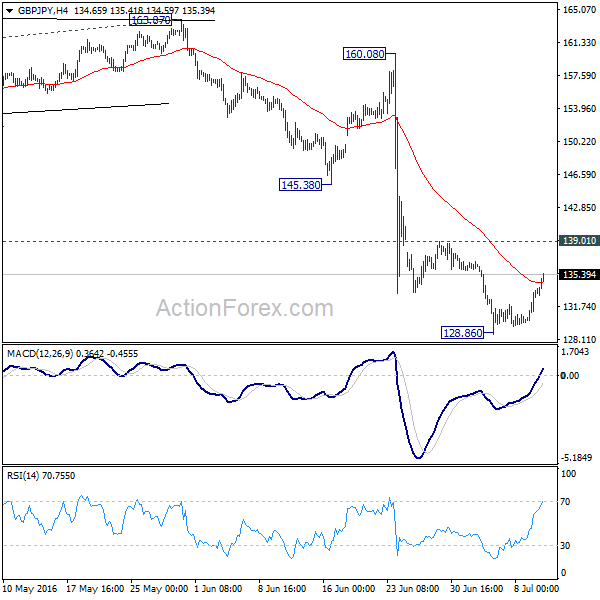

GBP/JPY Daily Outlook

Daily Pivots: (S1) 131.21; (P) 132.47; (R1) 134.85;

Intraday bias in GBP/JPY remains neutral for consolidations above 128.86 temporary low. Break of 139.01 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery. Below 128.86 will target next projection level at 122.71.

In the bigger picture, fall from 195.86 medium term top is still in progress and would target 100% projection of 195.86 to 154.70 from 163.87 at 122.71. There is prospect of retesting 116.83 (2011 low). On the upside, break of 154.70 support turned resistance is needed to be the first sign medium term bottoming. Otherwise, outlook will remain bearish in case of recovery.

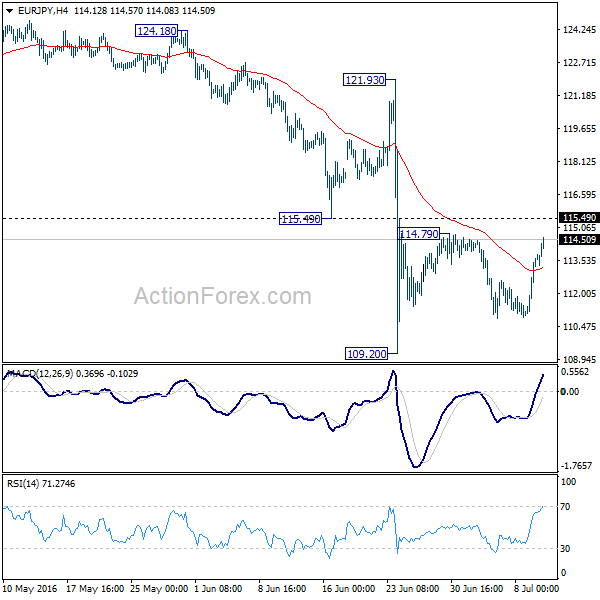

EUR/JPY Daily Outlook

Daily Pivots: (S1) 111.89; (P) 112.83; (R1) 114.59;

Current development suggests that consolidation pattern from 109.20 is still in progress. Further rise could be seen but upside would be limited by 115.49 support turned resistance and bring fall resumption. Break of 109.20 will target next long term fibonacci level at 107.24. However, further break of 115.49 will turn focus back to 121.93 key resistance instead.

In the bigger picture, medium term down trend form 149.76 is still in progress. Further downside acceleration would send the cross to 76.4% retracement of 94.11 to 149.76 at 107.24. Sustained break there will bring retest of 94.11 low. In any case, break of 121.93 resistance is needed to be the first signal of reversal. Otherwise, outlook will stay bearish in case of recovery.