USD/JPY Daily Outlook

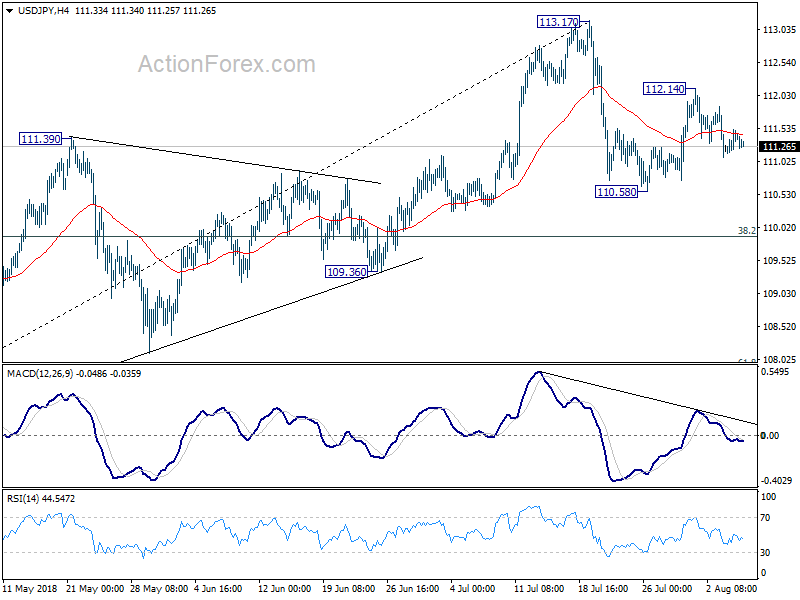

Daily Pivots: (S1) 111.19; (P) 111.37; (R1) 111.60;

Intraday bias in USD/JPY remains neutral at this point and outlook is unchanged. Corrective fall from 113.17 could extend lower. But in case of deeper fall, we’d expect strong support from 38.2% retracement of 104.62 to 113.17 at 109.90 to bring rebound. On the upside, above 112.14 will target a test on 113.17 high.

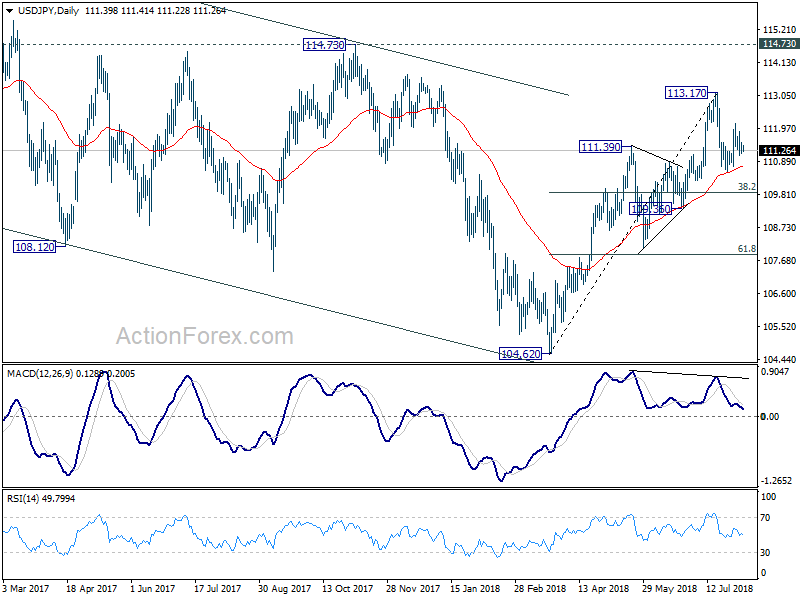

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds.

USD/CHF Daily Outlook

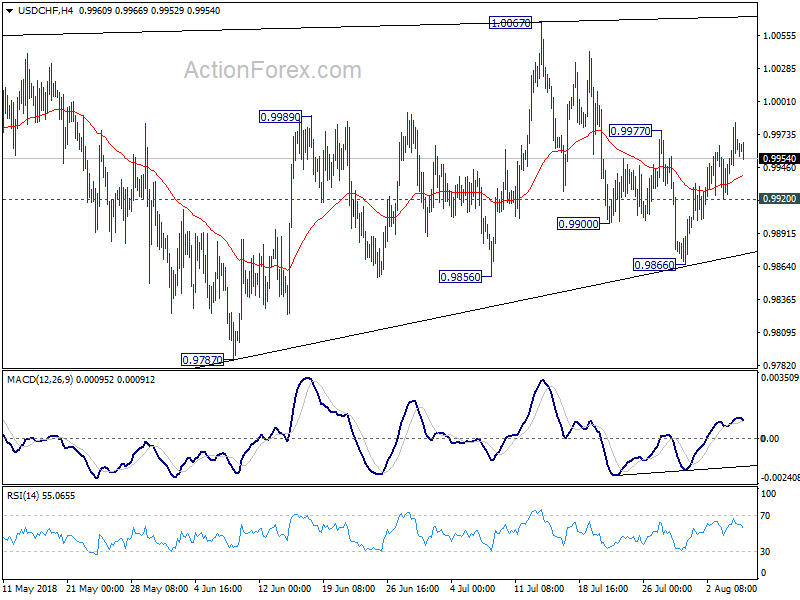

Daily Pivots: (S1) 0.9935; (P) 0.9960; (R1) 0.9991;

Intraday bias in USD/CHF remains mildly on the upside for the moment. Prior break of 0.9977 resistance suggests that pull back from 1.0067 has completed at 0.9866 already. Further rise would be seen back to retest 1.0067 high first. Decisive break there will resume larger rally from 0.9186. However, break of 0.9920 minor support will turn bias to the downside, to bring another decline to extend the consolidation pattern from 1.0056.

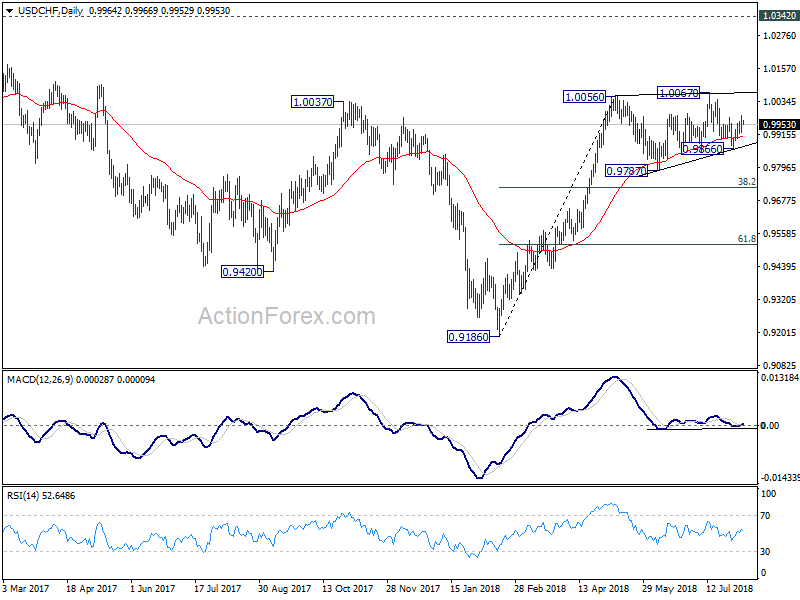

In the bigger picture, current development suggests that the consolidation pattern from 1.0056 is extending with another leg. As long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds, we’d expect rise from 0.9186 to resume at a later stage to retest 1.0342 key resistance (2016 high). However, sustained break of 0.9724 fibonacci level will bring deeper fall, as another declining leg in the long term range pattern.