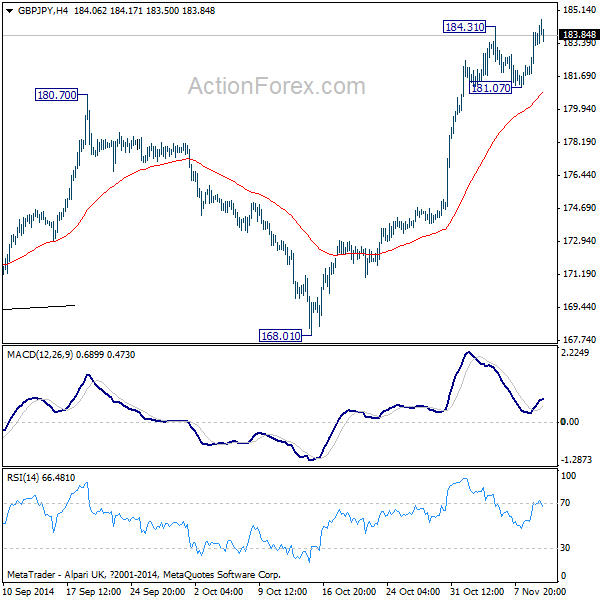

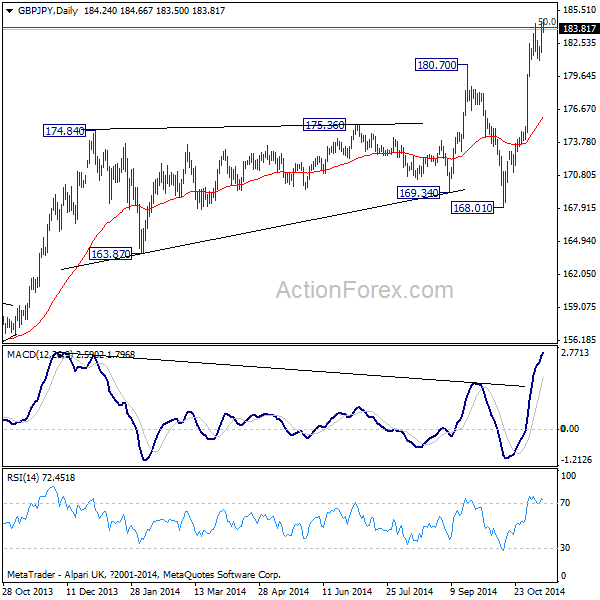

GBP/JPY Daily Outlook

Daily Pivots: (S1) 182.59; (P) 183.48; (R1) 185.22;

The breach of 184.31 temporary indicates resumption of recent rally. Intraday bias is back on the upside. Current up trend would target 190 psychological level next. On the downside, break of 181.07 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, the up trend from 116.83 has just resumed. Sustained break of 50% retracement retracement of 251.09 to 116.83 at 183.96 will pave the way to 61.8% retracement at 199.80, which is close to 200 psychological level. On the downside, break of 168.01 support is needed to confirm medium term topping. Otherwise, outlook will stay bullish in case of pull back.

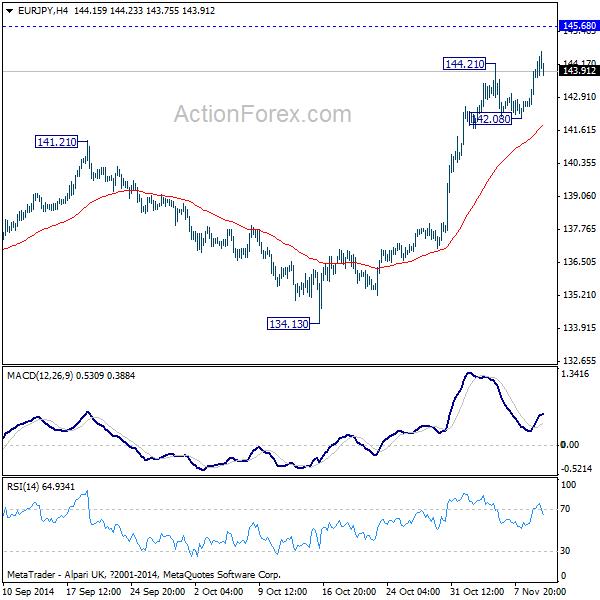

EUR/JPY Daily Outlook

Daily Pivots: (S1) 143.18; (P) 143.84; (R1) 145.10;

EUR/JPY rises to as high as 144.68 so far and break of 144.21 indicates rally resumption. Intraday bias is back on the upside for 145.68 key resistance next. Break will resume larger up trend from 94.11. On the downside, break of 142.08 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, recent development suggests that the consolidation pattern from 145.68 is completed at 134.13 after breaching 55 weeks EMA briefly. The up trend from 94.11 long term bottom is possibly resuming. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59 next. On the downside, break of 134.13 will extend the corrective pattern from 145.68 to 38.2% retracement of 94.11 to 145.68 at 125.98.