GBP/JPY Daily Outlook

Daily Pivots: (S1) 139.21; (P) 139.77; (R1) 140.59;

With 138.30 minor support intact, further rise is still expected in GBP/JPY. Current developments argues that consolidation pattern from 148.42 is possibly completed at 135.58, just ahead of 135.39 fibonacci level. Decisive break of 140.08 resistance will affirm this case. GBP/JPY should then target a test on 148.42 key resistance level. However, break of 138.30 will turn focus back to 135.58 low instead.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. As long as 50% retracement of 122.36 to 148.42 at 135.39 holds, another rising leg would be seen to 38.2% retracement of 195.86 to 122.36 at 150.42 and possibly above. However, firm break of 135.39 will bring retest of 122.36, with prospect of resuming the larger down trend from 195.86.

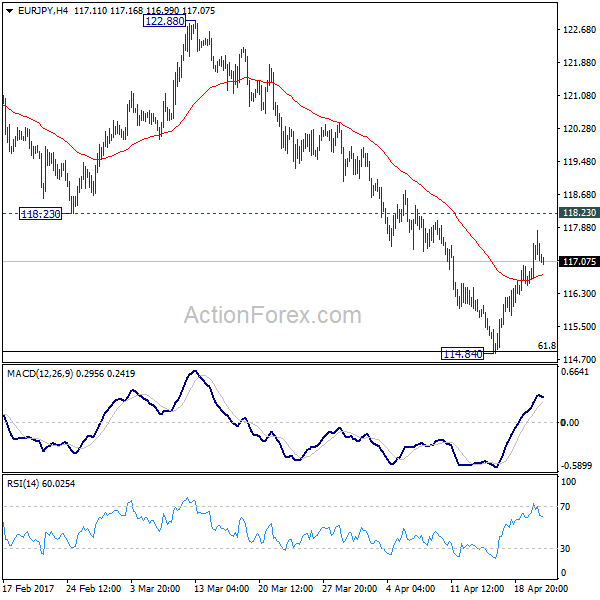

EUR/JPY Daily Outlook

Daily Pivots: (S1) 116.49; (P) 117.15; (R1) 117.80;

EUR/JPY's rebound from 114.84 extended higher but at this point, it's kept below 118.23 support turned resistance. Hence, intraday bias stays neutral at this point and outlook remains bearish. Below 61.8% retracement of 109.20 to 124.08 at 114.88 will extend the decline from 124.08 to retest 109.20 low. However, firm break of 118.23 will indicate near term reversal and target 122.88 resistance instead.

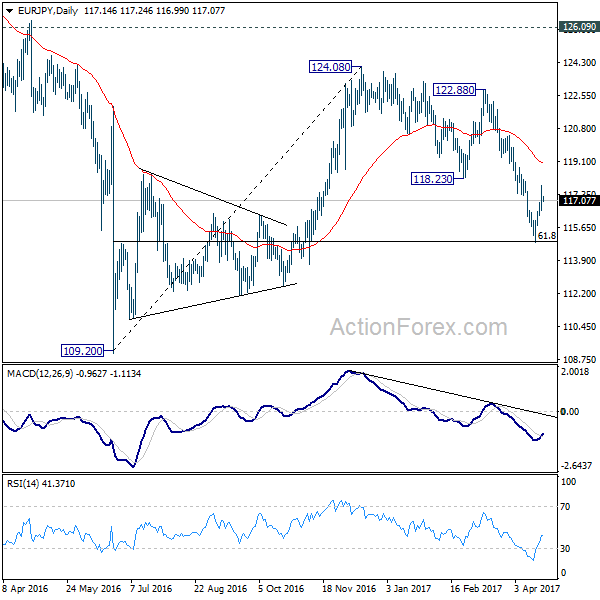

In the bigger picture, medium term corrective rise from 109.20 should have completed at 124.08, ahead of 126.09 support turned resistance. Medium term down trend from 149.76 is likely resuming. Break of 109.20 will target 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal. Otherwise, outlook will remain bearish in case of another rebound.