USD/CHF Daily Outlook

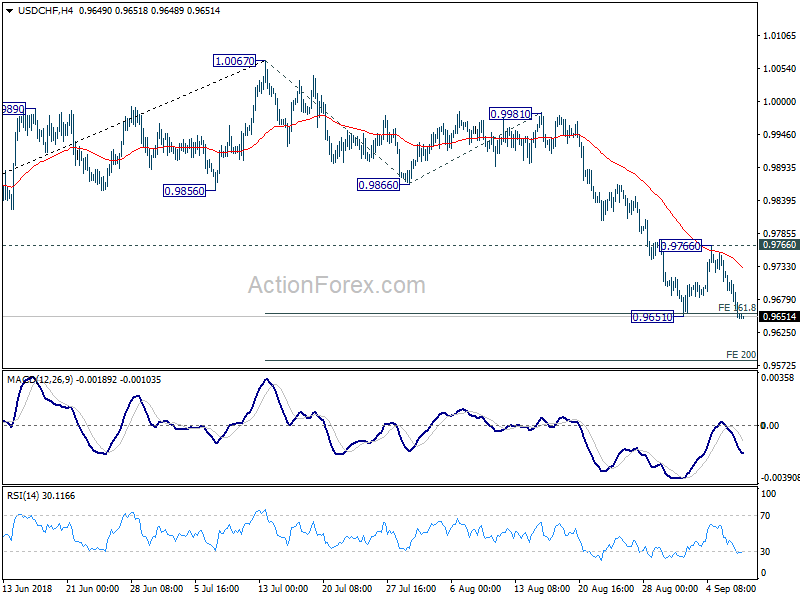

Daily Pivots: (S1) 0.9626; (P) 0.9676; (R1) 0.9701;

USD/CHF’s breach of 0.9651 suggests that the fall from 1.0067 is resuming. Intraday bias is back on the downside. Sustained break of 0.9651 will target 200% projection of 1.0067 to 0.9866 from 0.9981 at 0.8579 next. On the upside, break of 0.9766 resistance is needed to indicate short term bottoming. Otherwise, near term outlook will remain bearish in case of recovery.

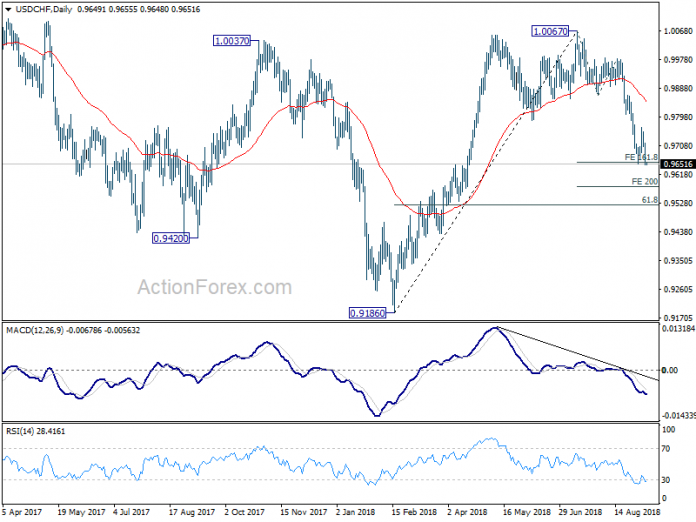

In the bigger picture, current development suggests that rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 0.9866 support turned resistance will suggests that fall from 1.0067 has completed and rise from 0.9186 is resuming.

EUR/USD Daily Outlook

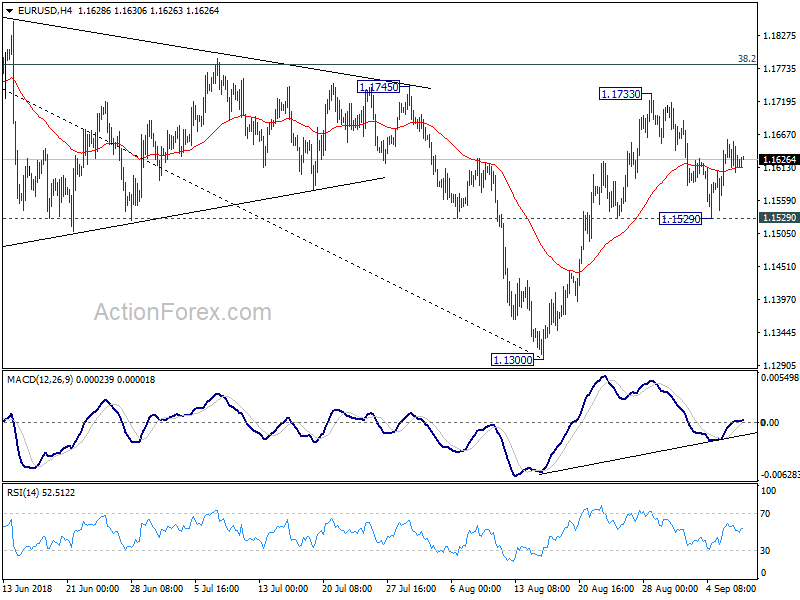

Daily Pivots: (S1) 1.1600; (P) 1.1630; (R1) 1.1653;

At this point, intraday bias stays mildly on the upside and EUR/USD could target 1.1733 and possibly above. But still, we’d expect strong resistance from 38.2% retracement of 1.2555 to 1.1300 at 1.1779 to limit upside, at least on first attempt, to bring near term reversal. On the downside, firm break of 1.1529 will indicate completion of the corrective rebound from 1.1300. In such case, intraday bias will be turned back to the downside for retesting 1.1300 low.

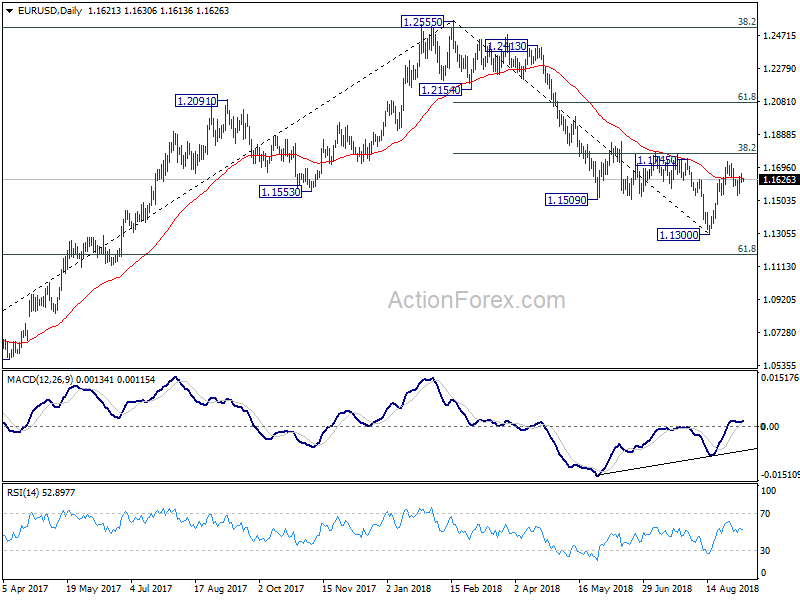

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).