USD/JPY Daily Outlook

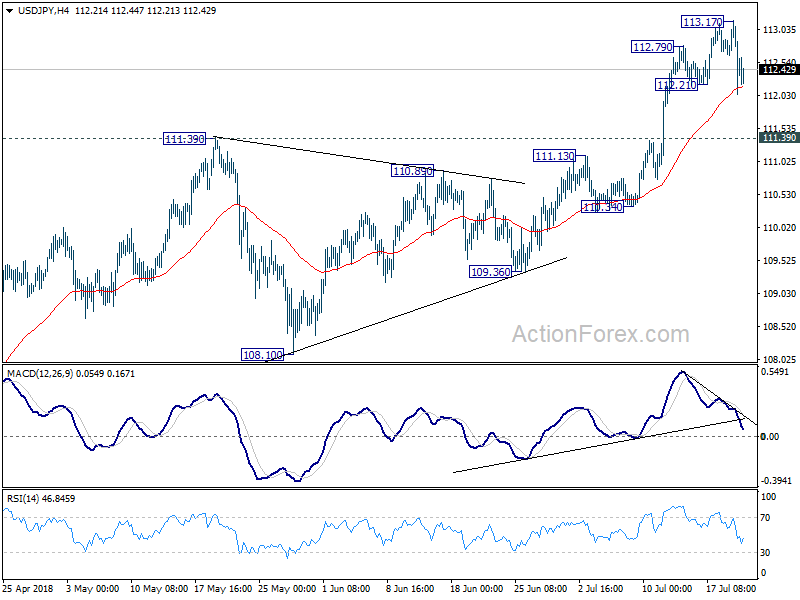

Daily Pivots: (S1) 111.94; (P) 112.58; (R1) 113.10;

The break of 112.21 minor support suggests short term topping at 113.17, on bearish divergence condition in 4 hour MACD. Intraday bias is turned to the downside for deeper pull back. But downside should be contained by 111.39 resistance turned support and bring rebound. Further rally is still expected. Break of 113.17 will resume the rise from 104.62 to 114.73 resistance next.

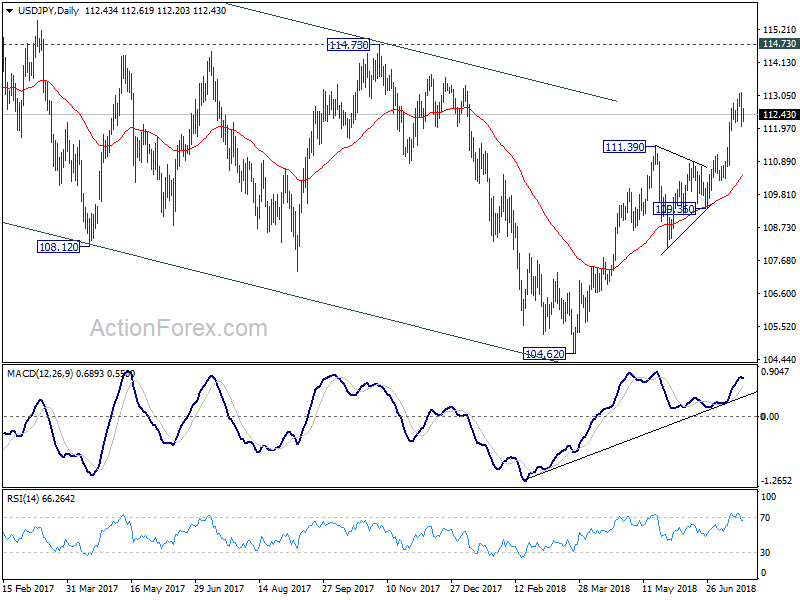

In the bigger picture, current development, with the solid break of medium term channel resistance from 118.65 (2016 high), affirm our view that corrective fall from there has completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will now be the preferred case as long as 119.36 support holds.

USD/CHF Daily Outlook

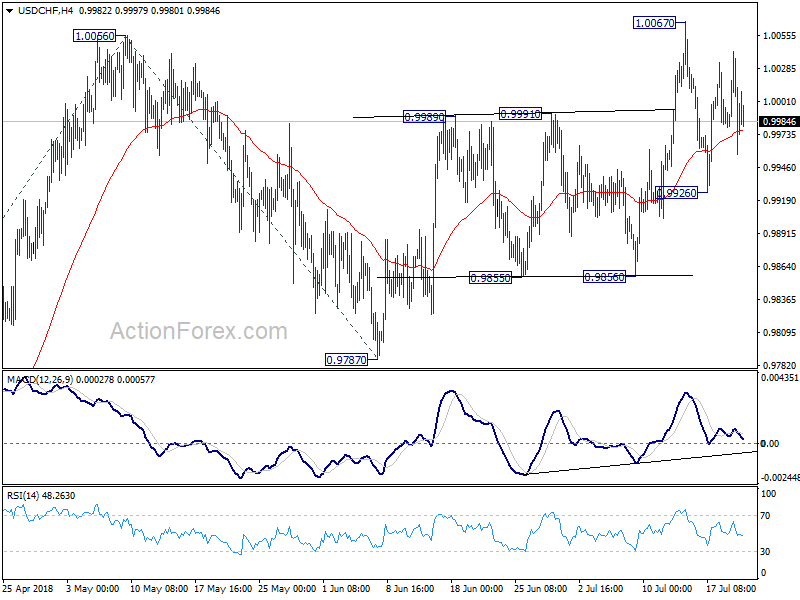

Daily Pivots: (S1) 0.9953; (P) 0.9998; (R1) 1.0037;

USD/CHF is staying in range of 0.9926/1.0067 and intraday bias remains neutral. On the upside, break of 1.0067 resistance will resume the larger rise from 0.9186. USD/CHF should then target 61.8% projection of 0.9186 to 1.0056 from 0.9787 at 1.0325, which is close to 1.0342 key resistance. However, break of 0.9926 will dampen the bullish view again.

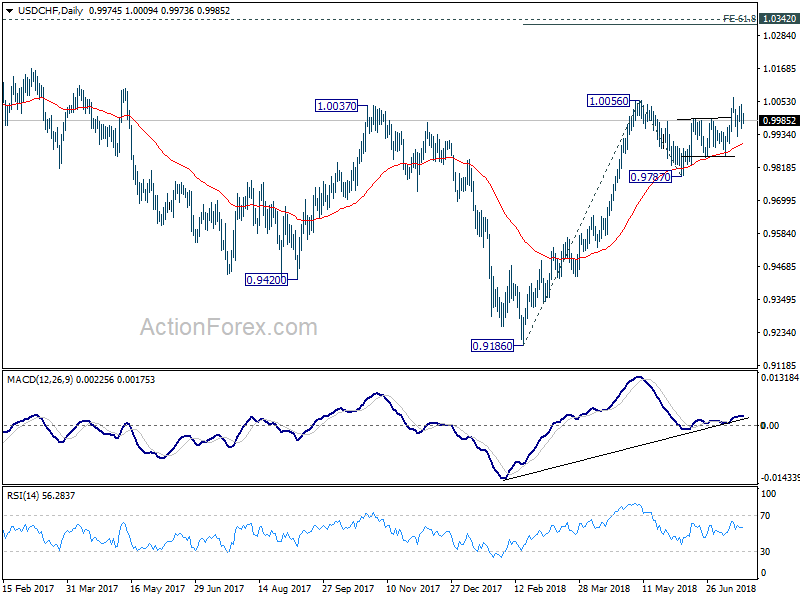

In the bigger picture, rise from 0.9186 is seen as a leg inside the long term range pattern. After drawing support from 55 day EMA, it’s now resuming for 1.0342 key resistance. For now, we’d still cautious on strong resistance from there to limit upside. Meanwhile, break of 0.9787 support is needed to signal completion of the rise. Otherwise, outlook will remain bullish even in case of deep pull back.