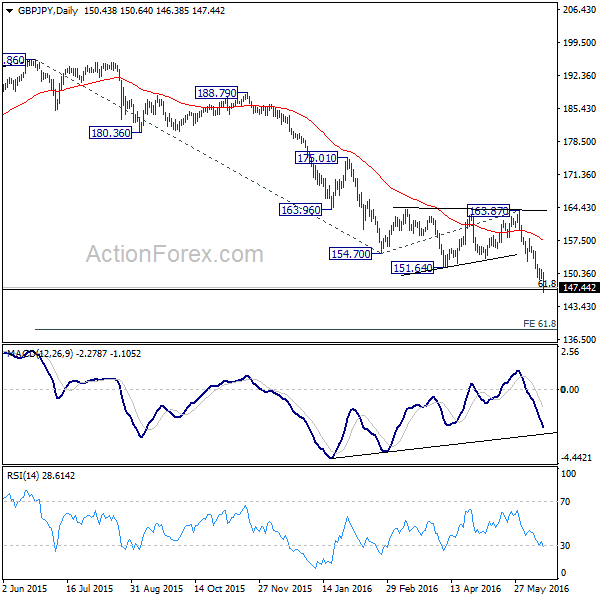

GBP/JPY Daily Outlook

Daily Pivots: (S1) 148.73; (P) 150.10; (R1) 151.03;

GBP/JPY's decline accelerates today and met long term fibonacci level at 147.01. There is no sign of bottoming and intraday bias stays on the downside. Current fall from 195.86 would target 138.43 projection level next. On the upside, above 149.13 minor resistance will turn bias neutral and bring consolidations first.

In the bigger picture, fall from 195.86 medium term top is still in progress and met 61.8% retracement of 116.83 to 195.86 at 147.01. Current downside acceleration suggest that it's target 61.8% projection of 195.86 to 154.70 from 163.87 at 138.43. In any case, break of 163.87 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish with risks on the downside.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 118.89; (P) 119.18; (R1) 119.65;

EUR/JPY's decline accelerates today and met projection level at 117.37. There is no sign of bottoming yet. Intraday bias stays on the downside for long term retracement level at 115.36 next. On the upside, above 118.50 minor resistance will turn bias neutral and bring consolidations first.

In the bigger picture, medium term correction from 149.76 is still in progress met 100% projection of 149.76 to 126.09 from 141.04 at 117.37 already. We'll look for bottoming signal around 61.8% retracement of 94.11 to 149.76 at 115.36. But further downside acceleration would send the cross to 76.4% retracement at 107.24. In any case, break of 126.09 support turned resistance is needed to be the first signal of medium term reversal. Otherwise, outlook will stay bearish.