GBP/JPY Daily Outlook

Daily Pivots: (S1) 140.65; (P) 141.36; (R1) 141.98;

Intraday bias in GBP/JPY remains neutral for the moment. On the upside, firm break of 142.16 will indicate completion of the fall from 148.42. More importantly, this will suggest that such decline is merely a three wave correction and the rise from 122.36 isn't completed. In such case, intraday bias will be turned to the upside for 148.42 and then 150.42 fibonacci level. Meanwhile, below 136.44 will target 61.8% retracement of 122.36 to 148.42 at 132.31 and below.

In the bigger picture, price actions from 122.36 medium term bottom are seen as developing into a corrective pattern. Upside is so far limited below 38.2% retracement of 195.86 to 122.36 at 150.42 for setting the medium term range. At this point, we don't expect a break of 122.36 in near term and the corrective pattern would extend for a while. Though, sustained break of 150.42 will target 61.8% retracement at 167.78.

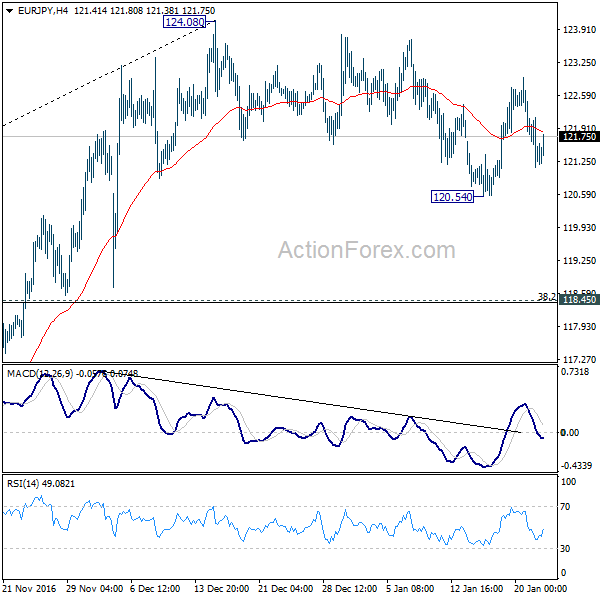

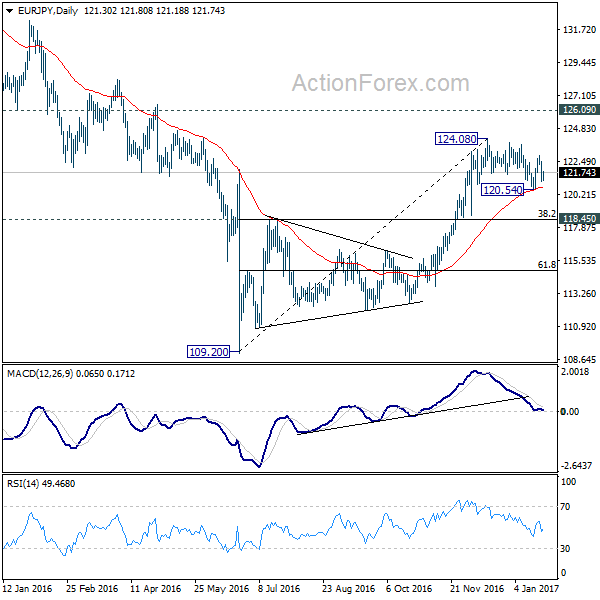

EUR/JPY Daily Outlook

Daily Pivots: (S1) 122.27; (P) 122.60; (R1) 122.94;

Intraday bias in EUR/JPY remains neutral for the moment. Price actions from 124.08 are corrective in nature and rebound from 109.20 is not completed. Break of 124.08 will target 126.09 key resistance next. Meanwhile, below 120.54 will target 118.45 cluster support (38.2% retracement of 109.20 to 124.08 at 118.39). We'd expect strong support from there to contain downside.

In the bigger picture, price actions from 109.20 medium term bottom are seen as part of a medium term corrective pattern from 149.76. There is prospect of another rise towards 126.09 key resistance level before completion. But even in that case, we'd expect strong resistance between 126.09 and 141.04 to limit upside, at least on first attempt. Sustained trading below 55 day EMA will pave the way to retest 109.20.