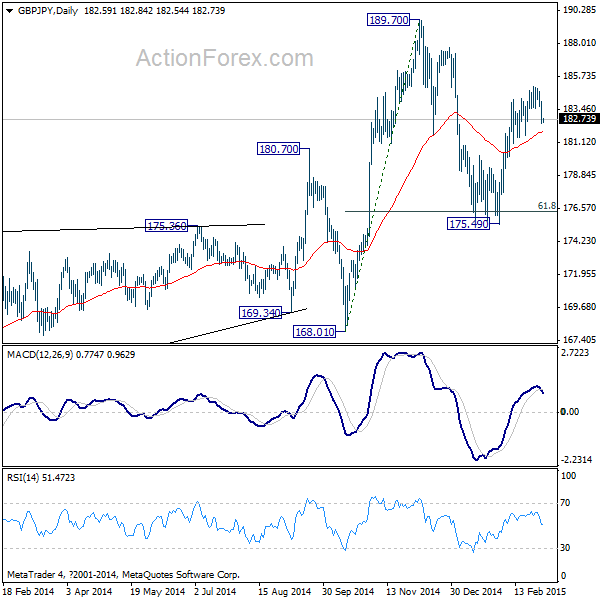

GBP/JPY Daily Outlook

Daily Pivots: (S1) 182.15; (P) 183.06; (R1) 183.62;

Intraday bias in GBP/JPY is neutral for the moment. With 181.65 minor support intact, further rally is in favor for 187.79/189.70 resistance zone. We'd expect strong resistance from there to bring reversal. Meanwhile, below 181.65 minor support will suggest that rise from 175.49 has completed and will turn bias back to the downside for this support.

In the bigger picture, the up trend from 116.83 is starting to lose medium term momentum again with bearish divergence condition seen in weekly MACD. Medium term top could be around the corner, if not formed. Break of 168.01 support will confirm this bearish case and bring deeper correction. Though, as long as 168.01 holds, the up trend could still extend to 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level.

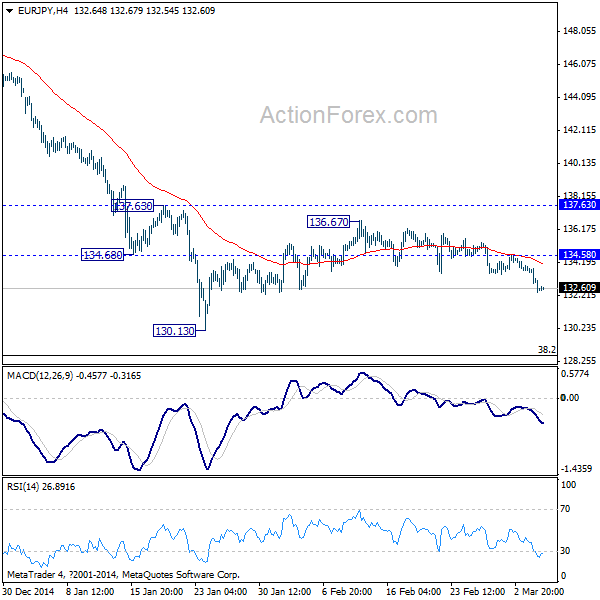

EUR/JPY Daily Outlook

Daily Pivots: (S1) 132.05; (P) 132.95; (R1) 133.50;

The breach of 132.53 minor support indicates that EUR/JPY corrective rise from 130.13 has finally completed. Intraday bias is cautiously on the downside for retesting 130.13 first. Break will confirm resumption of recent down trend and should target next fibonacci level at 128.50. However, above 134.58 minor resistance will dampen this immediate bearish view and would extend the consolidation from 130.13. In that case, upside should be limited by 137.63 resistance to bring down trend resumption eventually.

In the bigger picture, the break of 134.13 support should confirm medium term topping at 149.76, on bearish divergence condition in weekly MACD. Deeper correction should now be seen to 38.2% retracement of 94.11 to 149.76 at 128.50 first. Based on current momentum, the correction could go deeper to 61.8% retracement at 115.36.