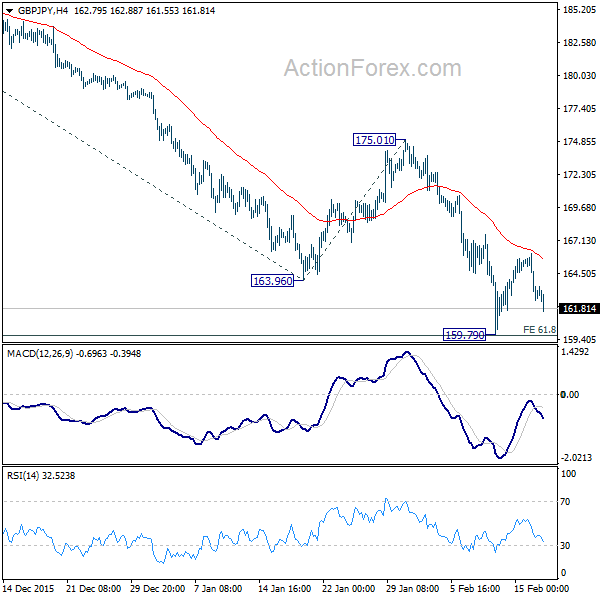

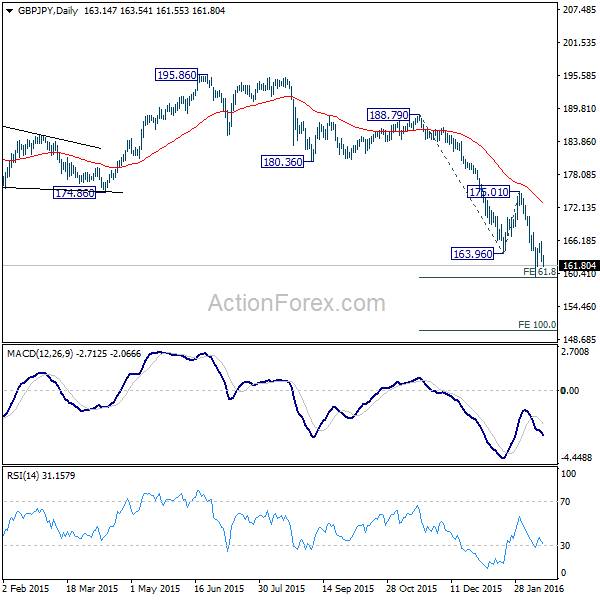

GBP/JPY Daily Outlook

Daily Pivots: (S1) 164.46; (P) 165.10; (R1) 166.02;

Intraday bias in GBP/JPY remains neutral for the moment and consolidations might continue. Upside of recovery should be limited below 175.01 resistance and bring fall resumption. Break of 159.79 should target 100% projection of 188.79 to 163.96 from 175.01 at 150.18 next.

In the bigger picture, a medium term top was formed at 195.86 on bearish divergence condition in weekly MACD. Fall from 195.86 is currently viewed as a correction and would likely extend to 61.8% retracement of 116.83 to 195.86 at 147.01 before completion. On the upside, break of 175.01 resistance is needed to indicate completion of fall from 195.86. Otherwise, outlook will remain bearish in case of rebound.

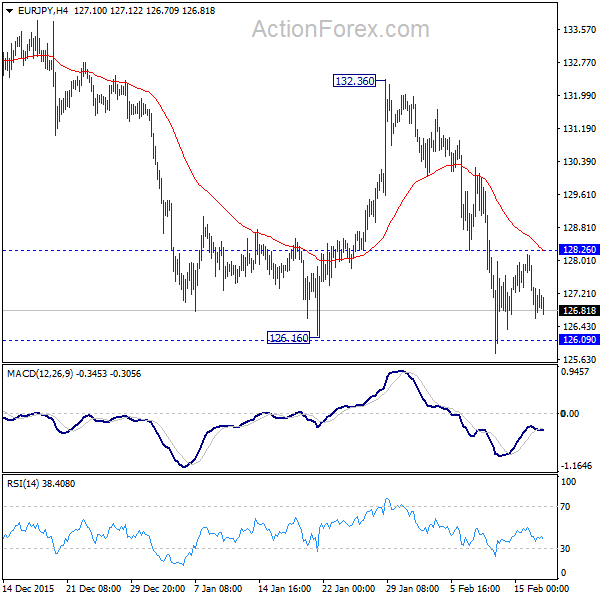

EUR/JPY Daily Outlook

Daily Pivots: (S1) 127.39; (P) 127.67; (R1) 128.10;

Intraday bias in EUR/JPY remains neutral for the moment. On the downside, decisive break of 126.09 will extend whole decline from 149.76 and target next long term fibonacci level at 115.36. Meanwhile, break of 128.26 support turned resistance will be the first sign of short term reversal and turn bias to the upside for 132.36 resistance.

In the bigger picture, price actions from 149.76 medium term top is viewed as developing into a corrective pattern. At this point, as long as 126.09 support holds, we'd expect a sideway pattern between 126.09 and 149.76 in medium term, to be followed by upside breakout at a later stage. However, decisive break of 126.09 will raise some question over this outlook and would at least bring deeper fall to 61.8% retracement of 94.11 to 149.76 at 115.36.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.