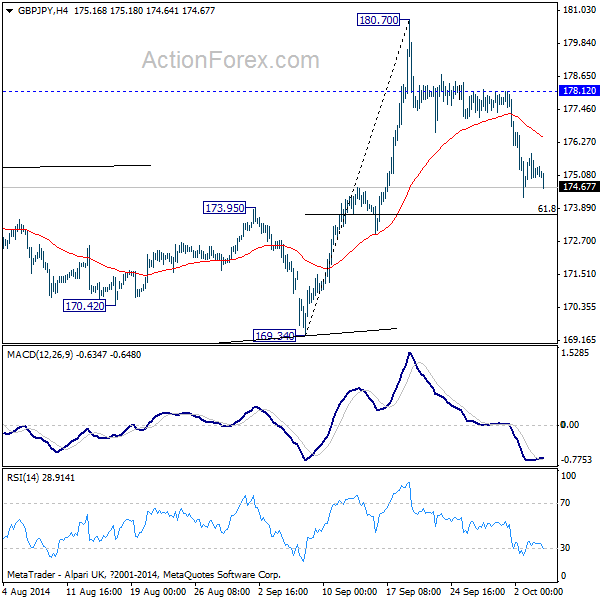

GBP/JPY Daily Outlook

Daily Pivots: (S1) 174.80; (P) 175.35; (R1) 177.83;

Intraday bias in GBP/JPY remains on the downside for the moment. At this point, we'd still expect strong support around 61.8% retracement of 169.34 to 180.70 at 173.67 to bring rally resumption eventually. Above 178.12 minor resistance will turn bias back to the upside for retesting 180.70 first. Though, sustained trading below 173.67 will turn focus back to 169.34 key support level.

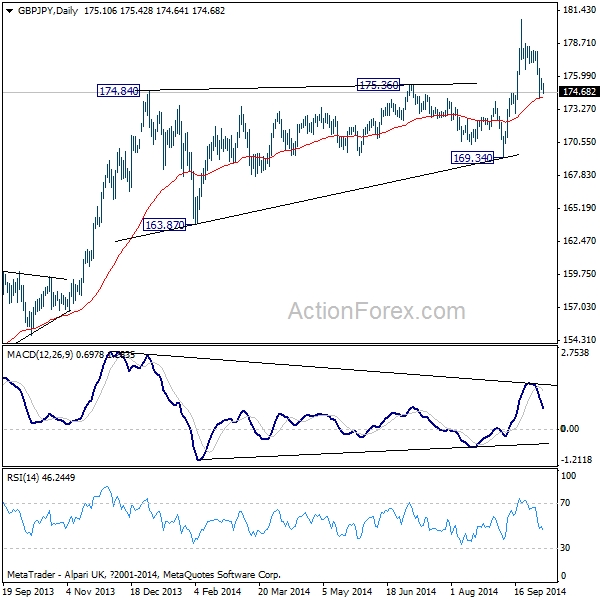

In the bigger picture, there is no sign of reversal yet and up trend from 116.83 low is still in progress. Such rise could target 50% retracement of 251.09 to 116.83 at 183.96 and possibly further to 61.8% retracement at 199.80. Meanwhile, outlook will stay bullish as long as 169.34 support holds, in case of deep pull back.

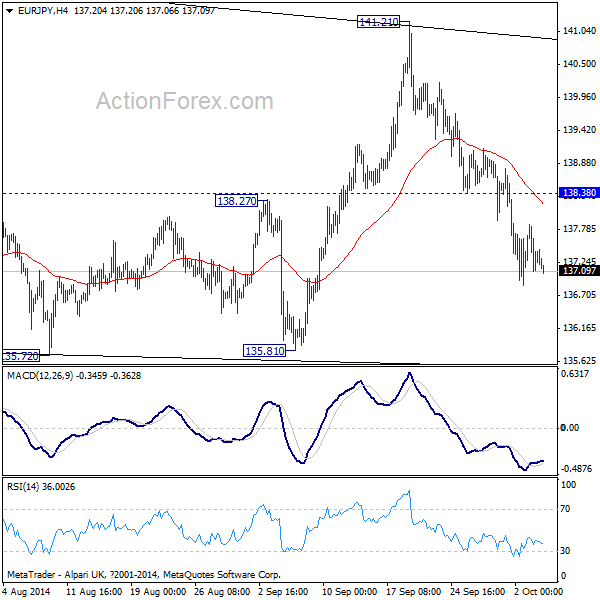

EUR/JPY Daily Outlook

Daily Pivots: (S1) 137.02; (P) 137.45; (R1) 137.80;

Intraday bias in EUR/JPY remains mildly on the downside for 135.81 support. The pair is probably developing into a triangle pattern with fall from 141.21 as the last wave. We'd expect strong support above 135.50 key level to bring reversal. On the upside, above 138.38 minor resistance will turn bias back to the upside for retesting 141.21 resistance.

In the bigger picture, the strong rebound from 55 weeks EMA, with 135.50 support intact, suggests that the up trend from 94.11 long term bottom is still in progress. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59. On the downside, again, sustained break of 135.50 key support level will confirm medium term reversal and would target 124.95 support and below.