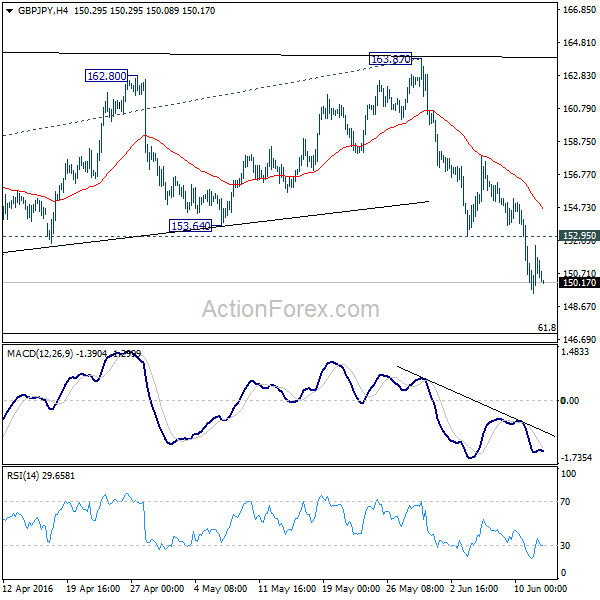

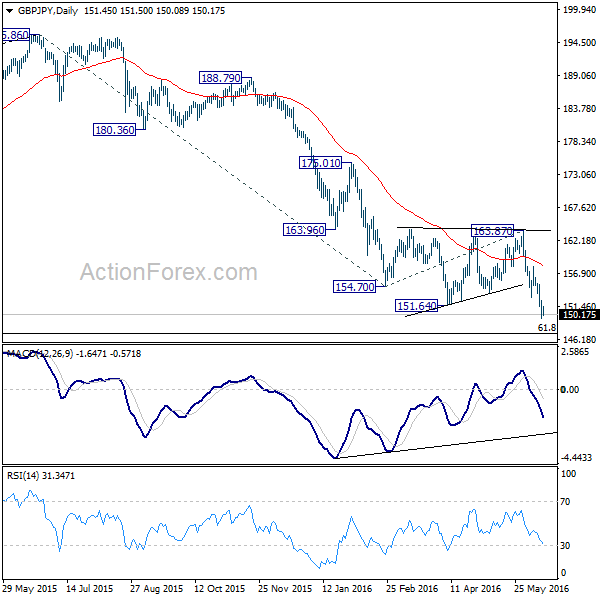

GBP/JPY Daily Outlook

Daily Pivots: (S1) 149.90; (P) 151.14; (R1) 152.83;

Intraday bias in GBP/JPY remains on the downside for the momentum Prior break of 151.64 support confirms resumption of whole decline from 195.86. Further fall should be seen to next long term fibonacci level at 147.01 first. On the upside, above 152.95 minor resistance will turn bias neutral and bring consolidations before staging another decline.

In the bigger picture, fall from 195.86 medium term top has just resumed and is starting 61.8% retracement of 116.83 to 195.86 at 147.01. At this point, we're viewing such decline as a corrective move and would look for bottoming at around 147.01. However, strong break there would indicate downside momentum and would target 61.8% projection of 195.86 to 154.70 from 163.87 at 138.43. In any case, break of 163.87 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish with risks on the downside.

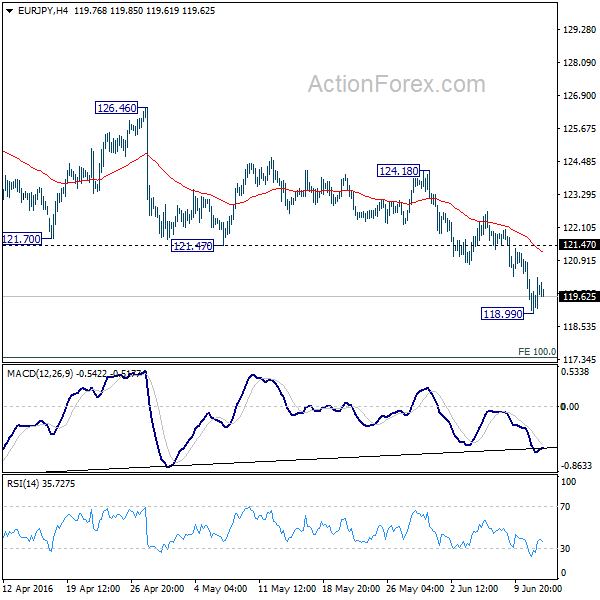

EUR/JPY Daily Outlook

Daily Pivots: (S1) 119.22; (P) 119.77; (R1) 120.55;

A temporary low is in place at 118.99 and intraday bias in EUR/JPY is turned neutral first. Some consolidation would be see but upside should be limited by 121.47 support turned resistance and bring fall resumption. Below 118.99 will extend the larger down trend to next projection level at 117.37.

In the bigger picture, medium term correction from 149.76 is still in progress and would extend to 100% projection of 149.76 to 126.09 from 141.04 at 117.37. We'll look for bottoming signal around 61.8% retracement of 94.11 to 149.76 at 115.36. Break of 124.18 resistance, however, will suggest that the correction has completed earlier than we thought and turn outlook bullish.