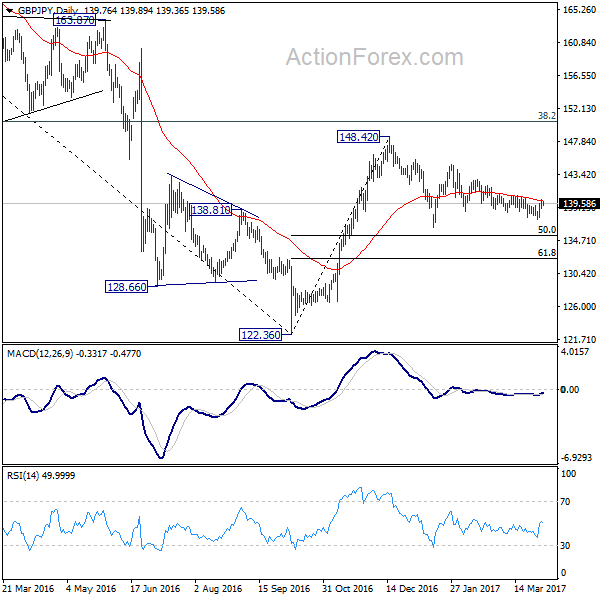

GBP/JPY Daily Outlook

Daily Pivots: (S1) 139.13; (P) 139.60; (R1) 140.24;

Intraday bias in GBP/JPY remains mildly on the upside for the moment. Fall from 142.79 is likely completed. Break of 140.60 resistance should confirm near term reversal and target 142.79 resistance first. Break there will send the cross through 144.77 resistance to 148.42 high. On the downside, below 137.51 minor support will extend the fall from 142.79 towards 136.44 support. But still, price actions from 148.42 are forming a consolidation pattern. We'd expect support from 50% retracement of 122.36 to 148.42 at 135.39 to contain downside and bring rebound.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Or, sustained break of 50% retracement of 122.36 to 148.42 at 135.39 will turn outlook bearish for a test on 122.36 low. Though, sustained break of 150.42 will extend the rebound towards 61.8% retracement of 195.86 to 122.36 at 167.78.

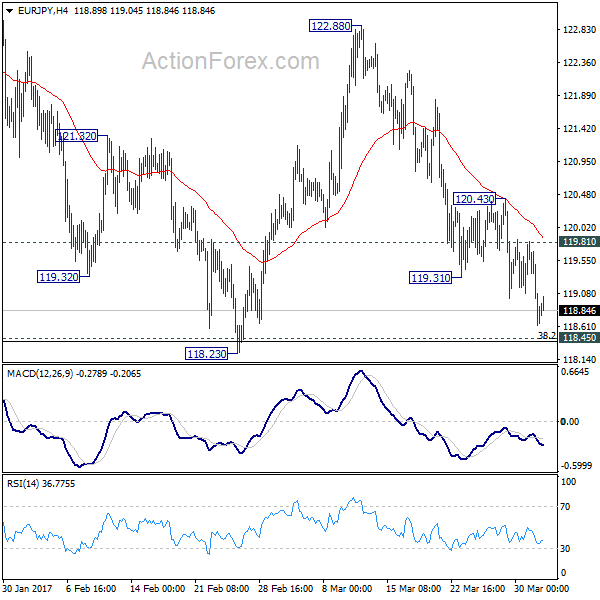

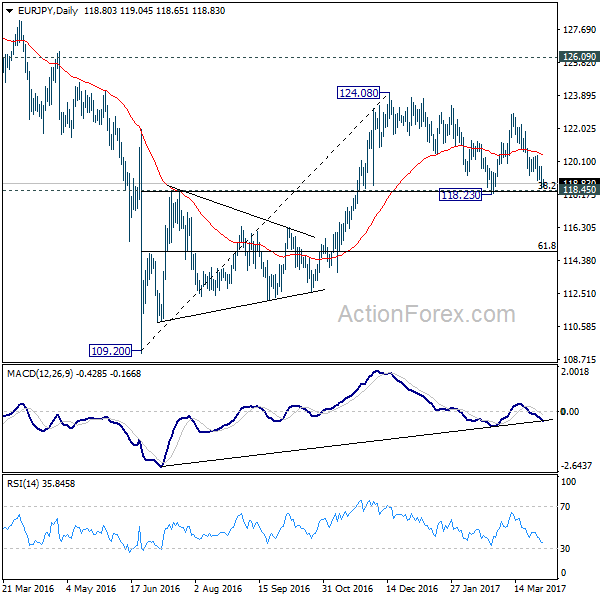

EUR/JPY Daily Outlook

Daily Pivots: (S1) 118.26; (P) 119.03; (R1) 119.45;

Intraday bias in EUR/JPY remains on the downside for the moment. Further fall is expected but overall, price actions from 124.08 are still viewed as a consolidation pattern. Hence we're expecting strong support from 118.39/45 (38.2% retracement of 109.20 to 124.08 at 118.39) to contain downside. On the upside, break of 119.81 resistance will indicate short term bottoming. In such case, intraday bias will be turned back to the upside for 120.43 resistance first. However, sustained trading below 118.39/45 will invalidate our view and bring deeper fall.

In the bigger picture, we're holding on to the view that medium term rise from 109.20 is still in progress. Focus is on 126.09 key resistance level. Sustained break will confirm completion of the whole decline from 149.76. And rise from 109.20 is of the same degree as the fall from 149.76. In such case, further rally would be seen to 104.04 resistance and possibly above before topping. Meanwhile, rejection from 126.09, or firm break of 118.45 cluster support, will likely extend the fall from 149.76 through 109.20 low.