GBP/JPY Daily Outlook

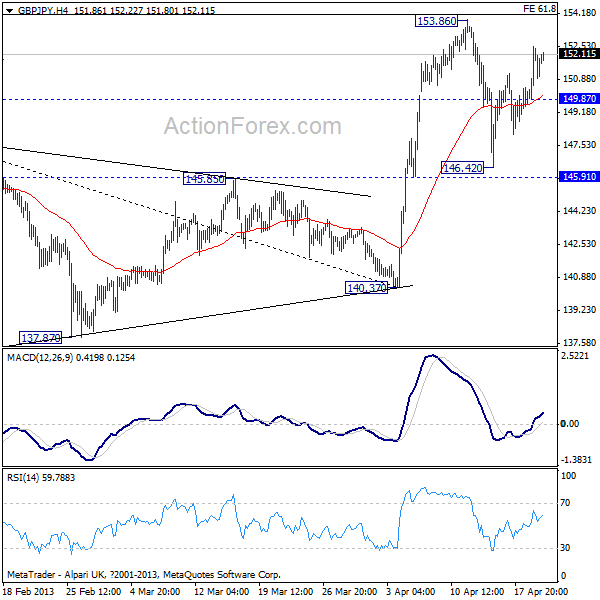

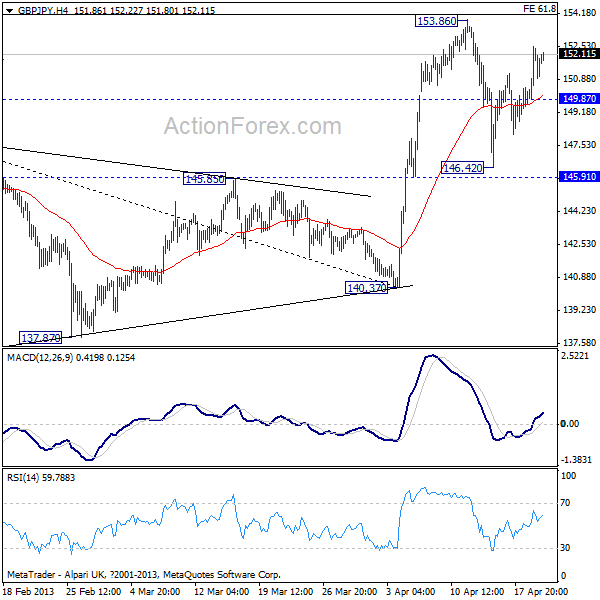

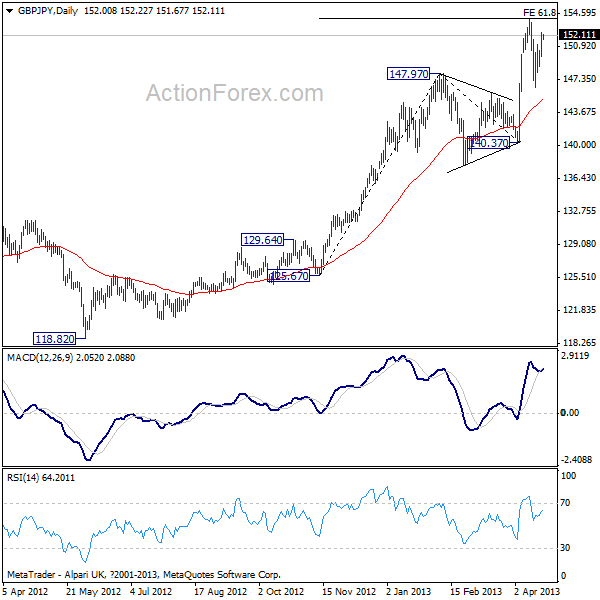

Daily Pivots: (S1) 150.10; (P) 151.30; (R1) 152.75;

Intraday bias in the GBP/JPY remains on the upside for further rise. Consolidation from 153.86 might extend further with another falling leg. Below 149.87 will turn bias to the downside. In that case, downside should be contained above 145.91. Eventually, we'd expect up trend from 118.82 to resume later.

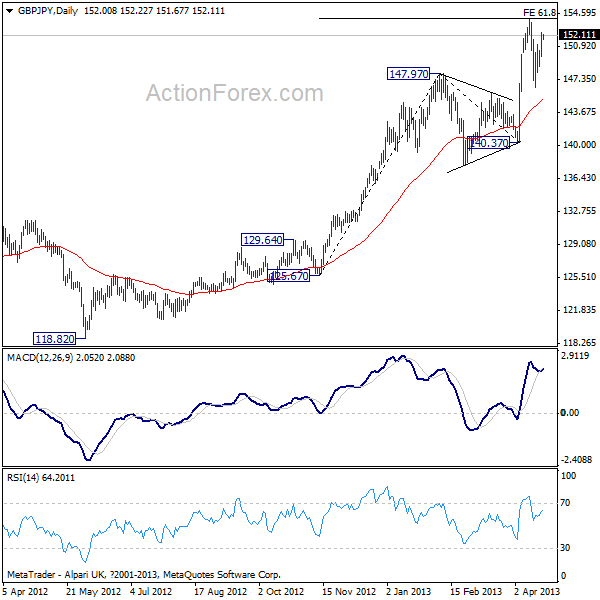

In the bigger picture, medium term fall from 163.05 has already completed at 116.83. It's a bit early to conclude reversal of the long term down trend from 251.09 (2007 high). Rise from 116.83 should at least be a move at the same degree as fall from 163.05. Medium term rise is now expected back to 163.05. We'll stay bullish as long as 140.37 support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

EUR/JPY Daily Outlook

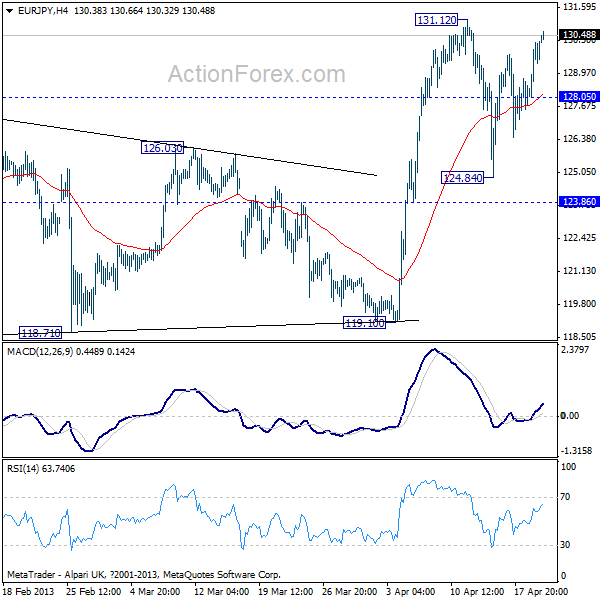

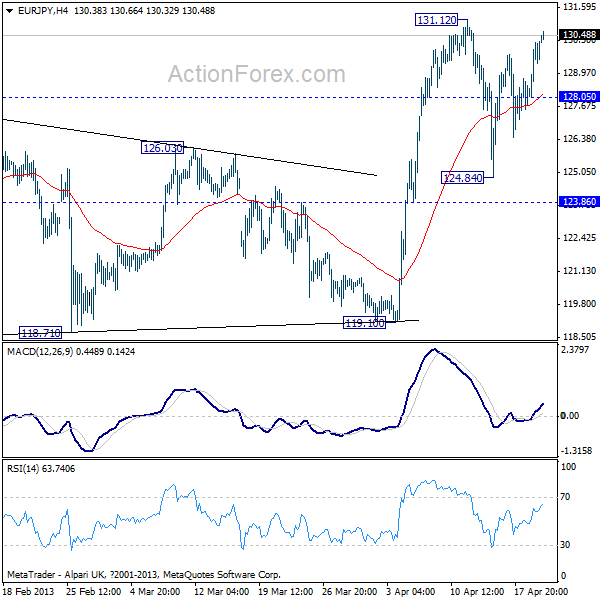

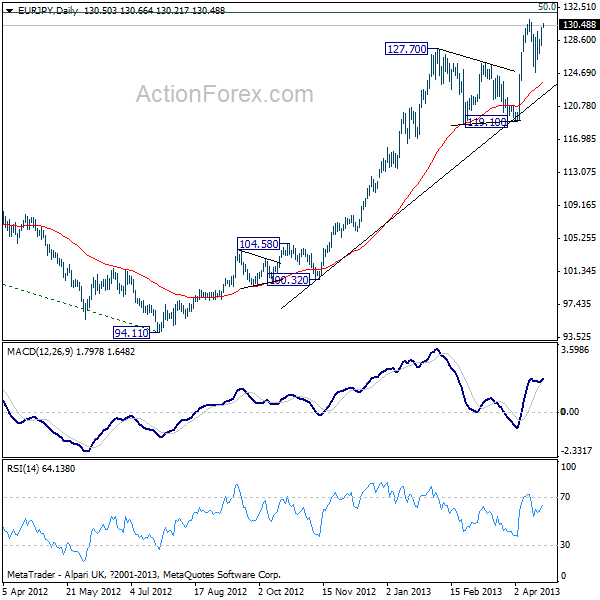

Daily Pivots: (S1) 128.53; (P) 129.39; (R1) 130.72;

The EUR/JPY edged higher to 130.66 and intraday bias remains on the upside for the moment. Note that price actions from 131.12 could turn out to be a three wave consolidation pattern. Below 128.05 minor support will turn bias to the downside for another leg. Downside should be contained above 123.86 support and bring rebound. An upside breakout is expected and above 131.12 will resume whole rally from 94.11.

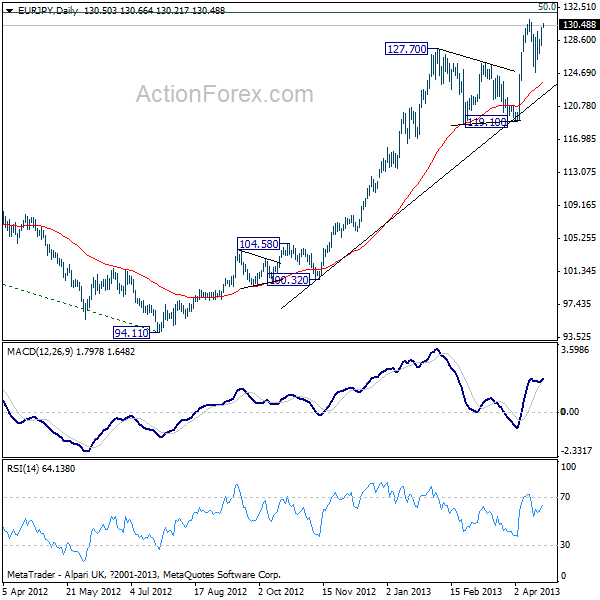

Whole down trend from 169.96 (2008 high) has already completed at 94.11, on bullish convergence condition in weekly MACD. Rise from there hasn't finished yet, and is expected to continue to 50% retracement of 169.96 to 94.11 at 132.03 next. Eventually, such a rise would would likely extend to 139.21 resistance and above. Break of 119.10 support is needed to be the first sign of medium term topping. Otherwise, outlook will stay bullish.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />

Daily Pivots: (S1) 150.10; (P) 151.30; (R1) 152.75;

Intraday bias in the GBP/JPY remains on the upside for further rise. Consolidation from 153.86 might extend further with another falling leg. Below 149.87 will turn bias to the downside. In that case, downside should be contained above 145.91. Eventually, we'd expect up trend from 118.82 to resume later.

In the bigger picture, medium term fall from 163.05 has already completed at 116.83. It's a bit early to conclude reversal of the long term down trend from 251.09 (2007 high). Rise from 116.83 should at least be a move at the same degree as fall from 163.05. Medium term rise is now expected back to 163.05. We'll stay bullish as long as 140.37 support holds.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.53; (P) 129.39; (R1) 130.72;

The EUR/JPY edged higher to 130.66 and intraday bias remains on the upside for the moment. Note that price actions from 131.12 could turn out to be a three wave consolidation pattern. Below 128.05 minor support will turn bias to the downside for another leg. Downside should be contained above 123.86 support and bring rebound. An upside breakout is expected and above 131.12 will resume whole rally from 94.11.

Whole down trend from 169.96 (2008 high) has already completed at 94.11, on bullish convergence condition in weekly MACD. Rise from there hasn't finished yet, and is expected to continue to 50% retracement of 169.96 to 94.11 at 132.03 next. Eventually, such a rise would would likely extend to 139.21 resistance and above. Break of 119.10 support is needed to be the first sign of medium term topping. Otherwise, outlook will stay bullish.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY" title="EUR/JPY" width="600" height="600" />

EUR/JPY" title="EUR/JPY" width="600" height="600" />