USD/JPY Daily Outlook

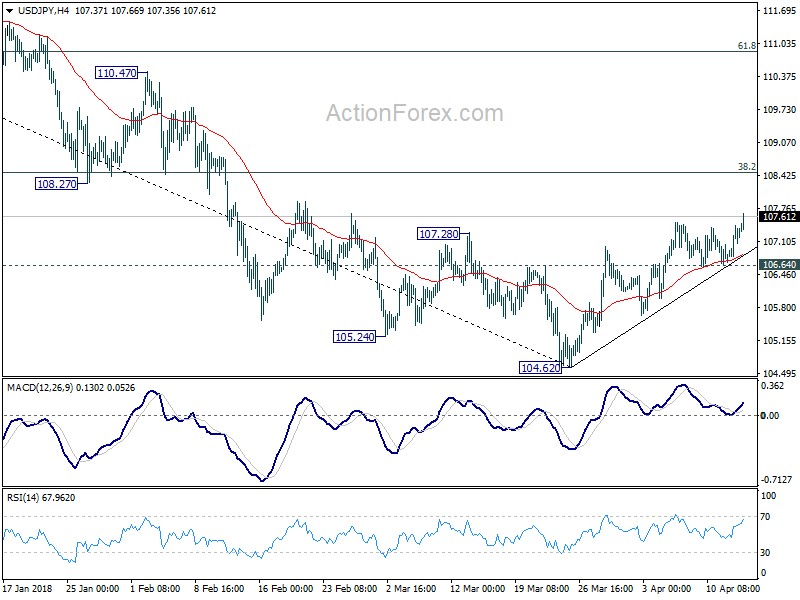

Daily Pivots: (S1) 106.88; (P) 107.15; (R1) 107.61;

USD/JPY’s rebound from 106.42 finally resumed by taking out 107.48 and reaches as high as 107.66 so far. Intraday bias is back on the upside for 38.2% retracement of 114.73 to 104.62 at 108.48 9 which is close to 108.12. This resistance zone will be crucial in determining the medium outlook. On the downside, break of 106.64 minor support is needed to indicate completion of the rebound. Otherwise, further rise will remain in favor even in case of retreat.

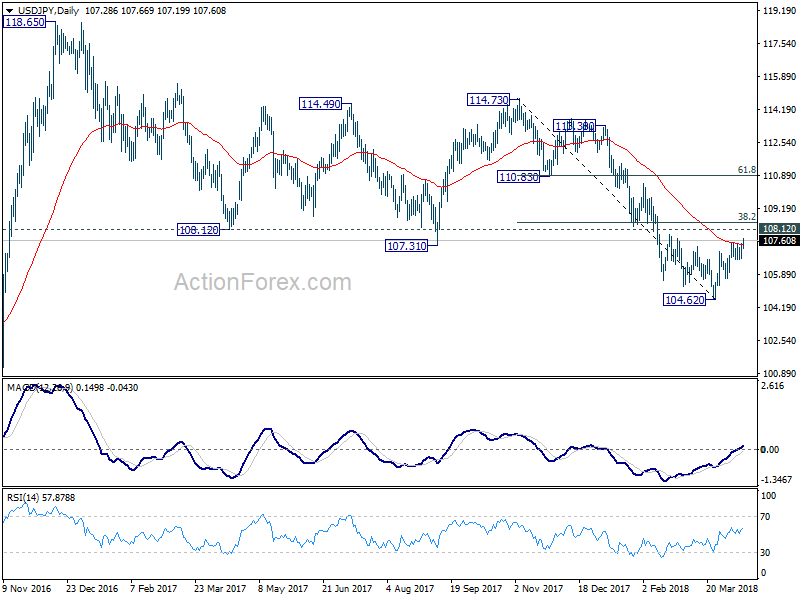

In the bigger picture, medium term down trend from 118.65 (2016 high) is still in progress and extending. Build up in downside momentum argues that it might be extending the whole corrective pattern from 125.85 (2015 high). 100% projection of 118.65 to 108.12 from 114.73 at 104.20 will be a key level to watch as firm break there could bring downside acceleration. And in that case, 98.97 key support level (2016 low) would at least be breached. This bearish case will now be favored as long as 108.12 support turned resistance holds.

USD/CHF Daily Outlook

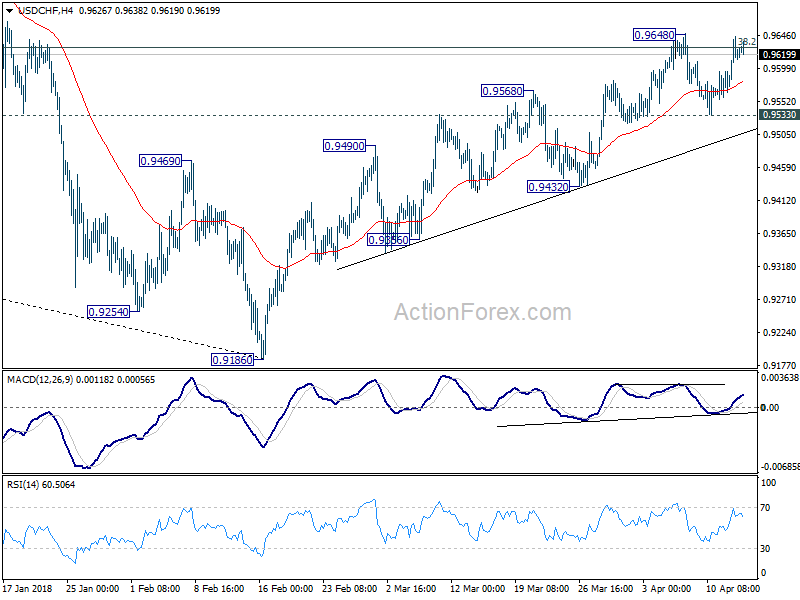

Daily Pivots: (S1) 0.9575; (P) 0.9610; (R1) 0.9659;

Intraday bias in USD/CHF remains neutral with focus on 0.9626 key fibonacci resistance. Sustained trading above this level will be another evidence of larger reversal. In that case, further rally should be seen back to next fibonacci level at 0.9900. On the downside, though, break of 0.9533 minor support should indicate rejection by 0.9626. Further break of 0.9432 will turn near term outlook bearish for retesting 0.9186 low.

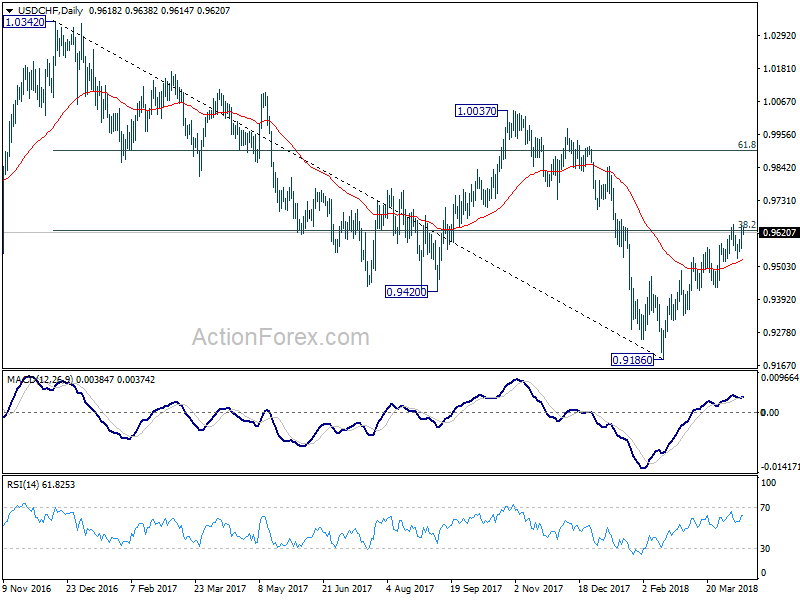

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Main focus is on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add to the case of trend reversal and target 61.8% retracement at 0.9900 and above. However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.