GBP/JPY Daily Outlook

Daily Pivots: (S1) 137.67; (P) 138.19; (R1) 138.67;

With 140.08 resistance intact, deeper decline is expected in GBP/JPY. Choppy fall from 144.77 would target medium term fibonacci level at 135.39. Overall, price action from 148.42 are seen as a consolidation pattern. We'll look for bottoming around 148.42. Meanwhile, break of 140.08 resistance is needed to indicate short term reversal. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Or, sustained break of 50% retracement of 122.36 to 148.42 at 135.39 will turn outlook bearish for a test on 122.36 low. Though, sustained break of 150.42 will extend the rebound towards 61.8% retracement of 195.86 to 122.36 at 167.78.

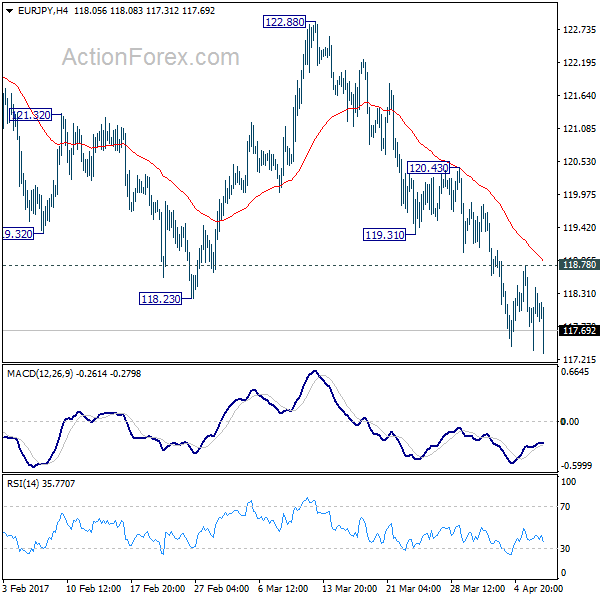

EUR/JPY Daily Outlook

Daily Pivots: (S1) 117.38; (P) 117.90; (R1) 118.44;

Downside momentum in EUR/JPY is a bit unconvincing with 4 hour MACD staying above signal line. But with 118.78 minor resistance intact, deeper decline is expected. Current development suggests that medium term rise from 109.20 has completed at 124.08 already. Further fall should be seen to 61.8% retracement of 109.20 to 124.08 at 114.88 next. On the upside, above 118.78 will indicate short term bottoming and bring rebound back to 119.31/120.43 resistance zone.

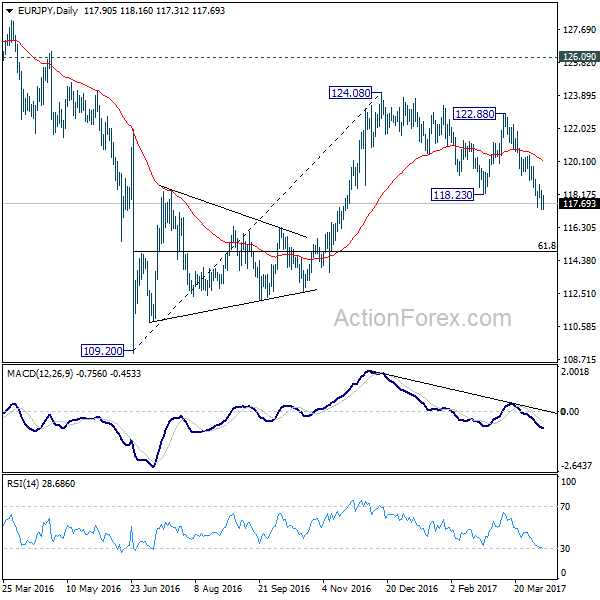

In the bigger picture, the firm break of 38.2% retracement of 109.20 to 124.08 at 118.39 indicates that medium term rise from 109.20 is completed at 124.08. That's well below 126.09 key support turned resistance. Also, EUR/JPY failed to sustain above 55 week EMA. Deeper decline would now be seen back to 109.20 low. Overall, the down trend from 149.76 (2014 high) is not completed yet. Break of 109.20 will resume such down trend towards 94.11 low. In any case, break of 126.09 is needed needed to confirm medium term reversal.