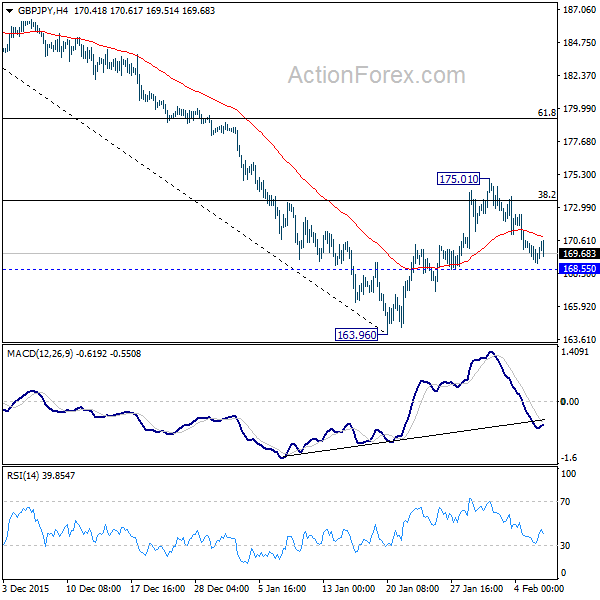

GBP/JPY Daily Outlook

Daily Pivots: (S1) 168.72; (P) 169.63; (R1) 170.28;

Intraday bias in GBP/JPY remains neutral for the moment. The corrective rise from 163.96 could have finished. Break of 168.55 minor support will firm this case. In such case, GBP/JPY should target a test on 163.96 low first. Overall, price actions from 163.96 are viewed as a correction and larger fall from 195.86 is expected to resume later.

In the bigger picture, a medium term top was formed at 195.86 on bearish divergence condition in weekly MACD. Fall from 195.86 is currently viewed as a correction and 38.2% retracement of 116.83 to 195.86 at 165.67 is already met. Based on the current momentum, the correction would likely extend to 61.8% retracement at 147.01 before completion. Nonetheless, firm break of 180.36 support turned resistance will suggest that price actions form 195.86 are merely developing into a sideway pattern.

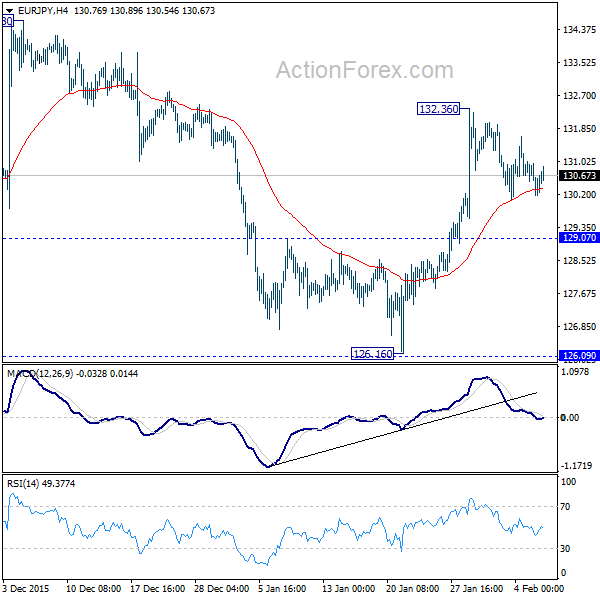

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.98; (P) 130.50; (R1) 130.84;

Intraday bias in EUR/JPY remains neutral for the moment. Another rise is expected as long as 129.07 resistance turned support holds. We'd sticking to the view that fall from 141.04 is completed at 126.16 already. Above 132.36 will pave the way back to 141.04 resistance again. However, break of 129.07 will turn focus back to 126.09 low.

In the bigger picture, price actions from 149.76 medium term top is viewed as developing into a corrective pattern. At this point, as long as 126.09 support holds, we'd expect a sideway pattern between 126.09 and 149.76 in medium term, to be followed by upside breakout at a later stage. However, decisive break of 126.09 will raise some question over this outlook and would at least bring deeper fall to 61.8% retracement of 94.11 to 149.76 at 115.36.