GBP/JPY Daily Outlook

Daily Pivots: (S1) 155.71; (P) 156.71; (R1) 158.20;

Intraday bias in GBP/JPY remains neutral for consolidation above 151.64 temporary low. In case of another recovery, upside should be limited below 158.42 support turned resistance and bring fall resumption. Below 151.64 will extend larger fall from 195.86 and target next long term fibonacci level at 147.01.

In the bigger picture, fall from 195.86 medium term is viewed as a corrective move and should target 61.8% retracement of 116.83 to 195.86 at 147.01. We'll start to look for reversal signal below there. On the upside, break of 164.09 resistance is needed to indicate completion of fall from 195.86. Otherwise, outlook will remain bearish in case of rebound.

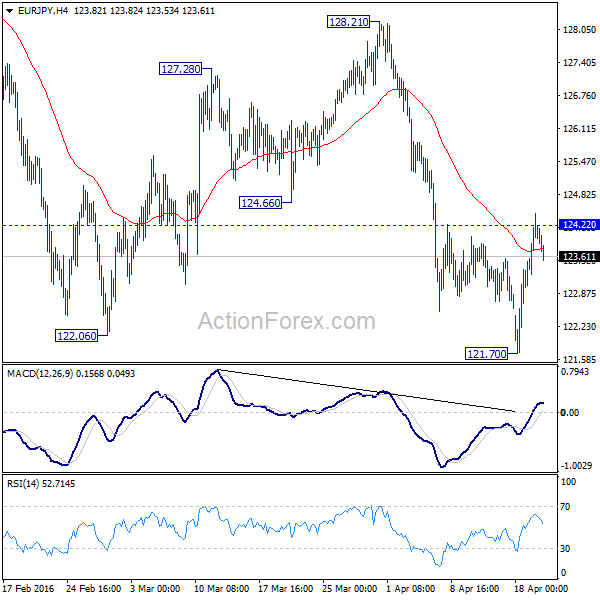

EUR/JPY Daily Outlook

Daily Pivots: (S1) 123.22; (P) 123.83; (R1) 124.63;

Break of 124.22 minor resistance argues that fall from 128.21 has completed at 121.70, where a short term bottom is formed. Intraday bias is mildly on the upside for rebound towards 55 days EMA (now at 125.92). There is no clear sign of trend reversal yet and thus, we'd be cautious on strong resistance above there to limit upside. Meanwhile, break of 121.70 will extend the larger down trend to next projection level at 117.37.

In the bigger picture, medium term correction from 149.76 is still in progress and would extend to 100% projection of 149.76 to 126.09 from 141.04 at 117.37. We'll look for bottoming signal around 61.8% retracement of 94.11 to 149.76 at 115.36. Break of 128.21 resistance is needed to be the first sign of medium term reversal. Otherwise, outlook will stay bearish in case of rebound.