USD/JPY Daily Outlook

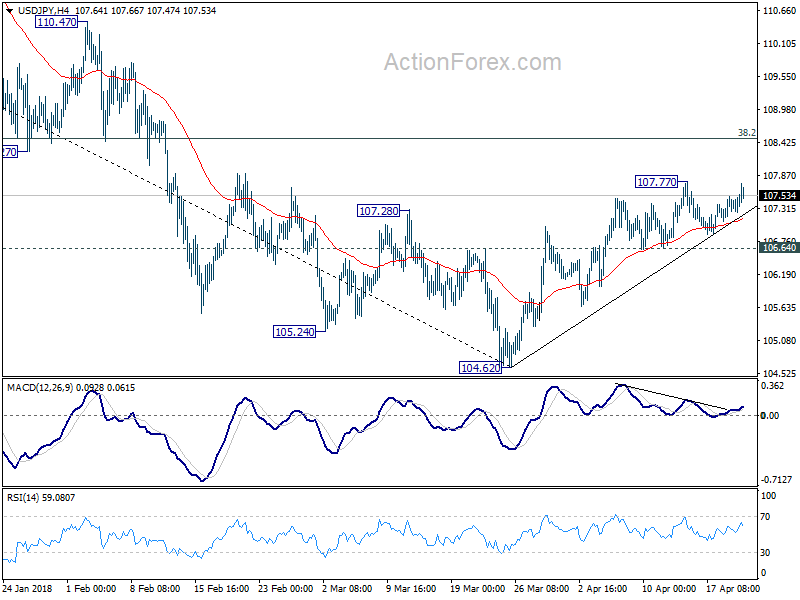

Daily Pivots: (S1) 107.17; (P) 107.34; (R1) 107.53;

Intraday bias in USD/JPY remains neutral at this point. Break of 107.77 will target 38.2% retracement of 114.73 to 104.62 at 108.48 which is close to 108.12. This level is crucial in determining the medium outlook. On the downside, break of 106.64, however, will indicate the rebound from 104.62 has completed. And in that case, bias will be turned back to the downside for retesting 104.62.

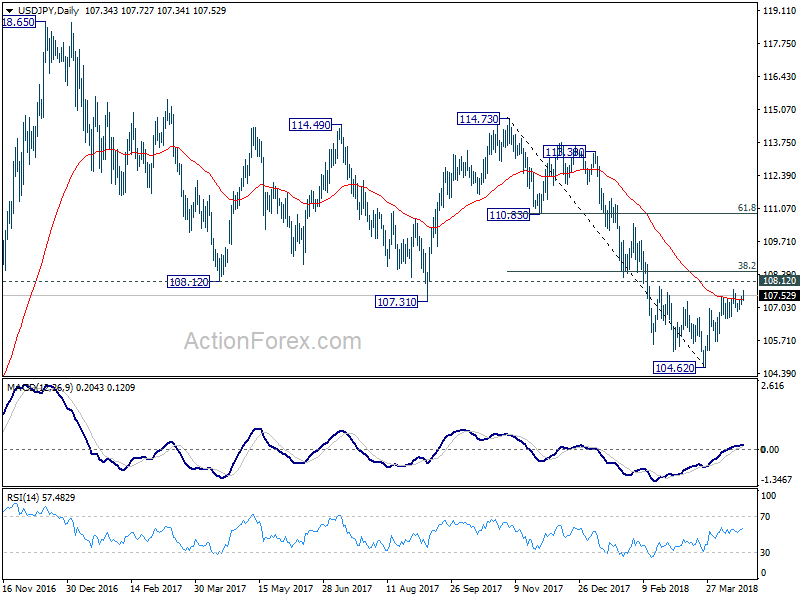

In the bigger picture, as long as 108.12 support turned resistance holds, the medium term down trend from 118.65 (2016 high) should still continue lower, at least to retest 98.97 (2016 low). However, sustained break of 108.12 will be an early sign of medium term reversal. In that case, further rise would be seen to 114.73 resistance to confirm completion of the fall from 118.65.

USD/CHF Daily Outlook

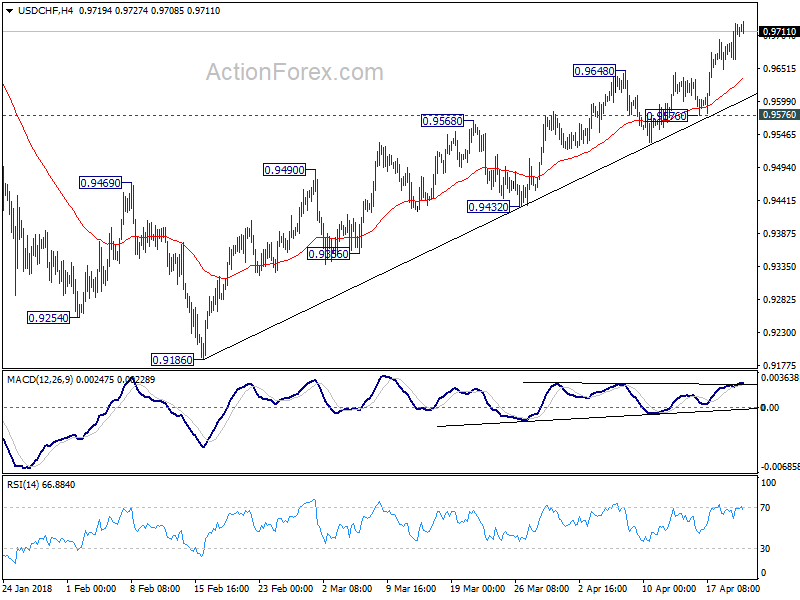

Daily Pivots: (S1) 0.9677; (P) 0.9700; (R1) 0.9735;

USD/CHF’s rally resumed after brief retreat and intraday bias is back on the upside. Current rise 0.9186 is expected to target 0.9900 fibonacci level next. On the downside, break of 0.9576 support is needed to indicate short term topping. Otherwise, outlook will remain bullish even in case of retreat.

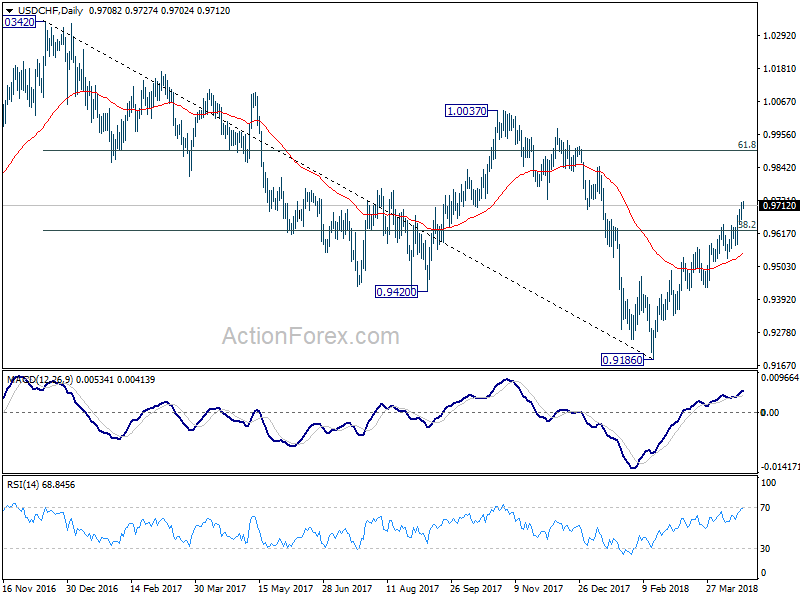

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. The break of 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626 suggests that it’s likely completed at 0.9186 already. Further rally would be seen back to 61.8% retracement at 0.9900 and above. Sustained break there would pave the way to retest 1.0342 key resistance next.