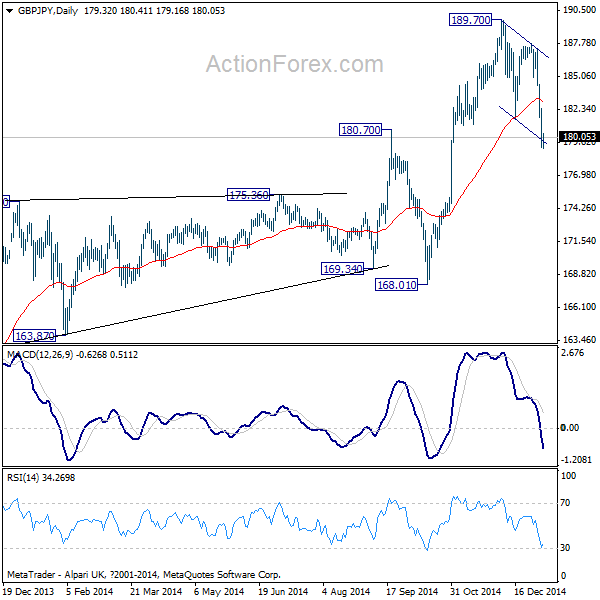

GBP/JPY Daily Outlook

Daily Pivots: (S1) 178.22; (P) 180.32; (R1) 181.41;

GBP/JPY's decline extended to as low as 179.16 so far. The break of 181.09 cluster support and mild downside acceleration is raising the chance of larger reversal. Intraday bias remains on the downside for 61.8% retracement of 168.01 to 189.70 at 176.29 next. On the upside, above 182.69 minor resistance will turn bias neutral first. But risk will stay on the downside as long as 187.79 resistance holds.

In the bigger picture, the up trend from 116.83 is starting to lose medium term momentum again but there is no clear sign of topping yet. Current rally might still extend to 61.8% retracement of 251.09 to 116.83 at 199.80, which is close to 200 psychological level. However, break of 168.01 support will confirm topping and bring deeper correction.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 140.05; (P) 141.41; (R1) 142.11;

EUR/JPY dropped to as low as 140.54 so far. The firm break of 142.08 cluster support and downside acceleration is raising the possibly of larger trend reversal. Intraday bias remains on the downside for 61.8% retracement of 134.13 to 149.76 at 140.10. Sustained break will pave the way to key support level at 134.13. On the upside, above 142.96 minor resistance will turn bias neutral and bring consolidations. But risk will stay on the downside as long as 144.95 resistance holds.

In the bigger picture, EUR/JPY started to lose medium term momentum ahead of 76.4% retracement of 169.96 to 94.11 at 152.59 next. The up trend from 94.11 long term bottom could be starting to top. Nonetheless, break of 134.13 support is needed to confirm medium term reversal. Otherwise, further rise is still expected through 152.59 fibonacci level.