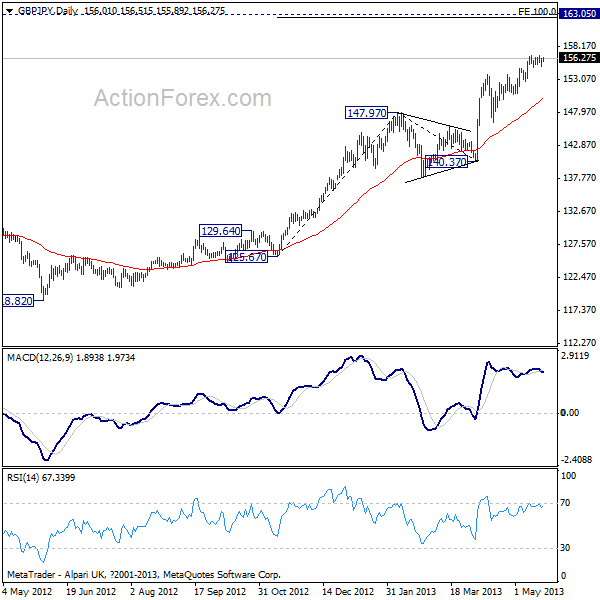

GBP/JPY Daily Outlook

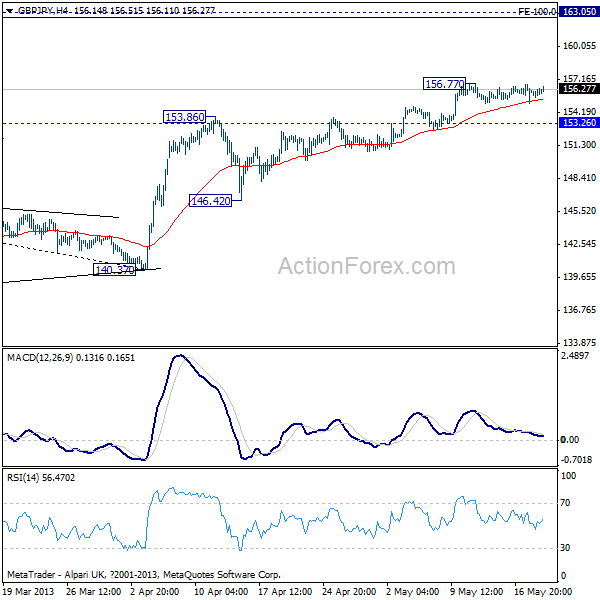

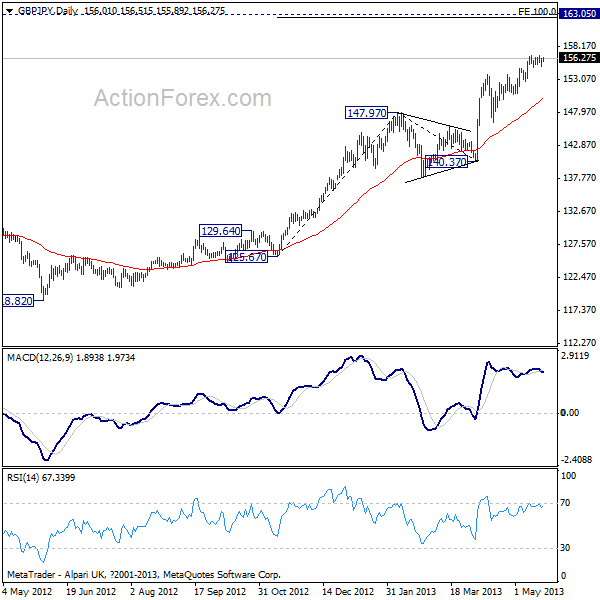

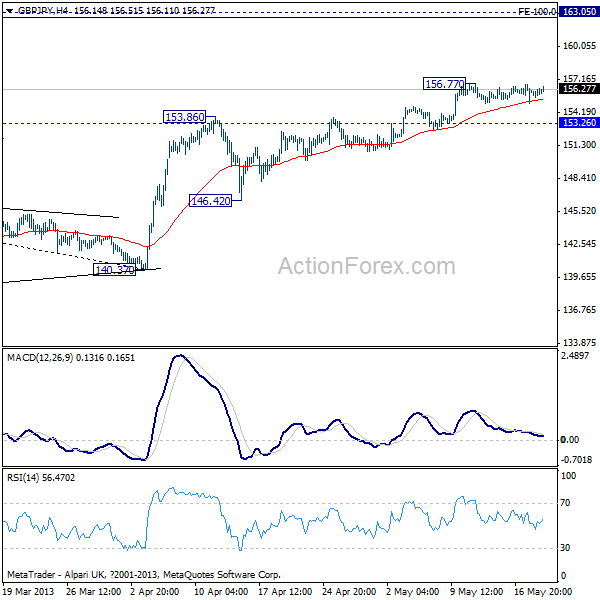

Daily Pivots: (S1) 155.17; (P) 155.75; (R1) 156.56;

Intraday bias in the GBP/JPY remains neutral for the moment, as consolidation from 156.77 continues. Another retreat could be seen, but downside should be contained by 153.26 support and bring rise resumption. Above 156.77 will target 100% projection of 125.67 to 147.97 from 140.37 at 162.67, which is close to 163.05 key resistance. On the downside, a break of 153.26 will indicate short term topping and bring deeper pull back.

In the bigger picture, the medium term rise from 116.83 is still in progress. As noted before, whether such rally is impulsive or corrective in nature, it's at least a move at the same degree as fall from 163.05. The current rise is expected to extend to 163.05 resistance and above. We'll stay bullish as long as 146.42 support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

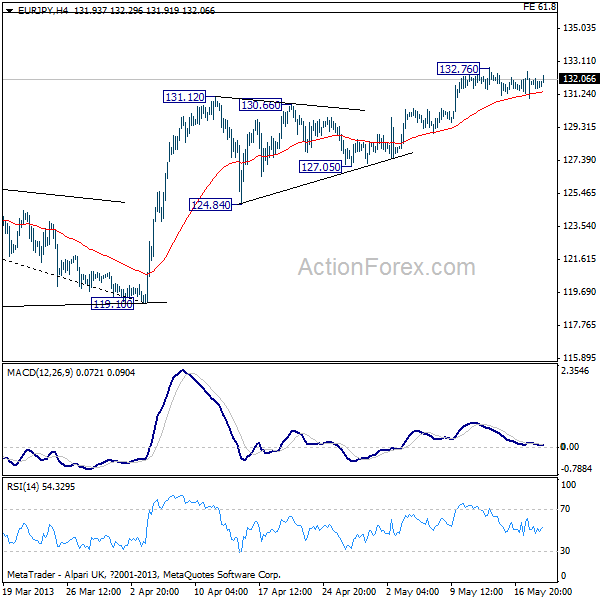

EUR/JPY Daily Outlook

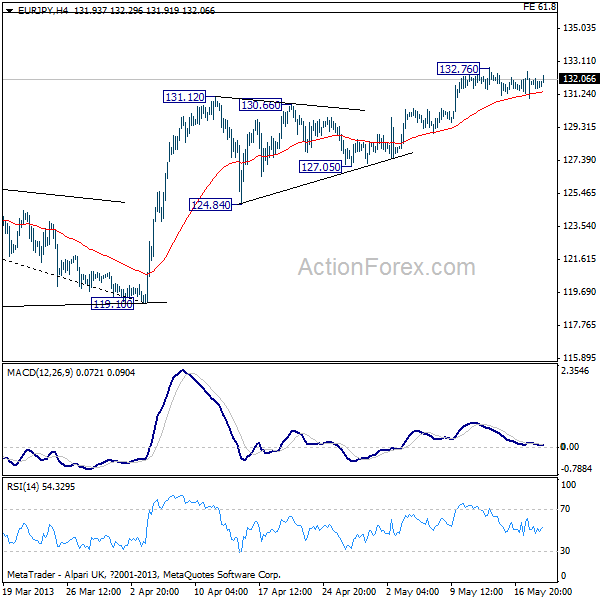

Daily Pivots: (S1) 131.03; (P) 131.60; (R1) 132.28;

Intraday bias in the EUR/JPY remains neutral for the moment, as consolidations from 132.76 continue. In the event of another retreat downside should be contained well above 127.05 support, and bring rise resumption. Above 132.76 will extend the larger up trend to next 61.8% projection of 100.32 to 127.70 from 119.10 at 136.02 next.

In the bigger picture, whole down trend from 169.96 (2008 high) has already completed at 94.11, on bullish convergence condition in weekly MACD. The rise from there has already met the mentioned 50% retracement of 169.96 to 94.11 at 132.03 , and there is no clear sign of reversal so far. Such a rally should now extend through 139.21 resistance to 61.8% retracement at 140.98. A break of the 127.05 support is needed to be the first sign of medium term topping. Otherwise, outlook will stay bullish.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 155.17; (P) 155.75; (R1) 156.56;

Intraday bias in the GBP/JPY remains neutral for the moment, as consolidation from 156.77 continues. Another retreat could be seen, but downside should be contained by 153.26 support and bring rise resumption. Above 156.77 will target 100% projection of 125.67 to 147.97 from 140.37 at 162.67, which is close to 163.05 key resistance. On the downside, a break of 153.26 will indicate short term topping and bring deeper pull back.

In the bigger picture, the medium term rise from 116.83 is still in progress. As noted before, whether such rally is impulsive or corrective in nature, it's at least a move at the same degree as fall from 163.05. The current rise is expected to extend to 163.05 resistance and above. We'll stay bullish as long as 146.42 support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 131.03; (P) 131.60; (R1) 132.28;

Intraday bias in the EUR/JPY remains neutral for the moment, as consolidations from 132.76 continue. In the event of another retreat downside should be contained well above 127.05 support, and bring rise resumption. Above 132.76 will extend the larger up trend to next 61.8% projection of 100.32 to 127.70 from 119.10 at 136.02 next.

In the bigger picture, whole down trend from 169.96 (2008 high) has already completed at 94.11, on bullish convergence condition in weekly MACD. The rise from there has already met the mentioned 50% retracement of 169.96 to 94.11 at 132.03 , and there is no clear sign of reversal so far. Such a rally should now extend through 139.21 resistance to 61.8% retracement at 140.98. A break of the 127.05 support is needed to be the first sign of medium term topping. Otherwise, outlook will stay bullish.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />