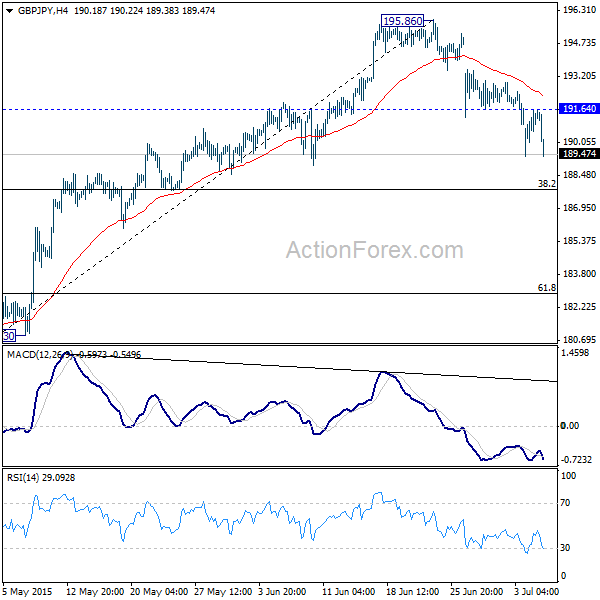

GBP/JPY Daily Outlook

Daily Pivots: (S1) 189.83; (P) 190.74; (R1) 192.12;

Intraday bias in GBP/JPY remains on the downside for the moment. As noted before, a short term top is in place at 195.86 on bearish divergence condition in 4 hours MACD. Deeper decline should be seen to 38.2% retracement of 174.86 to 195.86 at 187.83. We'd expect some support from there to bring recovery. On the upside, above 191.64 minor resistance will turn bias to the upside for retesting 195.86 high.

In the bigger picture, the up trend from 116.83 is still in progress and would target 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level. Medium term momentum is not too convincing with bearish divergence condition in weekly MACD. We'd be cautious on medium term topping around 200 and bring a deep correction. Meanwhile, break of 174.86 will suggest that the trend has reversed earlier than we expect.

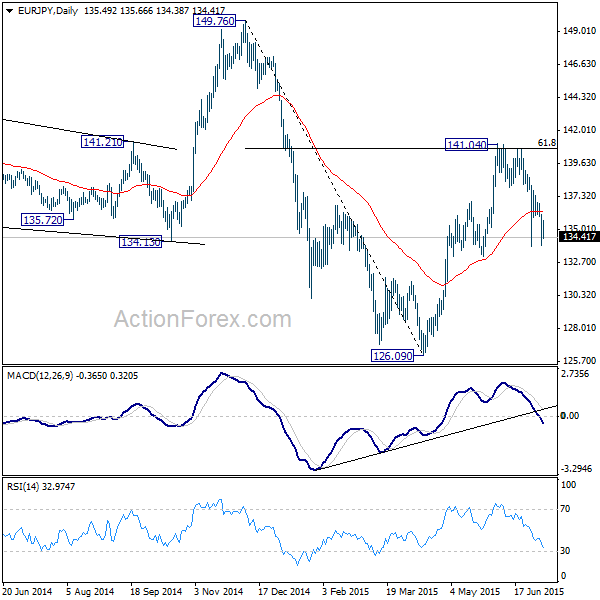

EUR/JPY Daily Outlook

Daily Pivots: (S1) 134.20; (P) 135.13; (R1) 136.40;

Intraday bias in EUR/JPY remains neutral for the moment first. Overall, we'd favoring the case the rebound from 126.09 has completed at 141.04 already, after hitting 61.8% retracement of 149.76 to 126.09. Thus, deeper fall is expected. Break of 133.77 will confirm this bearish case and target a test on 126.09 low. However, break of 141.04 will extend the rebound from 126.09 towards 149.76.

In the bigger picture, price actions from 149.76 medium term top is viewed as corrective in nature. Strong rebound after failing to sustain below 38.2% retracement of 94.11 to 149.76 at 128.50 argues that it's developing into a sideway pattern. We'd expect more range trading between 126.09 and 149.76 in medium term. And that should then be followed by an upside breakout at a later stage. Nonetheless, decisive break of 126.09 would extend the correction towards 61.8% retracement at 115.36.