GBP/JPY Daily Outlook

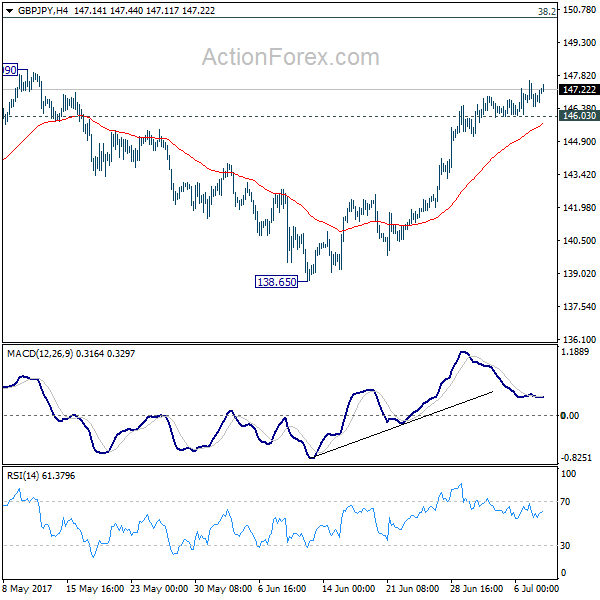

Daily Pivots: (S1) 146.17; (P) 146.88; (R1) 147.40;

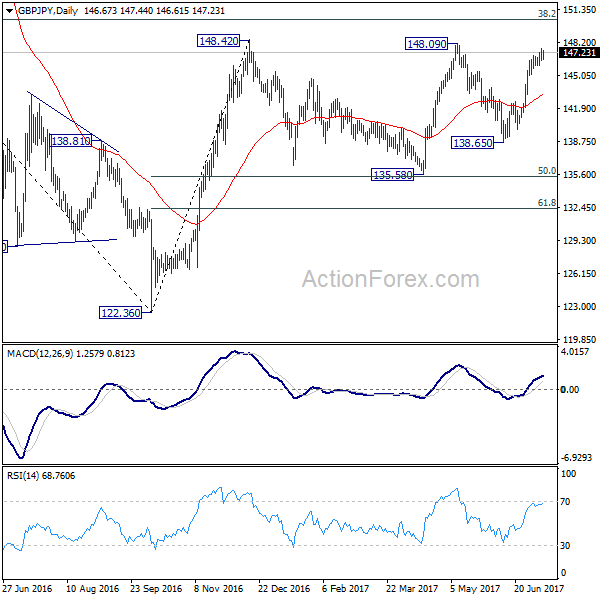

Upside momentum in GBP/JPY remains a bit weak. Still, with 146.03 minor support intact, further rise is expected for 148.09/42 resistance zone. Decisive break there will extend whole rally from 122.36 to long term fibonacci level at 150.43 next. Nonetheless, break of 146.03 minor support will indicate short term topping. In such case, bias will be turned back to the downside for pull back towards 55 day EMA (now at 143.30).

In the bigger picture, rise from medium term bottom at 122.36 is expected to continue to 38.2% retracement of 196.85 to 122.36 at 150.43. Decisive break there will carry long term bullish implications and pave the way to 61.8% retracement at 167.78. In case the sideway pattern from 148.42 extends, we'd be looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.30; (P) 129.71; (R1) 130.25;

EUR/JPY rises further to as high as 130.39 so far and intraday bias remains on the upside for 100% projection of 114.84 to 125.80 from 122.39 at 133.35 next. On the downside, break of 127.99 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, the break of 126.09 support turned resistance should have confirmed completion of down trend form 149.76 (2014 high), at 109.03 (2016 low). Current rise from 109.03 would now target 61.8% retracement of 149.76 to 109.03 at 134.20 and above. Medium term outlook will remain bullish as long as 122.39 support holds.