USD/JPY Daily Outlook

Daily Pivots: (S1) 110.32; (P) 110.47; (R1) 110.66;

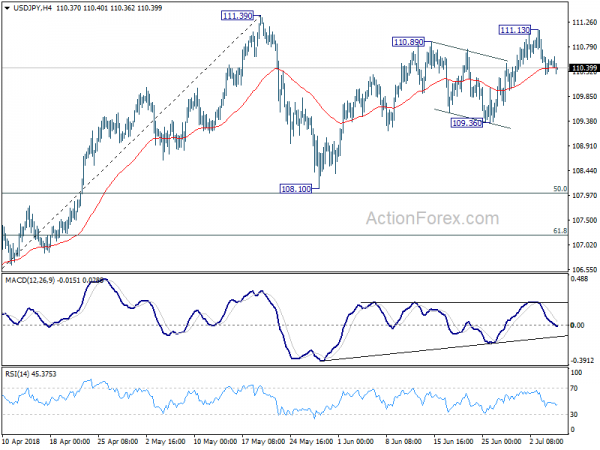

Intraday bias in USD/JPY remains mildly on the downside for the moment as rebound from 108.10 could have completed at 111.13 already. Break of 109.36 support will confirm that corrective pattern from 111.39 has started the third leg. And USD/JPY should target 108.10, and possibly below. In that case, we’d expect downside to be contained by 61.8% retracement of 104.62 to 111.39 at 107.20. On the upside, above 111.13 will bring retest of 111.39 instead.

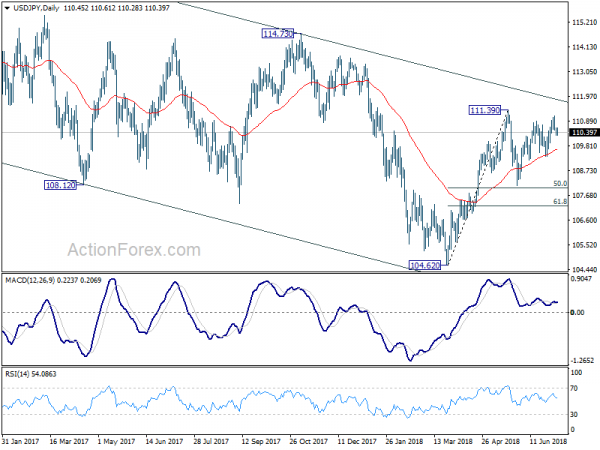

In the bigger picture, at this point, we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1630; (P) 1.1656 (R1) 1.1683;

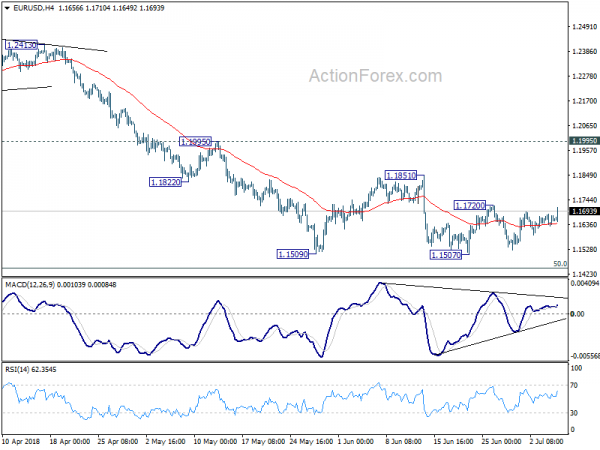

EUR/USD’s consolidation from 1.1507 is still in progress and further recovery could be seen. But upside is expected to be limited by 1.1851 resistance to bring fall resumption eventually. The larger decline from 1.2555 is expected to resume sooner or later. Firm break of 1.1507 will target 50% retracement of 1.0339 to 1.2555 at 1.1447 and then 61.8% retracement at 1.1186.

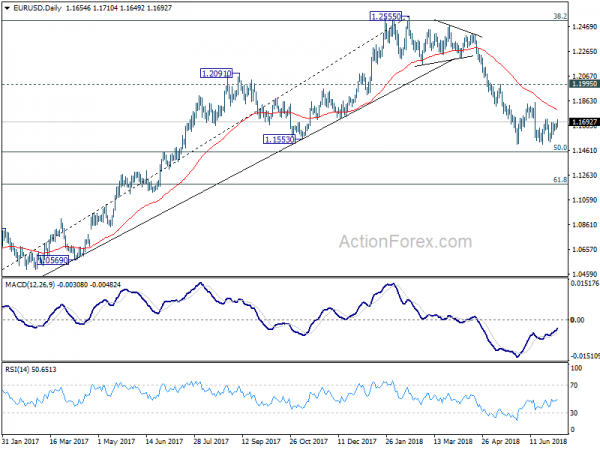

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.