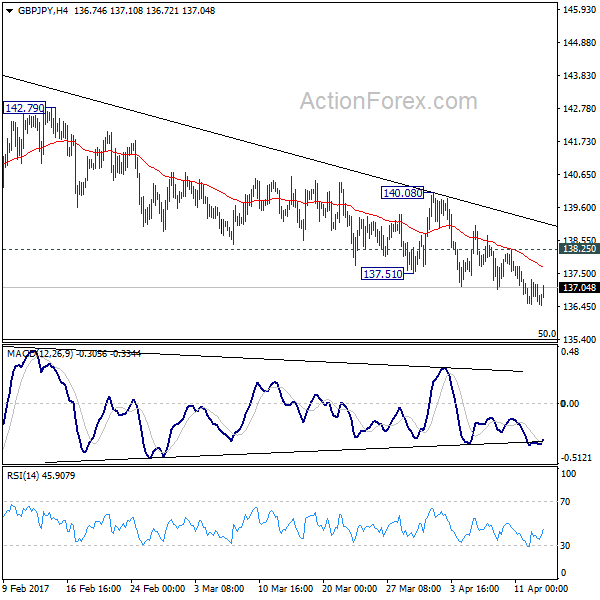

GBP/JPY Daily Outlook

Daily Pivots: (S1) 136.36; (P) 136.84; (R1) 137.16;

With 138.25 minor resistance intact, choppy decline from 144.77 is expected to extend lower. Nonetheless, price actions from 148.42 are still viewed as a corrective pattern. There, we'd anticipate strong support from 135.39 medium term fibonacci level to bring rebound. On the upside, break of 138.25 minor resistance will turn bias to the upside for 140.08 resistance. Break will indicate near term reversal. However, sustained break of 135.39 will target 61.8% retracement at 132.31.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Or, sustained break of 50% retracement of 122.36 to 148.42 at 135.39 will turn outlook bearish for a test on 122.36 low. Though, sustained break of 150.42 will extend the rebound towards 61.8% retracement of 195.86 to 122.36 at 167.78.

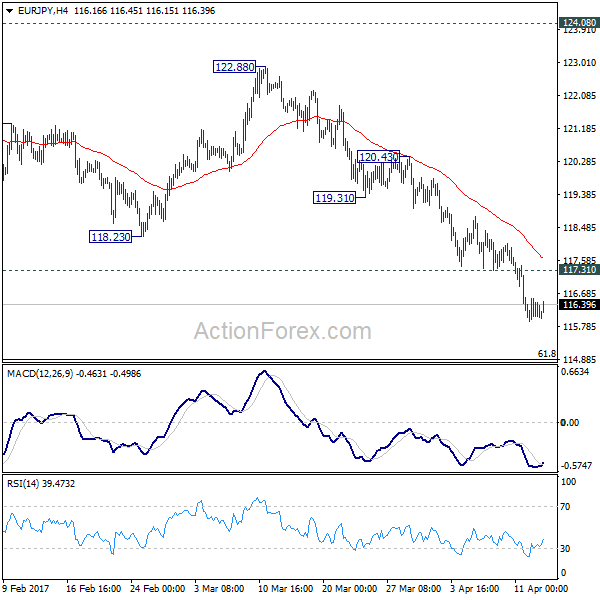

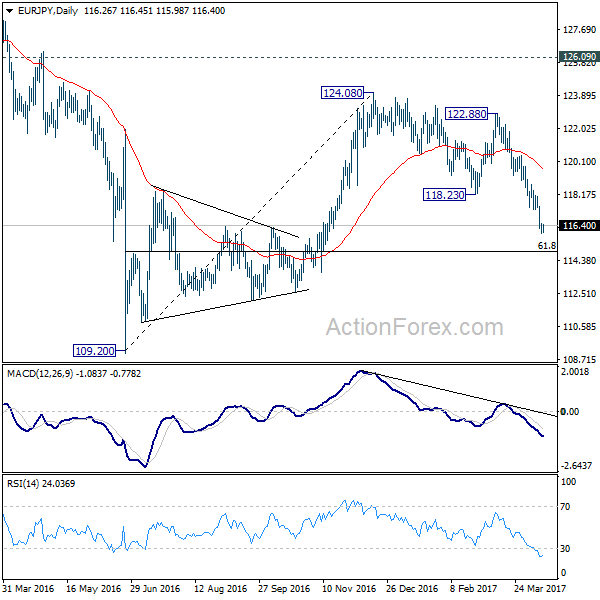

EUR/JPY Daily Outlook

Daily Pivots: (S1) 115.92; (P) 116.23; (R1) 116.54;

With 117.31 minor resistance intact, intraday bias in EUR/JPY stays on the downside for 61.8% retracement of 109.20 to 124.08 at 114.88 next. And, sustained break there will pave the way to retest 109.20 low. On the upside, above 117.31 minor resistance will turn bias neutral and bring consolidations. But upside should be limited below 119.31 support turned resistance and bring another fall.

In the bigger picture, the firm break of 38.2% retracement of 109.20 to 124.08 at 118.39 indicates that medium term rise from 109.20 is completed at 124.08. That's well below 126.09 key support turned resistance. Also, EUR/JPY failed to sustain above 55 week EMA. Deeper decline would now be seen back to 109.20 low. Overall, the down trend from 149.76 (2014 high) is not completed yet. Break of 109.20 will resume such down trend towards 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal.