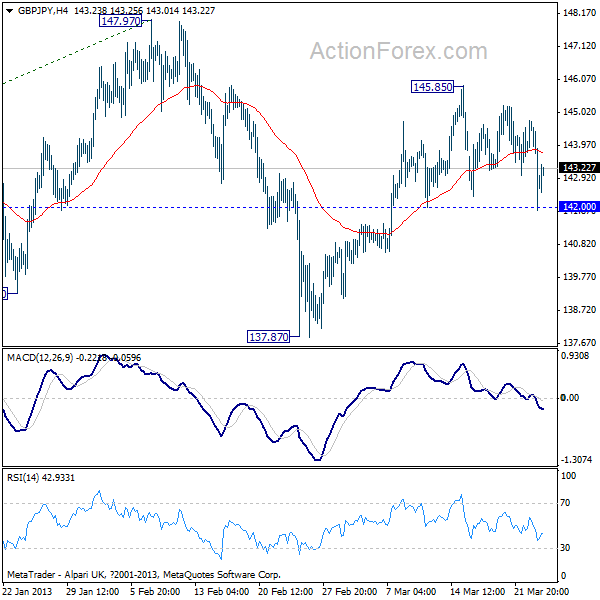

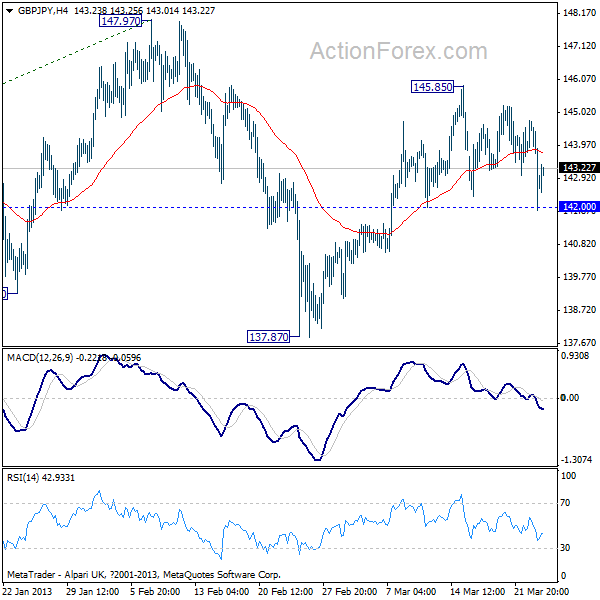

GBP/JPY Daily Outlook

In the bigger picture, medium term fall from 163.05 has completed at 116.83 already. It's a bit early to conclude reversal of the long term down trend from 251.09 (2007 high). But rise from 116.83 should at least be a move at the same degree as fall from 163.05. Thus, medium term rise is now expected back to 163.05. We'll stay bullish as long as 133.48 resistance turned support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY: Daily" title="GBP/JPY" width="600" height="600" />

GBP/JPY: Daily" title="GBP/JPY" width="600" height="600" />

EUR/JPY Daily Outlook

In the bigger picture, whole down trend from 169.96 (2008 high) has completed at 94.11 already, on bullish convergence condition in weekly MACD. Rise from there isn't finished yet and is expected to continue to 50% retracement of 169.96 to 94.11 at 132.03 next. Eventually, such rise would likely extend to 139.21 resistance and above. And, we'll stay bullish as long as 111.43 resistance turned support holds.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY: Daily" title="EUR/JPY" width="600" height="600" />

EUR/JPY: Daily" title="EUR/JPY" width="600" height="600" />

- Daily Pivots: (S1) 141.57; (P) 143.17; (R1) 144.47;

In the bigger picture, medium term fall from 163.05 has completed at 116.83 already. It's a bit early to conclude reversal of the long term down trend from 251.09 (2007 high). But rise from 116.83 should at least be a move at the same degree as fall from 163.05. Thus, medium term rise is now expected back to 163.05. We'll stay bullish as long as 133.48 resistance turned support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY: Daily" title="GBP/JPY" width="600" height="600" />

GBP/JPY: Daily" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

- Daily Pivots: (S1) 119.43; (P) 121.64; (R1) 123.21;

In the bigger picture, whole down trend from 169.96 (2008 high) has completed at 94.11 already, on bullish convergence condition in weekly MACD. Rise from there isn't finished yet and is expected to continue to 50% retracement of 169.96 to 94.11 at 132.03 next. Eventually, such rise would likely extend to 139.21 resistance and above. And, we'll stay bullish as long as 111.43 resistance turned support holds.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY: Daily" title="EUR/JPY" width="600" height="600" />

EUR/JPY: Daily" title="EUR/JPY" width="600" height="600" />