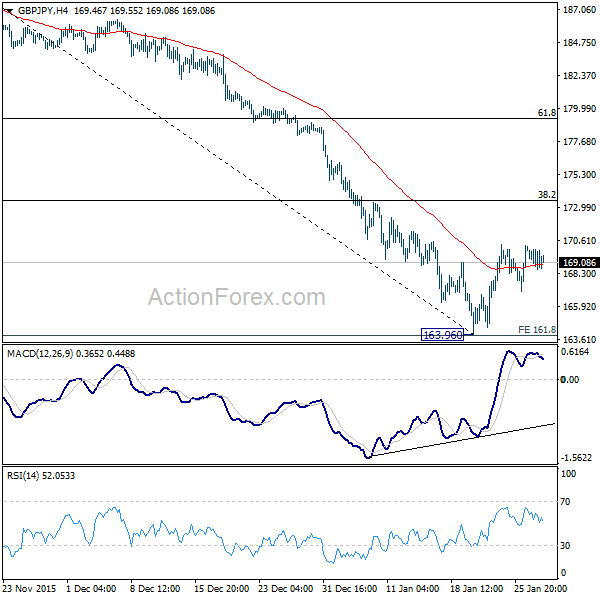

GBP/JPY Daily Outlook

Daily Pivots: (S1) 168.31; (P) 169.16; (R1) 169.77;

Intraday bias in GBP/JPY remains neutral for the moment. The consolidation from 163.96 short term bottom could extend with another rise. But we'd expect upside to be limited by 38.2% retracement of 188.79 to 163.96 at 173.44 and bring fall resumption. Break of 163.96 will extend the fall from 195.86.

In the bigger picture, current development confirmed medium term topping at 195.86 on bearish divergence condition in weekly MACD. Fall from 195.86 is currently viewed as a correction and 38.2% retracement of 116.83 to 195.86 at 165.67 is already met. Based on the current momentum, the correction would likely extend to 61.8% retracement at 147.01 before completion.

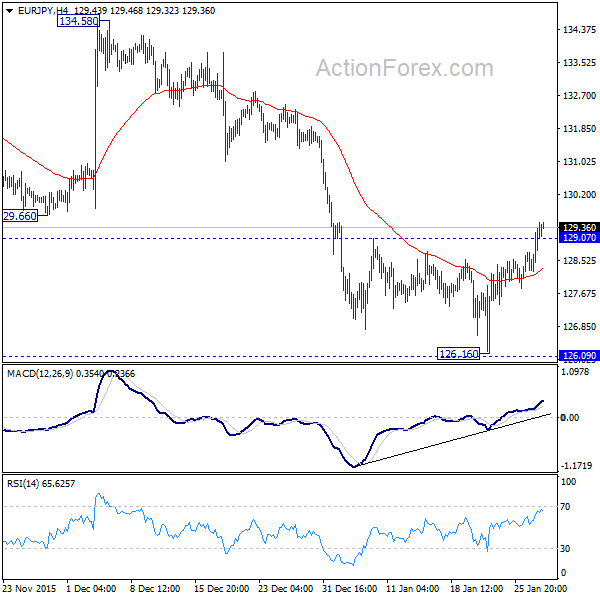

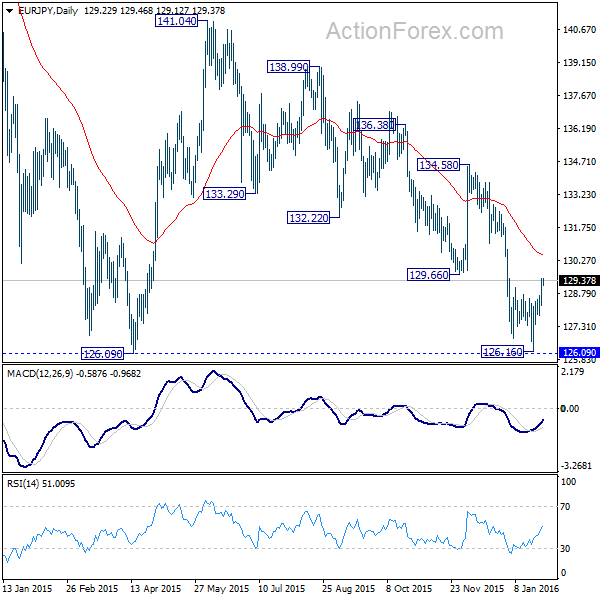

EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.52; (P) 129.00; (R1) 129.75;

The break of 129.07 minor resistance suggests near term reversal ahead of 126.09 key support level. Rebound from 126.16 should now target 55 days EMA (now at 130.57). Sustained break will target 134.58 resistance next. In case of retreat, we'd stay cautious on strong support from 126.09 to bring rebound.

In the bigger picture, price actions from 149.76 medium term top is viewed as developing into a corrective pattern. At this point, as long as 126.09 support holds, we'd expect a sideway pattern between 126.09 and 149.76 in medium term, to be followed by upside breakout at a later stage. However, decisive break of 126.09 will raise some question over this outlook and would at least bring deeper fall to 61.8% retracement of 94.11 to 149.76 at 115.36.