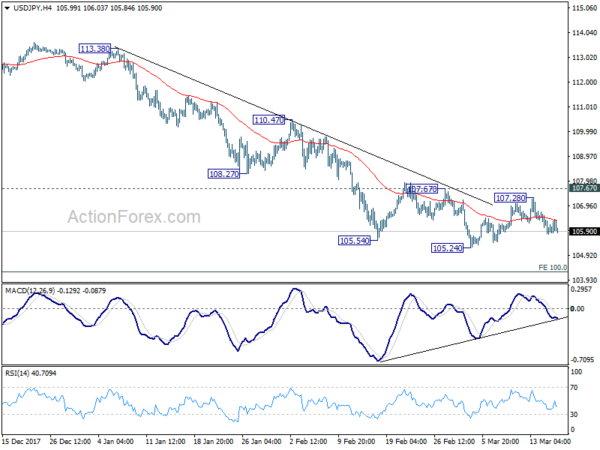

USD/JPY Daily Outlook

Daily Pivots: (S1) 105.94; (P) 106.17; (R1) 106.57;

At this point, USD/JPY is still bounded in range of 105.24/107.67 and intraday bias remains neutral. After all, near term outlook remains bearish with 107.67 resistance intact. And deeper decline is in favor. On the downside, break of 105.24 will resume larger decline from 118.65 and target 100% projection of 118.65 to 108.12 from 114.73 at 104.20 next. On the upside, firm break of 107.67 resistance will indicate near term reversal, on bullish convergence condition in 4 hour MACD. In such case, outlook will be turned bullish for 110.47 resistance next.

In the bigger picture, current development argues that the corrective pattern from 118.65 is extending. The solid break of 61.8% retracement of 98.97 to 118.65 at 106.48 now suggests that the pattern from 125.85 high is possibly extending. Deeper fall could be seen through 98.97 key support (2016 low). This bearish case will now be favored as long as 110.47 resistance holds.

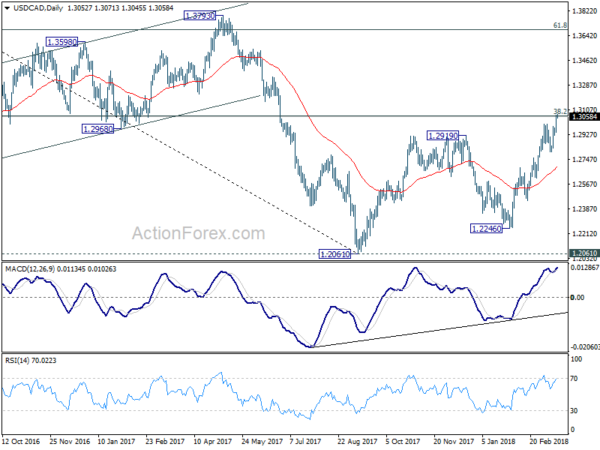

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2975; (P) 1.3021; (R1) 1.3099;

USD/CAD surges to as high as 1.3071 so far and met 1.3065 medium term fibonacci level. Intraday bias remains on the upside. Sustained trading above 1.306 will pave the way to next fibonacci level at 1.3685. On the downside, below 1.2920 minor support will turn bias neutral first. But near term outlook will stay bullish as long as 1.2802 support holds.

In the bigger picture, we’re favoring the medium term bullish case. That is larger down trend from 1.4689 has completed at 1.2061, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen back to 38.2% retracement of 1.4689 to 1.2061 at 1.3065 first. Break will target 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2687 support holds.