USD/JPY Daily Outlook

Daily Pivots: (S1) 112.09; (P) 112.36; (R1) 112.80;

Intraday bias in USD/JPY remains on the upside for the moment. Current rally from 104.62 should target 61.8% projection of 104.62 to 111.39 from 109.36 at 113.54 first. Break will put focus on 114.73 key resistance for confirming medium term reversal. On the downside, below 112.16 minor support will turn intraday bias neutral and bring retreat. But downside should be contained above 111.13 resistance turned support to bring another rally.

In the bigger picture, at this point, we’re favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Break of 111.39 resistance now affirms this view. Firm break of 114.73 will confirm and send USD/JPY through 118.65 towards 125.85 key resistance (2015 high). This will now be the preferred case as long as 109.36 support holds.

GBP/USD Daily Outlook

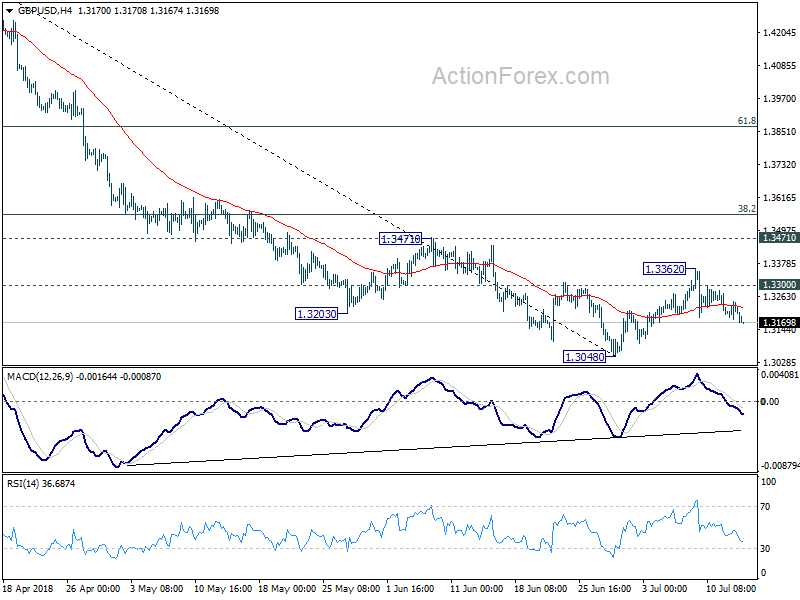

Daily Pivots: (S1) 1.3175; (P) 1.3209; (R1) 1.3239;

GBP/USD’s fall from 1.3362 continues today and current development should confirm completion of corrective rebound from 1.3048. Intraday bias is now on the downside for retesting 1.3048 low first. Firm break there will resume larger fall from 1.4376 for 1.2874 fibonacci level next. On the upside, above 1.3300 minor resistance will delay the bearish case and bring another recovery. But we’d expect strong resistance from 1.3471 to limit upside to finish the corrective rebound.

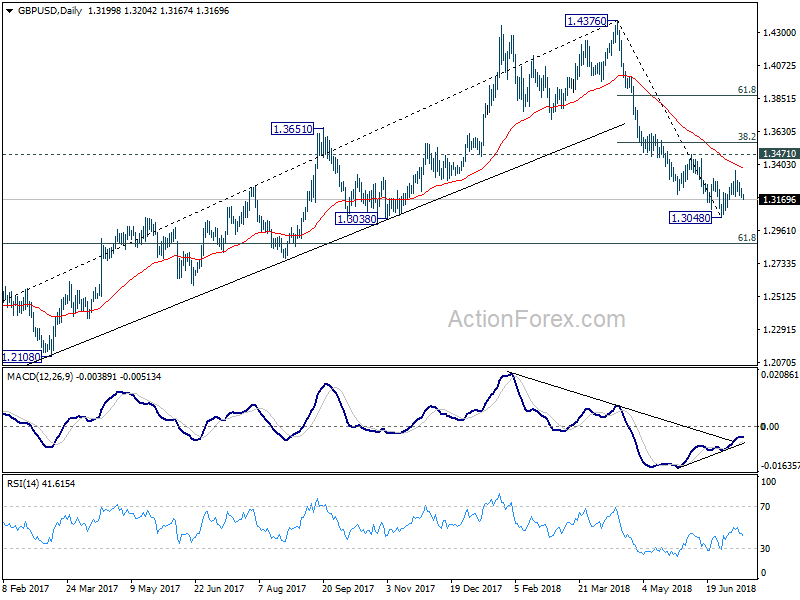

In the bigger picture, whole medium term rebound from 1.1936 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4179). Fall from 1.4376 should extend to 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 next. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. On the upside, sustained break of 38.2% retracement of 1.4376 to 1.3048 at 1.3555 is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.