GBP/JPY Daily Outlook

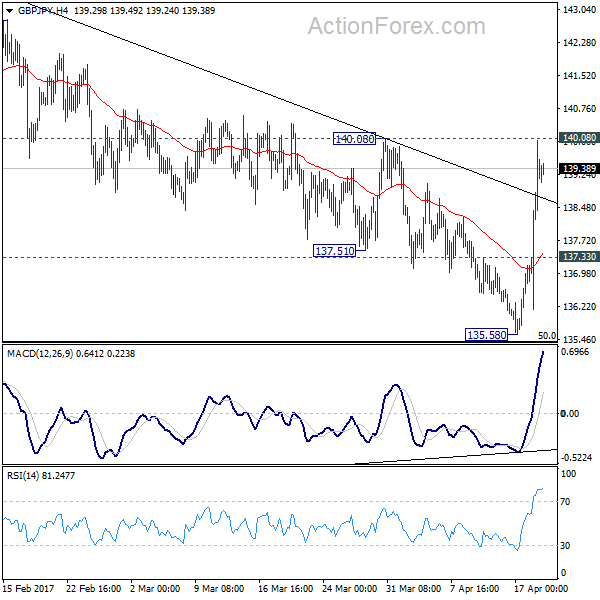

Daily Pivots: (S1) 136.92; (P) 138.46; (R1) 140.80;

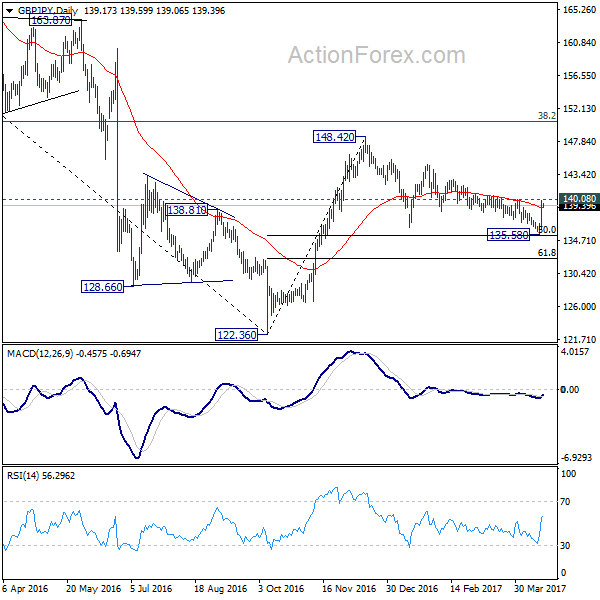

GBP/JPY rises to as high as 140.01 so far, just inch below 140.08 near term resistance. Current developments argues that consolidation pattern from 148.42 is possibly completed at 135.58, just ahead of 135.39 fibonacci level. Intraday bias stays on the upside and break of 140.08 will affirm this case. GBP/JPY should then target a test on 148.42 key resistance level. Meanwhile, this bullish case will be favored as long as 137.33 minor support holds, in case of retreat.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. As long as 50% retracement of 122.36 to 148.42 at 135.39 holds, another rising leg would be seen to 38.2% retracement of 195.86 to 122.36 at 150.42 and possibly above. However, firm break of 135.39 will bring retest of 122.36, with prospect of resuming the larger down trend from 195.86.

EUR/JPY Daily Outlook

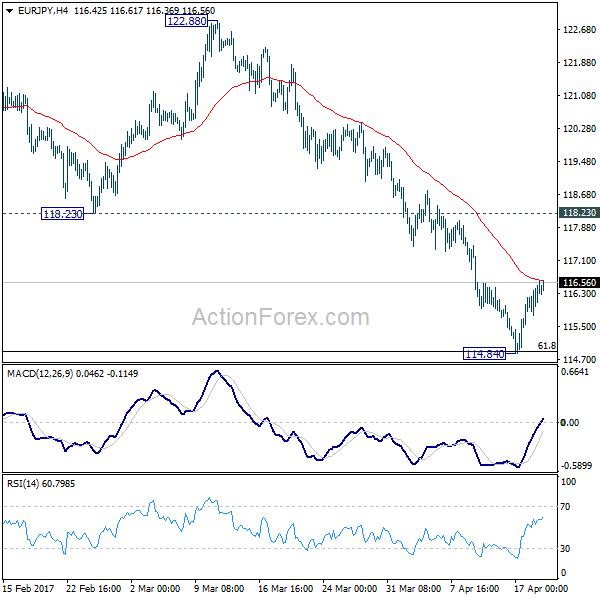

Daily Pivots: (S1) 115.91; (P) 116.19; (R1) 116.64;

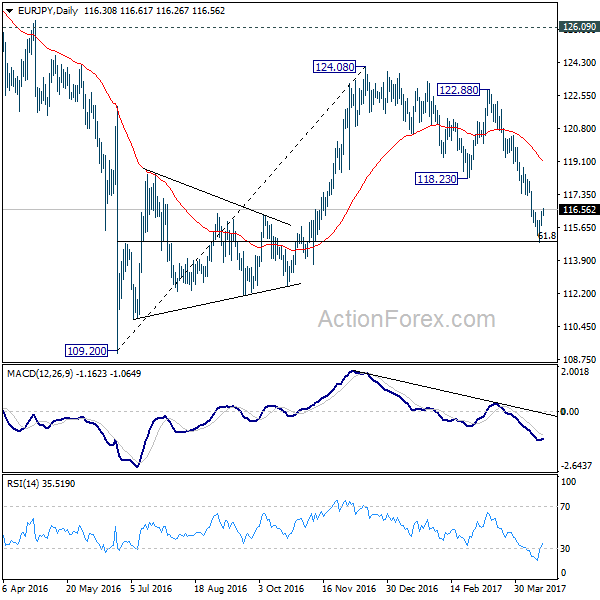

EUR/JPY's recovery from 114.84 low is still in progress. Intraday bias remains neutral for the moment. At this point, we'd still expect upside to be limited by 118.23 resistance and bring another fall. Corrective rise from 109.20 should have completed at 124.08. Sustained break of 61.8% retracement of 109.20 to 124.08 at 114.88 will pave the way to retest 109.20 low.

In the bigger picture, medium term corrective rise from 109.20 should have completed at 124.08, ahead of 126.09 support turned resistance. Medium term down trend from 149.76 is likely resuming. Break of 109.20 will target 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal. Otherwise, outlook will remain bearish in case of another rebound.