USD/JPY Daily Outlook

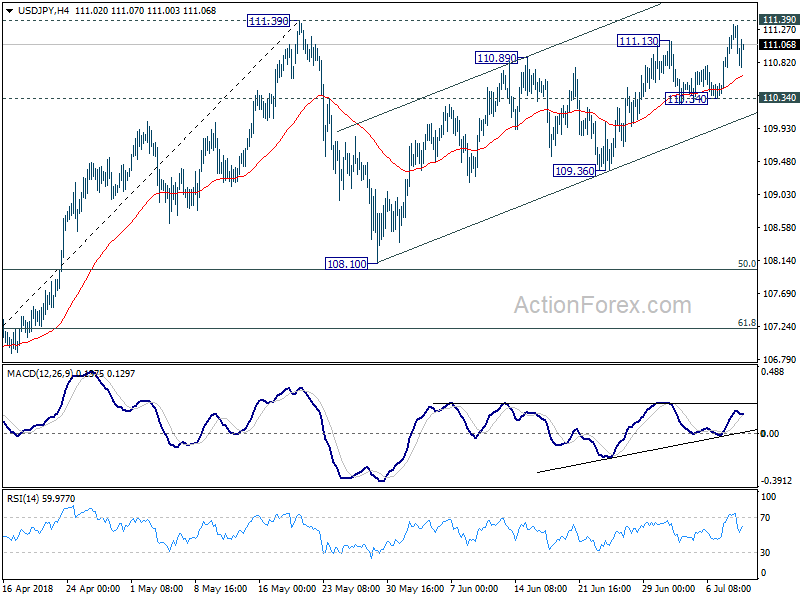

Daily Pivots: (S1) 110.78; (P) 111.07; (R1) 111.33;

USD/JPY fails to break 111.39 resistance so far despite rally attempt and retreated. Intraday bias is turned neutral first. On the upside, firm break of 111.39 will resume whole rally from 104.62 low. That will also add credence to the case of medium term reversal and target 114.73 resistance for confirmation. On the downside, however, break of 110.34 will indicate near term reversal. And, the consolidation pattern from 111.39 would then start the third leg for 108.10 again before completion.

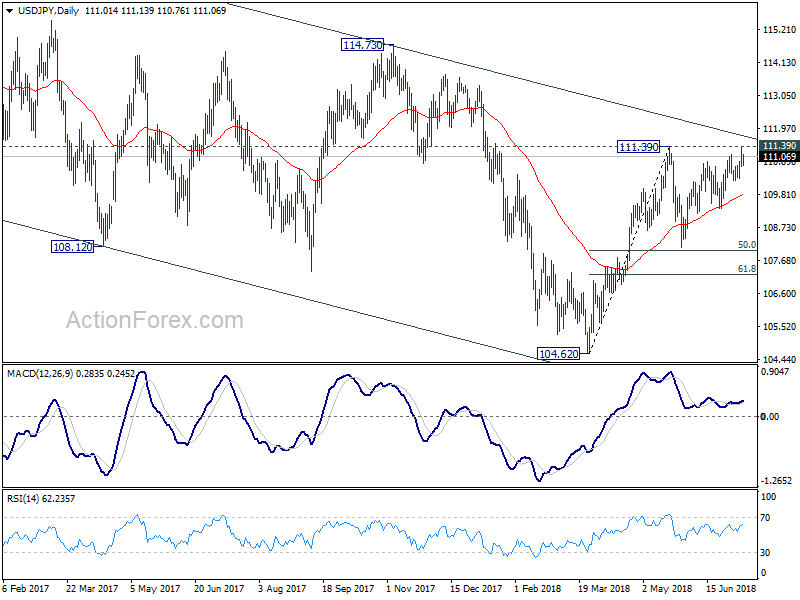

In the bigger picture, at this point, we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

USD/CHF Daily Outlook

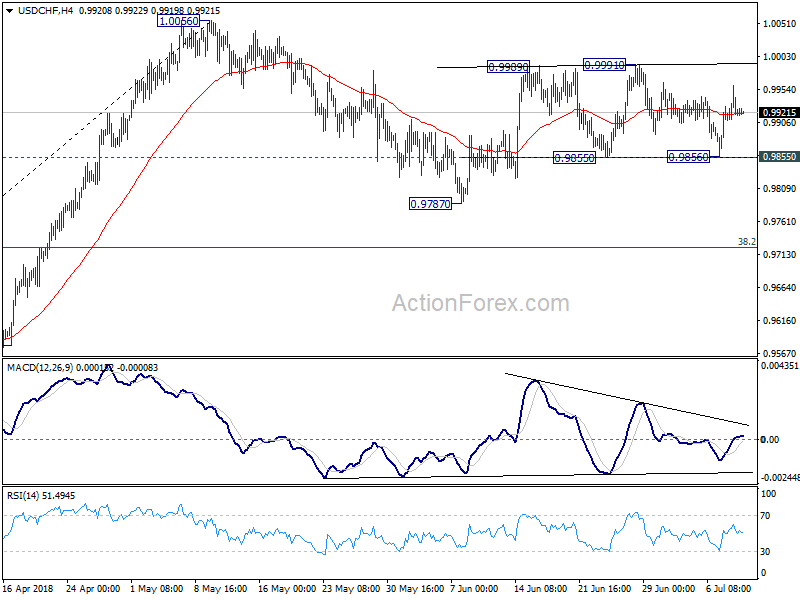

Daily Pivots: (S1) 0.9896; (P) 0.9929; (R1) 0.9953;

Intraday bias in USD/CHF remains neutral as it stays bounded in range of 0.9855/9991. On the downside, break of 0.9855 will extend the corrective pattern from 1.0056 with another fall to 0.9787 and below. Nonetheless, we’d expect strong support from 38.2% retracement of 0.9186 to 1.0056 at 0.9724 to bring rebound. On the upside, firm break of 0.9991 will target a test on 1.0056 high.

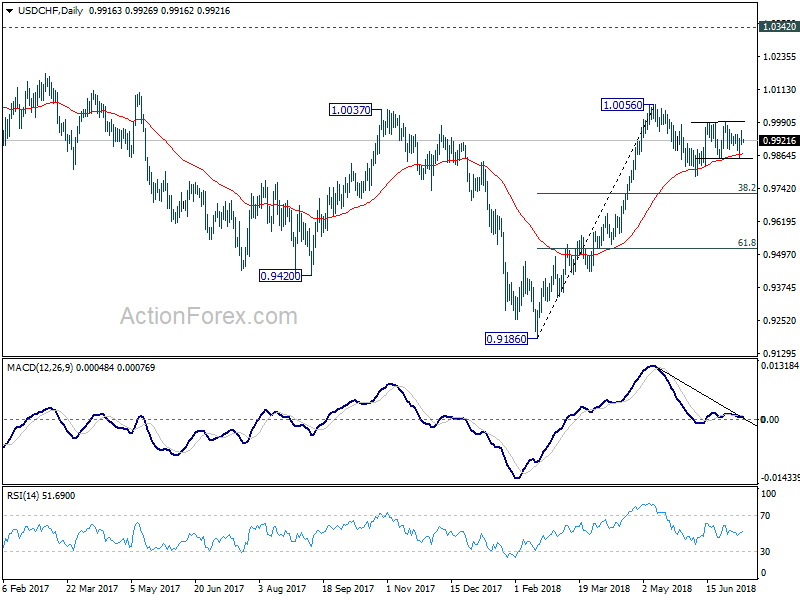

In the bigger picture, rise from 0.9186 is seen as a leg inside the long term range pattern. For now, further rise is expected as long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds. Above 1.0056 will target 1.0342 (2016 high). In that case, we’d be cautious on strong resistance from 1.0342 to limit upside. However, sustained break of 0.9724 will dampen this bullish view and would at least bring deeper fall to 61.8% retracement at 0.9518.