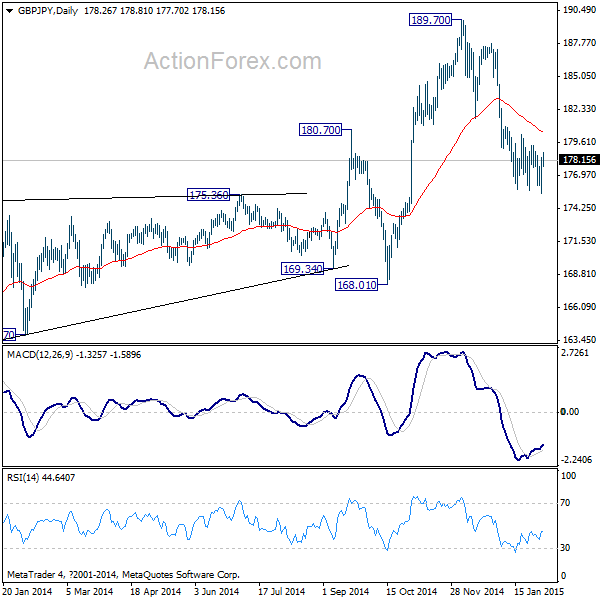

GBP/JPY Daily Outlook

Daily Pivots: (S1) 176.39; (P) 177.38; (R1) 179.28;

Intraday bias in GBP/JPY remains neutral as consolidation from 175.77 temporary low continues. We'd expect upside to be limited by 180.93 resistance and bring fall resumption. Sustained break of 175.77 will extend the fall from 189.70 to retest 168.01 key support level. Meanwhile, break of 180.93 will bring stronger rebound first.

In the bigger picture, the up trend from 116.83 is starting to lose medium term momentum again with bearish divergence condition seen in weekly MACD. Medium term top could be around the corner, if not formed. Break of 168.01 support will confirm this bearish case and bring deeper correction. Though, as long as 168.01 holds, the up trend could still extend to 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level.

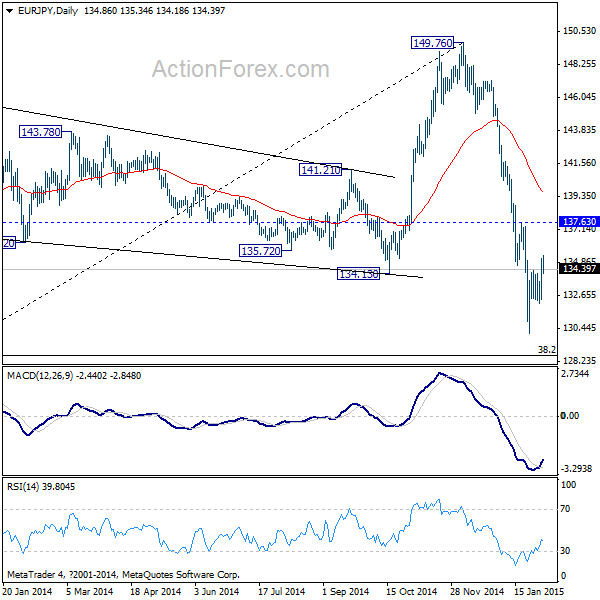

EUR/JPY Daily Outlook

Daily Pivots: (S1) 133.15; (P) 134.17; (R1) 135.95;

The recovery from 130.13 could extend higher. But we'd expect upside to be limited by 137.63 resistance and bring fall resumption. Below 132.37 minor support will turn bias to the downside. Break of 130.13 will target next medium term fibonacci level at 128.50. However, break of 137.63 will indicate near term reversal and bring stronger rebound.

In the bigger picture, the break of 134.13 support should confirm medium term topping at 149.76, on bearish divergence condition in weekly MACD. Deeper correction should now be seen to 38.2% retracement of 94.11 to 149.76 at 128.50 first. Based on current momentum, the correction could go deeper to 61.8% retracement at 115.36.