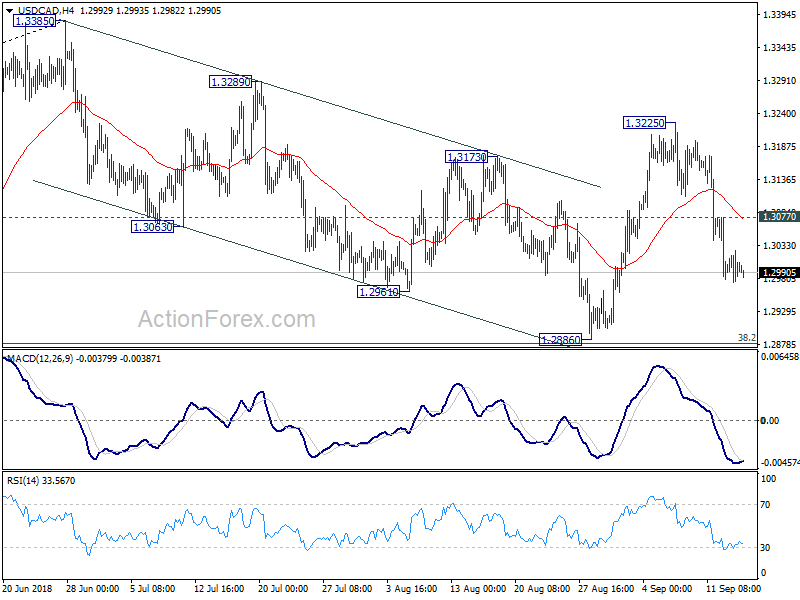

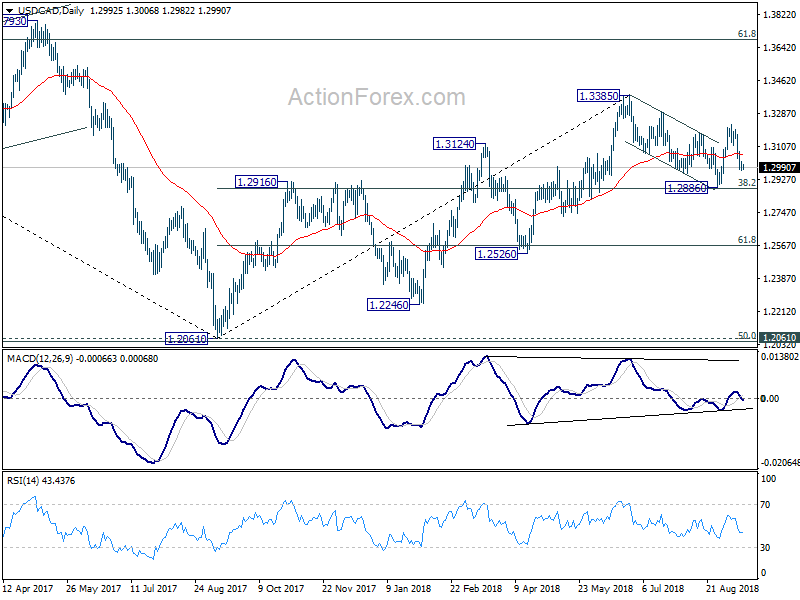

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2972; (P) 1.2999; (R1) 1.3023;

No change in USD/CAD’s outlook While pull back from 1.3225 might extend lower, downside should be contained well above 1.2886 support to bring rally resumption. We’re holding on to the view that corrective fall from 1.3385 has completed at 1.2886 already. On the upside, above 1.3077 minor resistance will turn bias back to the upside for 1.3225 first. Break will resume the rebound from 1.2886 to retest 1.3385 high.

In the bigger picture, strong rebound ahead of 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level retains medium term bullishness. That is, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. On the downside, as long as 1.2886 support holds, outlook will now remain bullish.

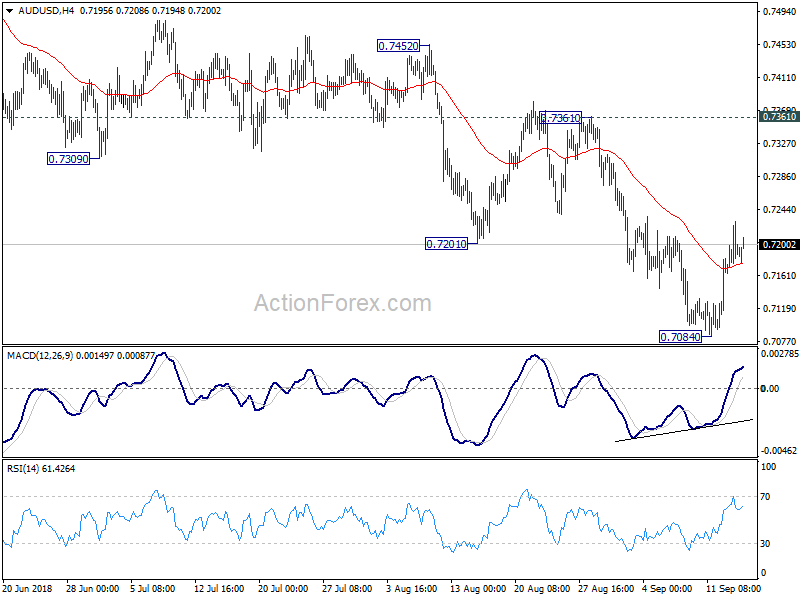

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7115; (P) 0.7149; (R1) 0.7205;

AUD/USD’s rebound from 0.7084 short term bottom is still in progress and intraday bias stays mildly on the upside. Further rise could be seen to 55 day EMA (now at 0.7313). But upside should be limited well below 0.7361 resistance to bring down trend resumption. On the downside, break of 0.7084 will resume the fall from 0.8135 for key support level at 0.6826. However, sustained break of 0.7361 will carry larger bullish implication.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in daily and weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.